Concept explainers

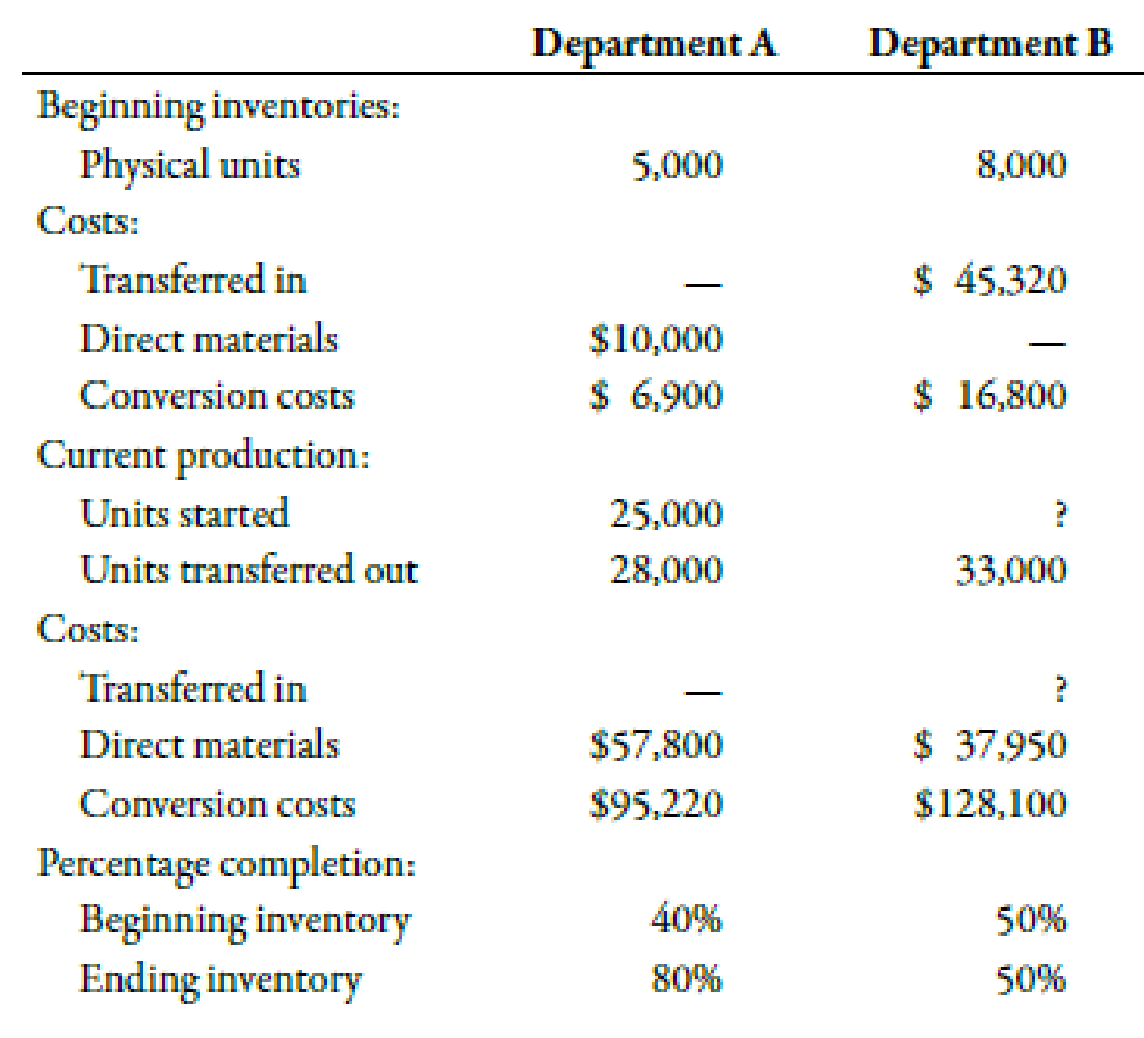

Seacrest Company uses a process-costing system. The company manufactures a product that is processed in two departments: A and B. As work is completed, it is transferred out. All inputs are added uniformly in Department A. The following summarizes the production activity and costs for November:

Required:

- 1. Using the weighted average method, prepare the following for Department A: (a) a physical flow schedule, (b) an equivalent unit calculation, (c) calculation of unit costs (Note: Round to four decimal places.), (d) cost of EWIP and cost of goods transferred out, and (e) a cost reconciliation.

- 2. CONCEPTUAL CONNECTION Prepare

journal entries that show the flow ofmanufacturing costs for Department A. Use a conversion cost control account for conversion costs. Many firms are now combining direct labor andoverhead costs into one category. They are not tracking direct labor separately. Offer some reasons for this practice.

1.

a.

Make a physical flow schedule for department A.

Explanation of Solution

Physical Flow Schedule:

The schedule which is made with the objective to determine the production of physical units is known as physical flow schedule. It considers all units in process which can be related to any completion stage.

Prepare physical flow schedule of Company J:

| Physical Flow Schedule | |

| Units to account for: | Units |

| Units in BWIP | 5,000 |

| Add: Units started | 25,000 |

| Total units account for | 30,000 |

| Units accounted for: | |

| Units started and completed that are transferred. | 28,000 |

|

Add: Units in EWIP | 2,000 |

| Total units accounted for | 30,000 |

Table (1)

Therefore, the units accounted for and units to account for are 30,000 units.

b.

Compute equivalent unit of production with help of equivalent unit schedule of Company J.

Answer to Problem 65P

The equivalent units of production are 29,600units.

Explanation of Solution

Prepare equivalent unit schedule of Department A:

| Particulars | Units |

| Units completed | 28,000 |

| Add: Units in EWIP | 1,600 |

| Total equivalent unit | 29,600 |

Table (2)

Therefore, equivalent units of production are 29,600 units.

c.

Compute unit cost of Department A.

Answer to Problem 65P

The unit cost for Department A is $5.7405.

Explanation of Solution

Use the following formula to calculate unit cost for Department A:

Therefore, the unit cost is $5.7405

d.

Compute total cost of goods transferred out and cost of EWIP.

Answer to Problem 65P

The total cost of goods transferred out and cost of EWIP are $160,734 and $9,185 respectively.

Explanation of Solution

Use the following formula to calculate total cost of goods transferred out:

Therefore, total cost of goods transferred out is $160,734.

Use the following formula to calculate cost of EWIP:

Therefore, cost of EWIP is $9,185.

e.

Make cost reconciliation for Department A.

Explanation of Solution

Prepare cost reconciliation for Department A:

| Costs to account for | Amount($) | Cost accounted for | Amount($) |

| Cost of BWIP | 16,900 | Transferred out | 160,734 |

| Cost of the period | 153,020 | Cost of EWIP | 9,185 |

| Total cost | 169,920 | 169,919 |

Table (3)

Therefore, total cost of $169,920 has been reconciled (the difference of $1 is due to differences in rounding off certain amounts).

2.

Journalize the transactions that show the flow of manufacturing costs for department A. State the reasons for firms combining direct labor and overhead costs into one category.

Explanation of Solution

Pass journal entry to record cost of direct materials incurred as shown below:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Work in Process | 57,800 | |||

| Raw materials | 57,800 | |||

| (To record cost of direct materials incurred during the period ) |

Table (1)

Work in process is debited as cost has increased, so this account is debited and raw materials account is credited.

Pass journal entry to record conversion cost incurred as shown below:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Work in Process | 95,220 | |||

| Conversion cost | 95,220 | |||

| (To record conversion cost incurred during the period ) |

Work in process is debited as cost has increased, so this account is debited and conversion cost is credited.

Pass journal entry to record transfer cost from department A to department B as shown below:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| Work in Process-Department B | 160,734 | |||

| Work in Process-Department A | 160,734 | |||

| (To record cost transferred from department A to department B ) |

The cost transferred from department A increases the cost of department B. This is the reason to debit the work in process of department B.

Cost is transferred from department A to department B. This is the reason that the amount of department A cost decreases. Therefore balance of work in process of department A is credited.

Direct labor is treated as any other overhead cost by some firms as direct labor carry out functions of other overhead costs such as inspection and maintenance. Another reason for merging these cost could be that fraction of direct labor cost acquires only small proportion of total manufacturing cost.

Want to see more full solutions like this?

Chapter 6 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,