Sustainability and cost estimation (Learning Objective 2)

SUSTAINABILITY

Moonlight Entertainment is a provider of cable, Internet, and on-demand video services. Moonlight currently sends monthly bills to its customers via the postal service. Because of a concern for the environment and recent increases in postal rates, Moonlight management is considering offering an option to its customers for paperless billing. In addition to saving printing, paper, and postal costs, paperless billing will save energy and water (through reduced paper needs, reduced waste disposal, and reduced transportation needs.) Although Moonlight would like to switch to 100% paperless billing, many of its customers are not comfortable with paperless billing or may not have online access, so the paper billing option will remain regardless of whether Moonlight adopts a paperless billing system or not.

The cost of the paperless billing system would be $288,600 per quarter with no variable costs since the costs of the system are the salaries of the clerks and the cost of leasing the computer system. The paperless billing system being proposed would be able to handle up to 990,000 bills per quarter (more than 990,000 bills per quarter would require a different computer system and is outside the scope of the current situation at Moonlight).

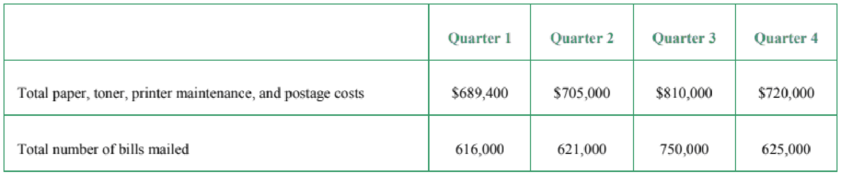

The company has gathered its cost data for the past year by quarter for paper, toner cartridges, printer maintenance costs, and postage costs for its billing department. The cost data are as follows:

Requirements

- 1. Calculate the variable cost per bill mailed under the current paper-based billing system. Use the high-low method.

- 2. Assume that the company projects that it will have a total of 760,000 bills to mail in the upcoming quarter. If enough customers choose the paperless billing option so that 45% of the mailings can be converted to paperless, how much would the company save from the paperless billing system (be sure to consider the cost of the paperless billing system)?

- 3. What if only 40% of the mailings are converted to the paperless option (assume a total of 760,000 bills)? Should the company still offer the paperless billing system? Explain your rationale.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting (5th Edition)

- Select the correct answerarrow_forwardWhat is a good response to this post? Hello everyone,The theory of facework is a beneficial instrument for preserving self-image and fostering mutual respect during exchanges. According to Nguyen-Phuong-Mai, Terlouw, and Pilot (2014), facework is the strategic approach individuals employ to validate their own identity while simultaneously considering the requirements of others. The necessity of these strategies has been evident to me during my nine years as a rideshare driver. I endeavor to understand the context and intentions of each passenger by dedicating sufficient time to attentive listening before disclosing undue personal information. This empathetic and respectful approach safeguards my identity and fosters trust, reducing the probability of rambling and mitigating the potential harm of receiving a poor rating.My experience in the restaurant industry, particularly at venues such as Tavern on the Green in New York City, has emphasized the significance of effective facework.…arrow_forwardCorrect answerarrow_forward

- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning