Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 46E

Weighted Average Method, Unit Costs, Valuing Inventories

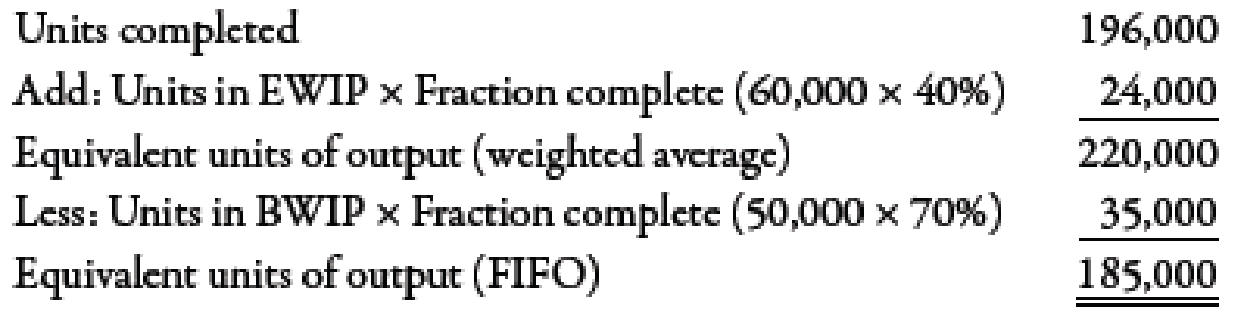

Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method:

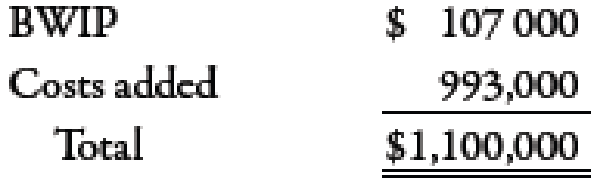

The costs that Byford had to account for during the month of November were as follows:

Required:

- 1. Using the weighted average method, determine unit cost.

- 2. Under the weighted average method, what is the total cost of units transferred out? What is the cost assigned to units in ending inventory?

- 3. CONCEPTUAL CONNECTION Bill Johnson, the manager of Byford, is considering switching from weighted average to FIFO. Explain the key differences between the two approaches and make a recommendation to Bill about which method should be used.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Don't use ai solution please given answer general accounting

Hello tutor please provide answer general accounting question

Please solve for the items highlighted in yellow and red check mark at the bottom of page.

Chapter 6 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 2DQCh. 6 - What are the similarities in and differences...Ch. 6 - Prob. 4DQCh. 6 - How would process costing for services differ from...Ch. 6 - How does the adoption of a JIT approach to...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - Under the weighted average method, how are...Ch. 6 - Prob. 9DQCh. 6 - Prob. 10DQ

Ch. 6 - Prob. 11DQCh. 6 - How is the equivalent unit calculation affected...Ch. 6 - Prob. 13DQCh. 6 - Prob. 14DQCh. 6 - Process costing works well whenever a....Ch. 6 - Job-order costing works well whenever a....Ch. 6 - Prob. 3MCQCh. 6 - To record the transfer of costs from a prior...Ch. 6 - The costs transferred from a prior process to a...Ch. 6 - During the month of May, the grinding department...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - During May, Kimbrell Manufacturing completed and...Ch. 6 - During June, Kimbrell Manufacturing completed and...Ch. 6 - For August, Kimbrell Manufacturing has costs in...Ch. 6 - For September, Murphy Company has manufacturing...Ch. 6 - During June, Faust Manufacturing started and...Ch. 6 - During July, Faust Manufacturing started and...Ch. 6 - Assume for August that Faust Manufacturing has...Ch. 6 - For August, Lanny Company had 25,000 units in...Ch. 6 - When materials are added either at the beginning...Ch. 6 - With nonuniform inputs, the cost of EWIP is...Ch. 6 - Transferred-in goods are treated by the receiving...Ch. 6 - Basic Cost Flows Gardner Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Golding Inc. just finished...Ch. 6 - Production Report, Weighted Average Manzer Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Carter Inc....Ch. 6 - Transferred-In Cost Powers Inc. produces a protein...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Hardy Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Craig Inc. just finished...Ch. 6 - Production Report, Weighted Average Washburn Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Ming Inc. had...Ch. 6 - Transferred-In Cost Vigor Inc. produces an energy...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Linsenmeyer Company produces a...Ch. 6 - Journal Entries, Basic Cost Flows In December,...Ch. 6 - Equivalent Units, Unit Cost, Valuation of Goods...Ch. 6 - Weighted Average Method, Equivalent Units Goforth...Ch. 6 - Cassien Inc. manufactures products that pass...Ch. 6 - Weighted Average Method, Unit Costs, Valuing...Ch. 6 - Physical Flow Schedule The following information...Ch. 6 - Physical Flow Schedule Nelrok Company manufactures...Ch. 6 - Production Report, Weighted Average Mino Inc....Ch. 6 - Nonuniform Inputs, Equivalent Units Terry Linens...Ch. 6 - Unit Cost and Cost Assignment, Nonuniform Inputs...Ch. 6 - Nonuniform Inputs, Transferred-In Cost Drysdale...Ch. 6 - Transferred-In Cost Goldings finishing department...Ch. 6 - (Appendix 6A) First-In, First-Out Method;...Ch. 6 - (Appendix 6A) First-In, First-Out Method; Unit...Ch. 6 - Basic Flows, Equivalent Units Thayn Company...Ch. 6 - Steps in Preparing a Production Report Recently,...Ch. 6 - Recently, Stillwater Designs expanded its market...Ch. 6 - Equivalent Units, Unit Cost, Weighted Average...Ch. 6 - Production Report Refer to the information for...Ch. 6 - Mimasca Inc. manufactures various holiday masks....Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Weighted Average Method, Separate Materials Cost...Ch. 6 - Seacrest Company uses a process-costing system....Ch. 6 - Required: 1. Using the FIFO method, prepare the...Ch. 6 - Benson Pharmaceuticals uses a process-costing...Ch. 6 - (Appendix 6A) First-In, First-Out Method Refer to...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - AKL Foundry manufactures metal components for...Ch. 6 - Consider the following conversation between Gary...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Waiting for your solution general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY