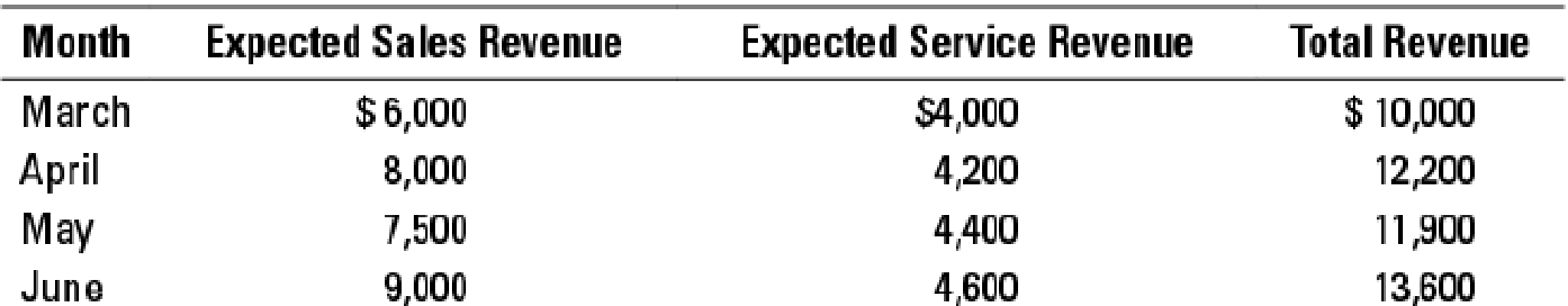

Sales and Service Revenues Budget March–-June 2018

Almost all of the sales revenues of the oxygen equipment are credit card sales; cash sales are negligible. The credit card company deposits 97% of the revenues recorded each day into HealthMart’s account overnight. For the servicing of home oxygen equipment, 60% of oxygen services billed each month is collected in the month of the service, and 40% is collected in the month following the service.

- 1. Calculate the cash that HealthMart expects to collect in April, May, and June 2018 from sales and service revenues. Show calculations for each month.

- 2. HealthMart has budgeted expenditures for May of $11,000 and requires a minimum cash balance of $250 at the end of each month. It has a cash balance on May 1 of $400.

- a. Given your answer to requirement 1, will HealthMart need to borrow cash to cover its payments for May and maintain a minimum cash balance of $250 at the end of May?

- b. Assume (independently for each situation) that (1) May total revenues might be 10% lower or that (2) total costs might be 5% higher. Under each of those two scenarios, show the total net cash for May and the amount HealthMart would have to borrow to cover its cash payments for May and maintain a minimum cash balance of $250 at the end of May. (Again, assume a balance of $400 on May 1.)

- 3. Why do HealthMart’s managers prepare a

cash budget in addition to the revenue, expenses, and operating income budget? Has preparing the cash budget been helpful? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

COST ACCOUNTING

- What is the firm's cost of equity on these financial accounting question?arrow_forwardNonearrow_forwardNovelli's Nursery has developed the following data in order to calculate the lower of cost or net realizable value for its products. The individual products are listed within the categories of trees. Selling Price Cost Broad leaf trees: Ash $ 1,840 $ 1,740 Beech 2,260 1,640 Needle leaf trees: Cedar $ 2,580 $ 1,790 Fir 3,700 3,390 Fruit trees: Apple $ 1,840 $ 1,440 Cherry 2,360 1,840 The costs to sell are 10% of selling price. Required: Determine the reported inventory value assuming the lower of cost or net realizable value rule is applied to the total inventory.arrow_forward

- The second step, when using dollar-value LIFO retail method for inventory, is to determine the estimated: Multiple Choice Cost of goods sold for the current year. Ending inventory at cost. Ending inventory at current year retail prices. Ending inventory at base year retail prices.arrow_forwardData related to the inventories of Kimzey Medical Supply are presented below: Surgical Equipment Surgical Supplies Rehab Equipment Rehab Supplies Selling price $ 315 $ 175 $ 395 $ 220 Cost 225 145 305 217 Replacement cost 295 135 290 213 Costs to sell 52 16 36 32 Normal gross profit ratio 40% 40% 40% 40% In applying the lower of cost or market rule, the inventory of surgical supplies would be valued at: Multiple Choice $155. $145. $135. $119.arrow_forwardData related to the inventories of Alpine Ski Equipment and Supplies is presented below: Skis Boots Apparel Supplies Selling price $ 168,000 $ 163,000 $ 109,000 $ 66,000 Cost 140,000 142,000 70,850 42,900 Replacement cost 131,000 128,000 90,850 38,900 Sales commission 10% 10% 10% 10% In applying the lower of cost or net realizable value rule, the inventory of skis would be valued at: Multiple Choice $151,200. $131,000. $140,000. $117,600.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT