Ethics of building inventory (Learning Objective 6)

ETHICS

Fanfare Products, Inc., is a manufacturer of mobile devices. Kyle is the plant manager at Fanfare’s Toledo, Ohio, plant. The Toledo plant manufactures a smartphone, the Zoom, which has sold well for the past six months. Kyle is being considered for promotion to manager of the entire West Coast division of Fanfare Products. Bethany is an accounting supervisor at Fanfare Products and is a good friend of Kyle’s.

Kyle and Bethany are having lunch in the company cafeteria. There are about six weeks left in the current fiscal year. Kyle is concerned that his plant will be showing a loss rather than the healthy profit he had projected for the year. The reason for the shortfall is that demand has radically declined for the Zoom smartphone currently manufactured by Kyle’s plant. New smartphones with more features have been brought to market by Fanfare’s competitors. Engineers at Fanfare are currently working on an updated model of the Zoom, but it will not be ready for production in Kyle’s plant for another five months. If Kyle’s plant shows a loss this year, Kyle will not receive his performance bonus for the year. He also knows that his chance of promotion to the West Coast manager will be greatly reduced.

Bethany thinks about Kyle’s situation. She then shares with him a strategy that he can use to help increase his profits. She explains that under absorption costing, the more units in ending inventory, the more costs can be deferred. Using her tablet, she makes up a quick example in Excel to show him how he can turn his situation around and show operating income for the year.

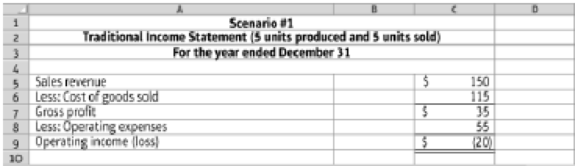

Bethany’s first spreadsheet assumes that five units are produced and sold in this hypothetical situation:

6.7-79 Full Alternative Text

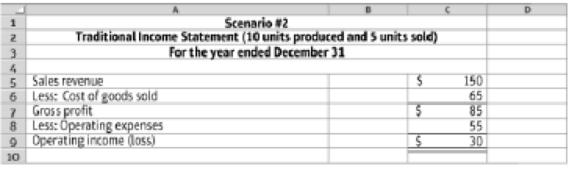

If five units are produced and sold, the hypothetical company would have a loss of $20. Now Bethany changes just one fact; instead of producing five units, the company in the example produces ten units. No other facts change—the company still sells just five units. Bethany shows Kyle the revised income statement under the increased production scenario:

6.7-80 Full Alternative Text

Under this second scenario, the operating income would be $30, which is quite a bit higher than the original scenario. Bethany again emphasizes that the only fact that was different between the two scenarios is that production, and therefore ending inventory, increased in the second scenario.

Bethany then urges Kyle to put on a major production push in the last month of the year. If he does, he will be able to push his income up to near projected levels. With the higher income, he will receive his annual performance bonus. In addition, he feels that his chances of getting the West Coast manager position are excellent.

Requirements

- 1. Using the IMA Statement of Ethical Professional Practice (refer to Exhibit 1-7) as an ethical framework, answer the following questions:

- a. What is (are) the ethical issue(s) in this situation?

- b. What are Bethany’s responsibilities as a management accountant?

- c. Has Bethany violated any part of the IMA Statement of Ethical Professional Practice? Support your answer.

- 2. What causes the shift from a loss to a profit in the hypothetical example?

- 3. What problems, if any, are caused by building inventories at year end?

- 4. What could Fanfare Products do to prevent future situations like the one described in this case?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Managerial Accounting (5th Edition)

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- ← Week 1: Homework Question 3 of 4 8.75/10 The project is completed in 2025, and a successful patent is obtained. The R&D costs to complete the project are $113,000. The administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2025 total $16,000. The patent has an expected useful life of 5 years. Record the costs for 2025 in journal entry form. Also, record patent amortization (full year) in 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Research and Development Expense Cash (To record research and development costs) Patents Cash (To record legal and administrative costs) Amortization Expense Patents (To record one year's amortization expense) Debit 113000 16000 3200 Credit 113000 16000 3200arrow_forwardJoe transfers land to JH Corporation for 90% of the stock in JH Corporation worth $20,000 plus a note payable to Joe in the amount of $40,000 and the assumption by JH Corporation of a mortgage on the land in the amount of $100,000. The land, which has a basis to Joe of $70,000, is worth $160,000. a. Joe will have a recognized gain on the transfer of $90,000. b. Joe will have a recognized gain on the transfer of $30,000.c. JH Corporation will have a basis in the land transferred by Joe of $70,000. d. JH Corporation will have a basis in the land transferred by Joe of $160,000. e. None of the above.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning