Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

7th Edition

ISBN: 9781337384285

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 42E

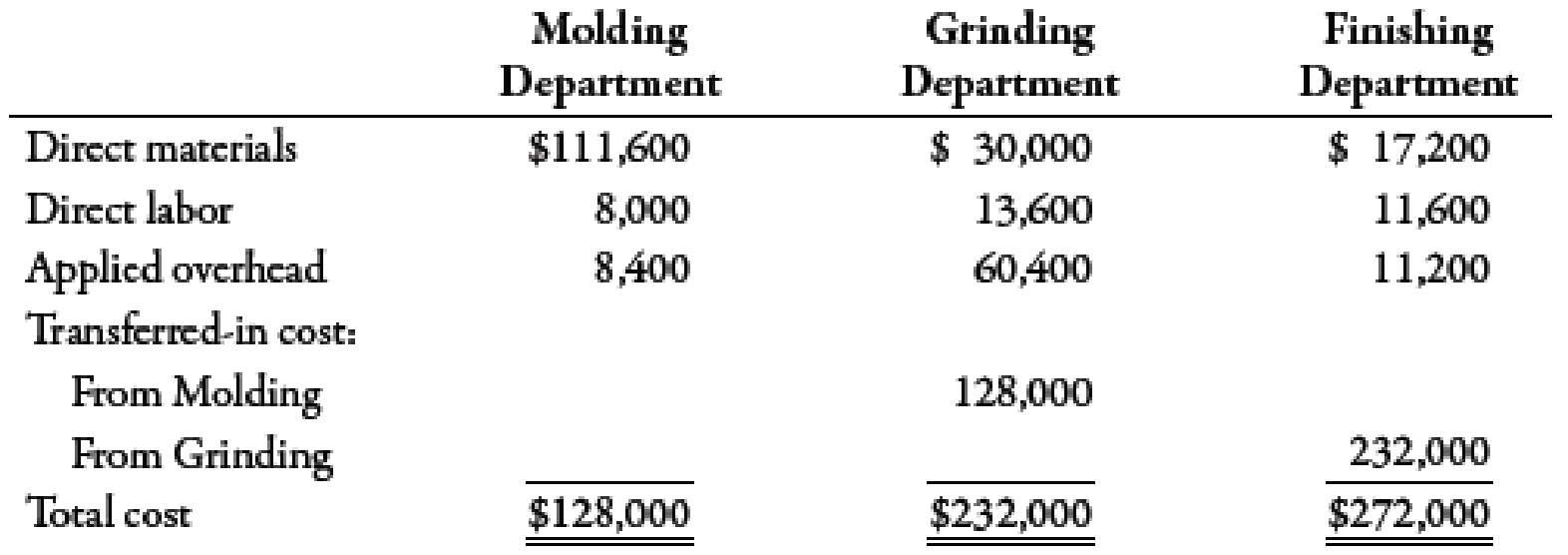

In December, Davis Company had the following cost flows:

Required:

- 1. Prepare the journal entries to transfer costs from (a) Molding to Grinding, (b) Grinding to Finishing, and (c) Finishing to Finished Goods.

- 2. CONCEPTUAL CONNECTION Explain how the journal entries differ from a

job-order cost system.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Beginning inventory, purchases, and sales for an inventory item are as follows:

Date

Line Item Description

Units and Cost

Sep. 1

Beginning Inventory

23 units @ $15

5

Sale

13 units

17

Purchase

25 units @ $17

30

Sale

17 units

Assuming a perpetual inventory system and the last-in, first-out method:

Determine the cost of goods sold for the September 30 sale.$

Determine the inventory on September 30.

$

Line Item Description

Units and Cost

Beginning inventory

12 units at $48

First purchase

15 units at $53

Second purchase

55 units at $56

Third purchase

13 units at $61

The firm uses the periodic inventory system, and there are 25 units of the commodity on hand at the end of the year.

What is the ending inventory balance of Commodity Z using LIFO?

a. $1,465

b. $1,265

c. $5,244

d. $1,200

Company sells blankets for $40 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Company uses a perpetual inventory system.

Date

Blankets

Units

Cost

May 3

Purchase

11

$20

10

Sale

4

17

Purchase

10

$17

20

Sale

6

23

Sale

3

30

Purchase

8

$24

Determine the May 31 inventory balance using the FIFO inventory costing method.

a. $328

b. $272

c. $320

d. $384

Chapter 6 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 2DQCh. 6 - What are the similarities in and differences...Ch. 6 - Prob. 4DQCh. 6 - How would process costing for services differ from...Ch. 6 - How does the adoption of a JIT approach to...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - Under the weighted average method, how are...Ch. 6 - Prob. 9DQCh. 6 - Prob. 10DQ

Ch. 6 - Prob. 11DQCh. 6 - How is the equivalent unit calculation affected...Ch. 6 - Prob. 13DQCh. 6 - Prob. 14DQCh. 6 - Process costing works well whenever a....Ch. 6 - Job-order costing works well whenever a....Ch. 6 - Prob. 3MCQCh. 6 - To record the transfer of costs from a prior...Ch. 6 - The costs transferred from a prior process to a...Ch. 6 - During the month of May, the grinding department...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - During May, Kimbrell Manufacturing completed and...Ch. 6 - During June, Kimbrell Manufacturing completed and...Ch. 6 - For August, Kimbrell Manufacturing has costs in...Ch. 6 - For September, Murphy Company has manufacturing...Ch. 6 - During June, Faust Manufacturing started and...Ch. 6 - During July, Faust Manufacturing started and...Ch. 6 - Assume for August that Faust Manufacturing has...Ch. 6 - For August, Lanny Company had 25,000 units in...Ch. 6 - When materials are added either at the beginning...Ch. 6 - With nonuniform inputs, the cost of EWIP is...Ch. 6 - Transferred-in goods are treated by the receiving...Ch. 6 - Basic Cost Flows Gardner Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Golding Inc. just finished...Ch. 6 - Production Report, Weighted Average Manzer Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Carter Inc....Ch. 6 - Transferred-In Cost Powers Inc. produces a protein...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Hardy Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Craig Inc. just finished...Ch. 6 - Production Report, Weighted Average Washburn Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Ming Inc. had...Ch. 6 - Transferred-In Cost Vigor Inc. produces an energy...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Linsenmeyer Company produces a...Ch. 6 - Journal Entries, Basic Cost Flows In December,...Ch. 6 - Equivalent Units, Unit Cost, Valuation of Goods...Ch. 6 - Weighted Average Method, Equivalent Units Goforth...Ch. 6 - Cassien Inc. manufactures products that pass...Ch. 6 - Weighted Average Method, Unit Costs, Valuing...Ch. 6 - Physical Flow Schedule The following information...Ch. 6 - Physical Flow Schedule Nelrok Company manufactures...Ch. 6 - Production Report, Weighted Average Mino Inc....Ch. 6 - Nonuniform Inputs, Equivalent Units Terry Linens...Ch. 6 - Unit Cost and Cost Assignment, Nonuniform Inputs...Ch. 6 - Nonuniform Inputs, Transferred-In Cost Drysdale...Ch. 6 - Transferred-In Cost Goldings finishing department...Ch. 6 - (Appendix 6A) First-In, First-Out Method;...Ch. 6 - (Appendix 6A) First-In, First-Out Method; Unit...Ch. 6 - Basic Flows, Equivalent Units Thayn Company...Ch. 6 - Steps in Preparing a Production Report Recently,...Ch. 6 - Recently, Stillwater Designs expanded its market...Ch. 6 - Equivalent Units, Unit Cost, Weighted Average...Ch. 6 - Production Report Refer to the information for...Ch. 6 - Mimasca Inc. manufactures various holiday masks....Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Weighted Average Method, Separate Materials Cost...Ch. 6 - Seacrest Company uses a process-costing system....Ch. 6 - Required: 1. Using the FIFO method, prepare the...Ch. 6 - Benson Pharmaceuticals uses a process-costing...Ch. 6 - (Appendix 6A) First-In, First-Out Method Refer to...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - AKL Foundry manufactures metal components for...Ch. 6 - Consider the following conversation between Gary...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the basis of the following data, what is the estimated cost of the inventory on May 31 using the retail method? Date Line Item Description Cost Retail May 1 Inventory $23,800 $39,670 May 1-31 Purchases 42,600 67,540 May 1-31 Sales 91,090 a. $24,690 b. $19,580 c. $29,564 d. $9,984arrow_forward00000000 The following lots of Commodity Z were available for sale during the year. Line Item Description Units and Cost Beginning inventory 12 units at $48 First purchase 15 units at $53 Second purchase 55 units at $56 Third purchase 13 units at $61 The firm uses the periodic inventory system, and there are 25 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using LIFO? a. $1,465 b. $1,265 c. $5,244 d. $1,200arrow_forwardBeginning inventory 8 units at $51 First purchase 17 units at $55 Second purchase 26 units at $58 Third purchase 15 units at $63 The firm uses the periodic inventory system, and there are 23 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using FIFO? a. $1,173 b. $1,409 c. $3,773 d. $3,796arrow_forward

- 00000arrow_forwardThe inventory data for an item for November are: Nov. 1 Inventory 4 Sold 19 units at $23 8 units 10 Purchased 32 units at $21 25 units 17 Sold 30 Purchased 21 units at $23 Using a perpetual system, what is the cost of goods sold for November if the company uses LIFO? a. $731 b. $861 c. $962 Od. $709arrow_forwardI got the 3rd incorrect. can you help me go step by step. Date Line Item Description Units and Cost Amount Mar. 1 Inventory 21 units @ $31 $651 June 16 Purchase 29 units @ $33 957 Nov. 28 Purchase 39 units @ $39 1,521 Total 89 units $3,129 There are 13 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the inventory cost using the weighted average cost methods. $arrow_forward

- 3arrow_forwardBoxwood Company sells blankets for $31 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system. Date Blankets Units Cost May 3 Purchase 8 $15 10 Sale 5 17 Purchase 10 $18 20 Sale 7 23 Sale 2 30 Purchase 12 $19 Determine the cost of goods sold for the sale of May 20 using the FIFO inventory costing method. a. $201 b. $114 c. $117 O d. $171arrow_forwardIn the month of March, Horizon Textiles Ltd. had 7,500 units in beginning work in process that were 65% complete. During March, 29,500 units were transferred into production from another department. At the end of March, there were 3,800 units in ending work in process that were 40% complete. Compute the equivalent units of production for materials and conversion costs using the weighted-average method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY