Concept explainers

Account Analysis, Two-Stage Allocation, and Product Costing

Tiger Furnishings’s CFO believes that a two-stage cost allocation system would give managers better cost information. She asks the company’s cost accountant to analyze the accounts and assign

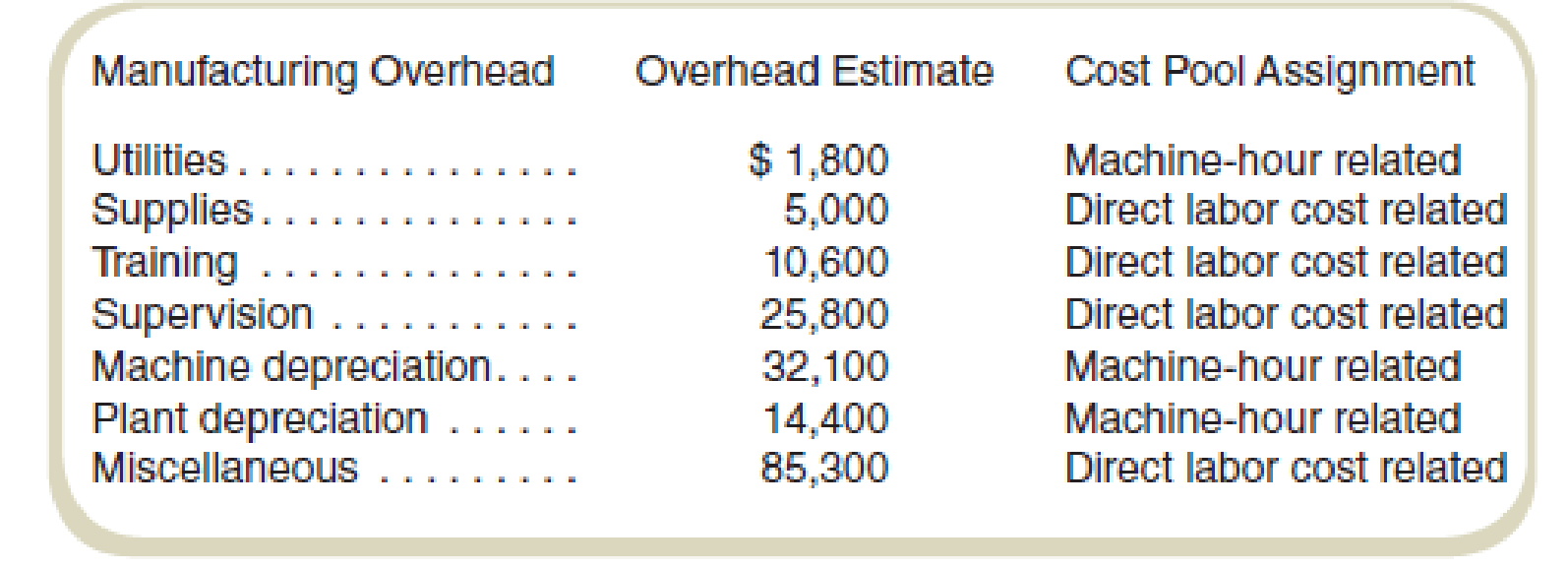

The analysis of overhead accounts by the cost accountant follows:

All other information is the same as in Exercise 6-39.

Required

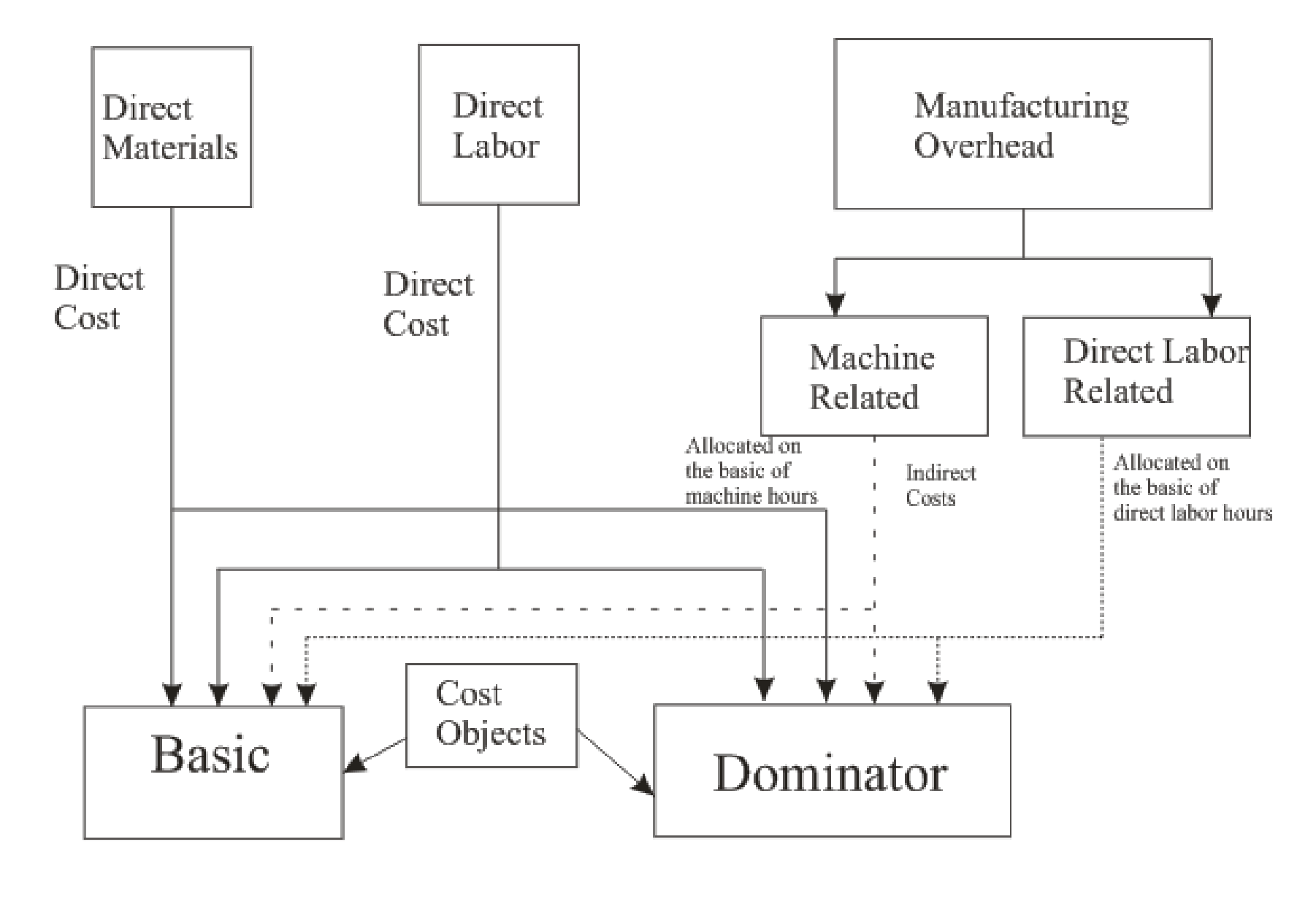

- a. Draw the cost flow diagram that illustrates the two-stage cost allocation of overhead for Tiger Furnishings using the results of the cost accountant’s analysis of accounts.

- b. Compute the product costs per unit assuming that Tiger Furnishings uses direct labor costs and machine-hours to allocate overhead to the products.

a.

Draw the cost flow diagram that illustrates the two-stage cost allocation of overhead for Company T using the results of the cost accountant’s analysis of accounts.

Explanation of Solution

The cost flow diagram that illustrates the two-stage cost allocation of overhead for Company T using the results of the cost accountant’s analysis of accounts is as follows:

b.

Compute the product costs per unit using direct labor costs and machine-hours to allocate overhead to products.

Answer to Problem 61P

The value of cost per unit for Product Basic is $177 and for Product Dominator is $390.

Explanation of Solution

Cost per unit: The cost per unit is determined by dividing the total of variable and fixed cost with the total number of units.

Compute the cost per unit:

For Product Basic:

For Product Dominator:

Thus, the value of cost per unit for Product Basic is $177 and for Product Dominator is $390.

Working note 1:

For product Basic:

Compute the cost related to machine hours for Product Basic:

Working note 2:

Compute the cost related to direct labor cost for Product Basic:

Working note 3:

Compute the cost related to machine-hour for Product Dominator:

Working note 4:

Compute the cost related to direct-labor for Product Dominator:

Working note 5:

Compute the machine-hours rate for both the products:

Working note 6:

Compute the direct labor costs for both the products:

Working note 7:

Compute the total cost for the Product Basic:

Working note 8:

Compute the total cost of Product Dominator:

Want to see more full solutions like this?

Chapter 6 Solutions

FUNDAME.OF COST ACCT. W/CONNECT

- What is its average inventory of this financial accounting question?arrow_forwardThe underapplication of overhead will result in Group of answer choices understatement of net income. overstatement of cost of goods sold. understatement of cost of goods sold. overvalued finished goods inventory.arrow_forwardchoose best answer financial accountingarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning