Concept explainers

In a certain Kentucky Fried Chicken franchise, half of the customers typically request “crispy” instead of “original.” (a) What is the

(a)

Find the probability that none of the customer will order light beer.

Answer to Problem 70CE

The probability for none of the customer will order light beer is 0.0168.

Explanation of Solution

Calculation:

The given information is that there is 40% of the U.S. beer drinkers order light beer.

The situation is a discrete probability distribution, in that the order light beer is success and does not order light beer is failure.

Binomial Distribution:

The random variable X denotes the number of successes in trail of n.

The PDF of the distribution is,

Here n denotes the number of trails and

In the given situation, the random variable X denotes the number of beer drinkers order light beer, the value of n is 8 and the value of

The probability for more than none of the customer will order light beer is,

Software procedure:

Step-by-step software procedure to obtain probability value using EXCEL software is as follows:

- Open an EXCEL file.

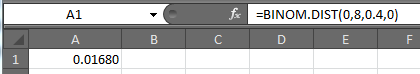

- In cell A1, enter the formula “=BINOM.DIST(0,8,0.40,0)”

- Output using EXCEL software is given below:

From the output, the value of

Thus, the probability for none of the customer will order light beer is 0.0168.

(b)

Find the probability one customer will order light beer.

Answer to Problem 70CE

The probability that one customer will order light beer is 0.0896.

Explanation of Solution

Calculation:

The probability for one customer will order light beer is,

Software procedure:

Step-by-step software procedure to obtain probability value using EXCEL software is as follows:

- Open an EXCEL file.

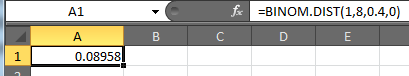

- In cell A1, enter the formula “=BINOM.DIST(1,8,0.40,0)”

- Output using EXCEL software is given below:

From the output, the value of

Thus, the probability for one customer will order light beer is 0.0896.

(c)

Find the probability that two customers will order light beer.

Answer to Problem 70CE

The probability that two customers will order light beer is 0.2090.

Explanation of Solution

Calculation:

The probability for two customer will order light beer is,

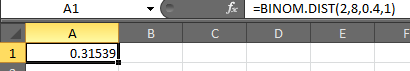

Software procedure:

Step-by-step software procedure to obtain probability value using EXCEL software is as follows:

- Open an EXCEL file.

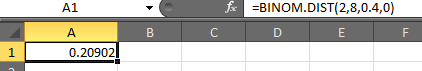

- In cell A1, enter the formula “=BINOM.DIST(2,8,0.40,0)”

- Output using EXCEL software is given below:

From the output, the value of

Thus, the probability for two customers will order light beer is 0.2090.

(d)

Find the probability that fewer than three customers will order light beer.

Answer to Problem 70CE

The probability that fewer than three customers will order light beer is 0.3154.

Explanation of Solution

Calculation:

The probability for fewer than three customers will order light beer is,

Software procedure:

Step-by-step software procedure to obtain probability value using EXCEL software is as follows:

- Open an EXCEL file.

- In cell A1, enter the formula “=BINOM.DIST(2,8,0.40,1)”

- Output using EXCEL software is given below:

From the output, the value of

Thus, the probability for fewer than three customers will order light beer is 0.3154.

(e)

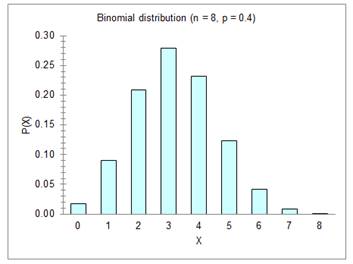

Construct the probability distribution.

Draw the graph of PDF and find the shape of the distribution.

Answer to Problem 70CE

The distribution shape is right-skewed.

Explanation of Solution

Calculation:

Shape of the distribution:

Symmetric distribution:

When the left and right sides of the distribution are approximately equal or mirror images of each other, then it is symmetric distribution. For this distribution, mean and standard deviation are useful. For a symmetric distribution,

Right skewed distribution:

If the tail of the distribution is elongated towards the right, then it is a right-skewed distribution. It is also called as positively skewed. For right skewed,

Left-skewed distribution:

If the tail of the distribution is elongated towards the left, then it is a left-skewed distribution. It is also called as negatively skewed. For left skewed,

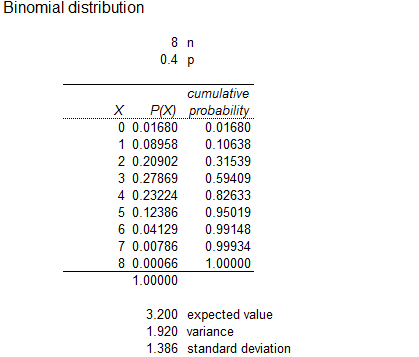

Construct the probability distribution and graph:

Software procedure:

Step by step procedure to obtain probability distribution by using MegaStat software is as follows:

- Open an EXCEL file, Go to Add-ins, select MegaStat.

- Choose Probability, select the Discrete probability distributions.

- In Binomial, enter number of trails as 8 and probability occurrence as 0.40.

- Select Display graph.

- Click on Ok.

- Output using EXCEL software is given below:

Observation:

From the output, the tail of the distribution elongated slightly towards to right.

Thus, the distribution shape is right skewed.

Want to see more full solutions like this?

Chapter 6 Solutions

APPLIED STAT.IN BUS.+ECONOMICS

- Faye cuts the sandwich in two fair shares to her. What is the first half s1arrow_forwardQuestion 2. An American option on a stock has payoff given by F = f(St) when it is exercised at time t. We know that the function f is convex. A person claims that because of convexity, it is optimal to exercise at expiration T. Do you agree with them?arrow_forwardQuestion 4. We consider a CRR model with So == 5 and up and down factors u = 1.03 and d = 0.96. We consider the interest rate r = 4% (over one period). Is this a suitable CRR model? (Explain your answer.)arrow_forward

- Question 3. We want to price a put option with strike price K and expiration T. Two financial advisors estimate the parameters with two different statistical methods: they obtain the same return rate μ, the same volatility σ, but the first advisor has interest r₁ and the second advisor has interest rate r2 (r1>r2). They both use a CRR model with the same number of periods to price the option. Which advisor will get the larger price? (Explain your answer.)arrow_forwardQuestion 5. We consider a put option with strike price K and expiration T. This option is priced using a 1-period CRR model. We consider r > 0, and σ > 0 very large. What is the approximate price of the option? In other words, what is the limit of the price of the option as σ∞. (Briefly justify your answer.)arrow_forwardQuestion 6. You collect daily data for the stock of a company Z over the past 4 months (i.e. 80 days) and calculate the log-returns (yk)/(-1. You want to build a CRR model for the evolution of the stock. The expected value and standard deviation of the log-returns are y = 0.06 and Sy 0.1. The money market interest rate is r = 0.04. Determine the risk-neutral probability of the model.arrow_forward

- Several markets (Japan, Switzerland) introduced negative interest rates on their money market. In this problem, we will consider an annual interest rate r < 0. We consider a stock modeled by an N-period CRR model where each period is 1 year (At = 1) and the up and down factors are u and d. (a) We consider an American put option with strike price K and expiration T. Prove that if <0, the optimal strategy is to wait until expiration T to exercise.arrow_forwardWe consider an N-period CRR model where each period is 1 year (At = 1), the up factor is u = 0.1, the down factor is d = e−0.3 and r = 0. We remind you that in the CRR model, the stock price at time tn is modeled (under P) by Sta = So exp (μtn + σ√AtZn), where (Zn) is a simple symmetric random walk. (a) Find the parameters μ and σ for the CRR model described above. (b) Find P Ste So 55/50 € > 1). StN (c) Find lim P 804-N (d) Determine q. (You can use e- 1 x.) Ste (e) Find Q So (f) Find lim Q 004-N StN Soarrow_forwardIn this problem, we consider a 3-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year. The interest rate is r = 0%. 16 22 28 12 16 12 8 4 2 time Figure 1: Stock evolution for Problem 1. (a) A colleague notices that in the model above, a movement up-down leads to the same value as a movement down-up. He concludes that the model is a CRR model. Is your colleague correct? (Explain your answer.) (b) We consider a European put with strike price K = 10 and expiration T = 3 years. Find the price of this option at time 0. Provide the replicating portfolio for the first period. (c) In addition to the call above, we also consider a European call with strike price K = 10 and expiration T = 3 years. Which one has the highest price? (It is not necessary to provide the price of the call.) (d) We now assume a yearly interest rate r = 25%. We consider a Bermudan put option with strike price K = 10. It works like a standard put, but you can exercise it…arrow_forward

- In this problem, we consider a 2-period stock market model with evolution given in Fig. 1 below. Each period corresponds to one year (At = 1). The yearly interest rate is r = 1/3 = 33%. This model is a CRR model. 25 15 9 10 6 4 time Figure 1: Stock evolution for Problem 1. (a) Find the values of up and down factors u and d, and the risk-neutral probability q. (b) We consider a European put with strike price K the price of this option at time 0. == 16 and expiration T = 2 years. Find (c) Provide the number of shares of stock that the replicating portfolio contains at each pos- sible position. (d) You find this option available on the market for $2. What do you do? (Short answer.) (e) We consider an American put with strike price K = 16 and expiration T = 2 years. Find the price of this option at time 0 and describe the optimal exercising strategy. (f) We consider an American call with strike price K ○ = 16 and expiration T = 2 years. Find the price of this option at time 0 and describe…arrow_forward2.2, 13.2-13.3) question: 5 point(s) possible ubmit test The accompanying table contains the data for the amounts (in oz) in cans of a certain soda. The cans are labeled to indicate that the contents are 20 oz of soda. Use the sign test and 0.05 significance level to test the claim that cans of this soda are filled so that the median amount is 20 oz. If the median is not 20 oz, are consumers being cheated? Click the icon to view the data. What are the null and alternative hypotheses? OA. Ho: Medi More Info H₁: Medi OC. Ho: Medi H₁: Medi Volume (in ounces) 20.3 20.1 20.4 Find the test stat 20.1 20.5 20.1 20.1 19.9 20.1 Test statistic = 20.2 20.3 20.3 20.1 20.4 20.5 Find the P-value 19.7 20.2 20.4 20.1 20.2 20.2 P-value= (R 19.9 20.1 20.5 20.4 20.1 20.4 Determine the p 20.1 20.3 20.4 20.2 20.3 20.4 Since the P-valu 19.9 20.2 19.9 Print Done 20 oz 20 oz 20 oz 20 oz ce that the consumers are being cheated.arrow_forwardT Teenage obesity (O), and weekly fast-food meals (F), among some selected Mississippi teenagers are: Name Obesity (lbs) # of Fast-foods per week Josh 185 10 Karl 172 8 Terry 168 9 Kamie Andy 204 154 12 6 (a) Compute the variance of Obesity, s²o, and the variance of fast-food meals, s², of this data. [Must show full work]. (b) Compute the Correlation Coefficient between O and F. [Must show full work]. (c) Find the Coefficient of Determination between O and F. [Must show full work]. (d) Obtain the Regression equation of this data. [Must show full work]. (e) Interpret your answers in (b), (c), and (d). (Full explanations required). Edit View Insert Format Tools Tablearrow_forward

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage LearningAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage LearningAlgebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage