Concept explainers

Benson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules.

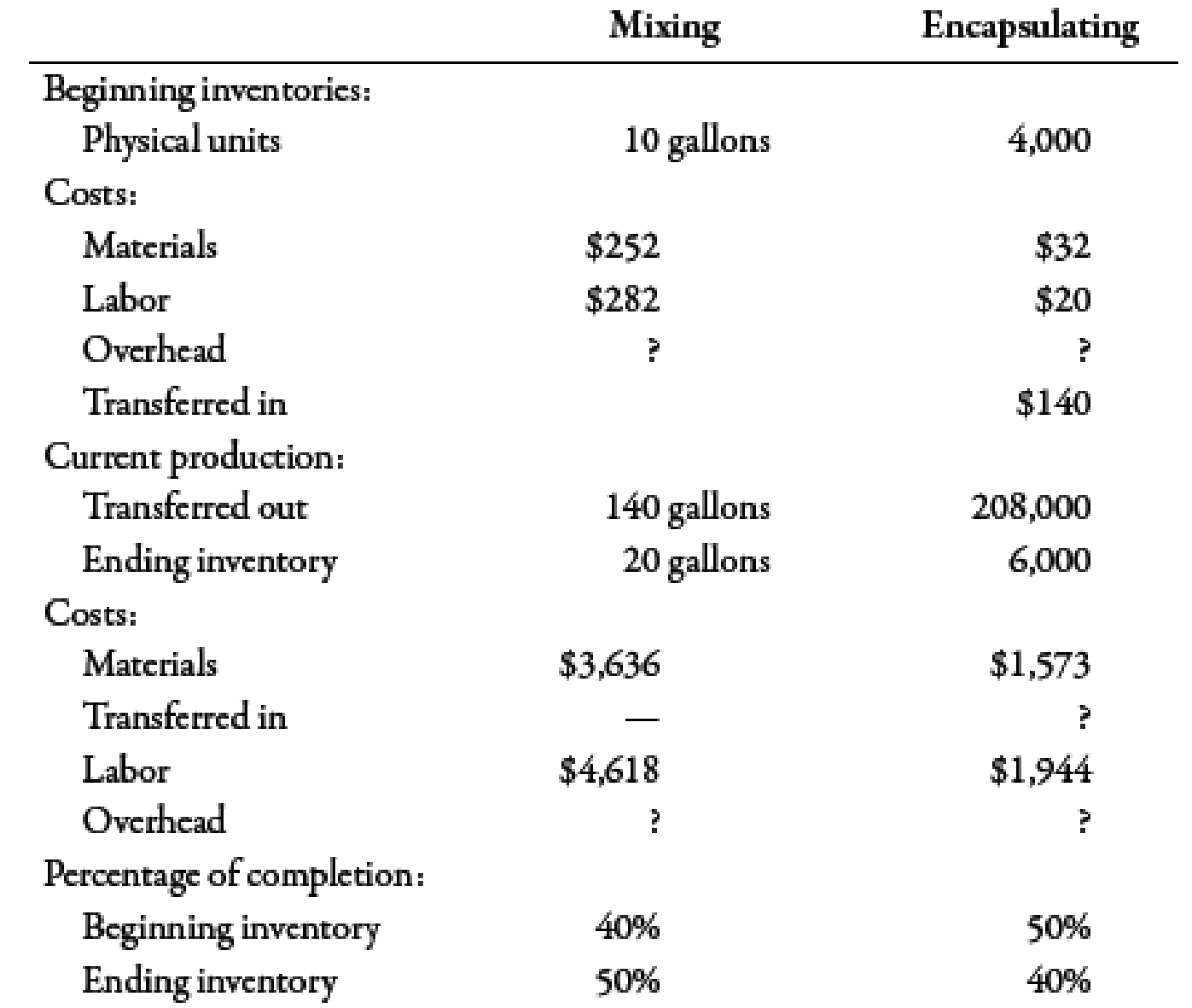

During March, the following results are available for the first two departments:

Required:

- 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.)

- 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.)

- 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.

1.

Present a production report for the mixing department using weighted average method.

Explanation of Solution

Weighted Average Method:

Weighted average method is an inventory valuation method. In this method, cost is divided by equivalent units to obtain unit cost. This unit cost is used to value the inventory units.

Step 1: Physical flow analysis:

| Particulars | Units |

| Units to account for: | |

| Units in beginning WIP | 10 |

| Add: Units started during the period1 | 150 |

| Units to account for | 160 |

| Units accounted for: | |

| Units completed and transferred | 140 |

| Add: Units in ending WIP | 20 |

| Units accounted for | 160 |

Table (1)

Step 2: Computation of equivalent units:

| Particulars | Units |

| Units completed and transferred | 140 |

| Equivalent units from ending inventory | 10 |

| Equivalent units | 150 |

Table (2)

Step 3: Computation of unit cost:

| Particulars | Amount ($) |

| Cost of beginning inventory: | |

| Material | 252 |

| Labor | 282 |

| Overhead | 564 |

| Total cost of beginning inventory (A) | 1,098 |

| Cost incurred: | |

| Material | 3,636 |

| Labor | 4,618 |

| Overhead | 9,236 |

| Total cost incurred (B) | 17,490 |

| Total manufacturing cost | 18,588 |

| Unit cost |

123.92 |

Table (3)

Step 4: Valuation of inventories:

| Particulars | Amount ($) |

| Cost of goods transferred | 17,348.8 |

| Cost of ending WIP | 1239.2 |

| Total value | 18,588 |

Table (4)

Step 5: Cost reconciliation:

| Particulars | Amount ($) |

| Cost of goods transferred | 17,348.8 |

| Cost of ending WIP | 1239.2 |

| Total value | 18,588 |

| Total cost of beginning inventory | 1,098 |

| Total cost incurred | 17,490 |

| Total manufacturing cost | 18,588 |

Table (5)

Working Notes:

1. Computation of units started during the period:

2.

Present a production report for the encapsulating department using weighted average method.

Explanation of Solution

Step 1: Physical flow analysis:

| Particulars | Units |

| Units to account for: | |

| Units in beginning WIP | 4,000 |

| Add: Units started during the period1 | 210,000 |

| Units to account for | 214,000 |

| Units accounted for: | |

| Units completed and transferred | 208,000 |

| Add: Units in ending WIP | 6,000 |

| Units accounted for | 214,000 |

Table (6)

Step 2: Computation of equivalent units:

| Particulars | Units |

| Units completed and transferred | 208,000 |

| Equivalent units from ending inventory | 2,400 |

| Equivalent units | 210,400 |

Table (7)

Step 3: Computation of unit cost:

| Particulars | Amount ($) |

| Cost of beginning inventory: | |

| Material | 32 |

| Labor | 20 |

| Overhead | 30 |

| Transferred in | 140 |

| Total cost of beginning inventory (A) | 222 |

| Cost incurred: | |

| Material | 1,573 |

| Transferred in | 17,348.8 |

| Labor | 1,944 |

| Overhead | 2,916 |

| Total cost incurred (B) | 23,781.8 |

| Total manufacturing cost | 24,003.8 |

| Unit cost |

0.1141 |

Table (8)

Step 4: Valuation of inventories:

| Particulars | Amount ($) |

| Cost of goods transferred | 23,732.8 |

| Cost of ending WIP | 273.84 |

| Total value | 24,006.64 |

Table (9)

Step 5: Cost reconciliation:

| Particulars | Amount ($) |

| Cost of goods transferred | 23,732.8 |

| Cost of ending WIP | 273.84 |

| Total value | 24,006.64 |

| Total cost of beginning inventory | 222 |

| Total cost incurred | 23,781.8 |

| Total manufacturing cost | 24,003.8 |

Table (10)

Working Notes:

1.

Computation of units started during the period:

3.

Discuss whether or not weighted average method is easier than FIFO. Also, discuss the situation in which weighted average will give about the same results as FIFO.

Explanation of Solution

It is easier to compute unit cost in case of weighted average method, because all equivalent units are categorized in one class.

Weighted average would provide similar result from FIFO, in case, costs are not much fluctuating and are similar from previous periods.

Want to see more full solutions like this?

Chapter 6 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- 1. Steve works in an insurance office and in 2013 was provided with uniforms by her employer which cost $15,000. Which of the following tax treat of the uniform allowance is incorrect? A. Any amount exceeding $5739 is taxable at a rate of 25% B. She cannot claim uniform and laundry allowance C. The amount is added to her salary and taxed at 25% D. If the company provided uniform allowance, then it would regarded as a taxable benefit 2. Which of the following is false in describing a contract of service A. Individual can conduct business on his/her own account B.Tools, materials and work place are provided by the payer C. Individual is subject to the supervision, direction and control of another person D. Contract is a legally binding exclusive service agreement between the performer and payer. 3. What year was the tax threshold system established in Jamaica? A.1960 B.1986 C.1990 D.1953 4. Mr. Williams did a presentation explaining Adam Smith’s initial Canons of Taxation to his…arrow_forwardEckhart Corp. reports that at an activity level of 5,800 machine-hours in a month, its total variable inspection cost is $348,240 and its total fixed inspection cost is $128,500. What would be the total variable inspection cost at an activity level of 6,100 machine-hours in a month? Assume that this level of activity is within the relevant range.arrow_forwardFinancial accounting questionarrow_forward

- Need help with this question solution general accountingarrow_forwardKay works in an insurance office and in 2013 was provided with uniforms by her employer which cost $15,000. Which of the following tax treat of the uniform allowance is incorrect? A.Any amount exceeding $5739 is taxable at a rate of 25% B.She cannot claim uniform and laundry allowance C.The amount is added to her salary and taxed at 25% D.If the company provided uniform allowance, then it would regarded as a taxable benefitarrow_forwardNonearrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning