Concept explainers

Calculate ending inventory end cost of goods sold using FIFO and LIFO and adjust inventory using lower of cost and net realizable value (LO6–3, 6–6)

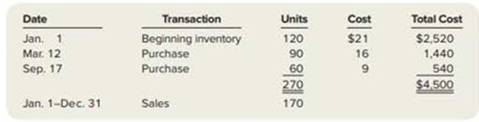

For the current year, Parker Games has the following inventory transactions related to its traditional board games.

Because of the increasing popularity of electronic video games, Parker Games continues to see a decline in the demand for board games. Sales prices have decreased by over 50% during the year. At the end of the war, Parker estimates the net realizable value of the 100 units of unsold inventory to be $500.

Required:

1. Using FIFO, calculate ending inventory and cost of goods sold.

2. Using LIFO, calculate ending inventory and cost of goods sold.

3. Determine the amount of ending inventory to report using lower of cost and net realizable value under FIFO. Record any necessary adjustment.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

FINANCIAL ACCOUNTINGLL W/CONNECT >IC<

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardI need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardJob #508 used $3,500 in direct materials, 200 direct labor hours at $22 per hour, and overhead is applied at 150% of direct labor cost. Calculate the total cost of Job #508.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Rayburn Corporation has a building that it bought during year 0 for $850,000. It sold the building in year 5. During the time it held the building, Rayburn depreciated it by $100,000. What are the amount and character of the gain or loss Rayburn will recognize on the sale in each of the following alternative situations? Note: Loss amounts should be indicated by a minus sign. Enter NA if a situation is not applicable. Leave no answers blank. Enter zero if applicable. Problem 11-43 Part-a (Static) a. Rayburn receives $840,00arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- Fenton Manufacturing Inc. had a variable costing operating income of $128,400 in 2023. Ending inventory decreased during 2023 from 45,000 units to 40,000 units. During both 2022 and 2023, fixed manufacturing overhead was $1,080,000, and 135,000 units were produced. Determine the absorption costing operating income for 2023.arrow_forwardWhat are the total product Costs for the company under variable costing?arrow_forwardQuestion 8-Barrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning