Concept explainers

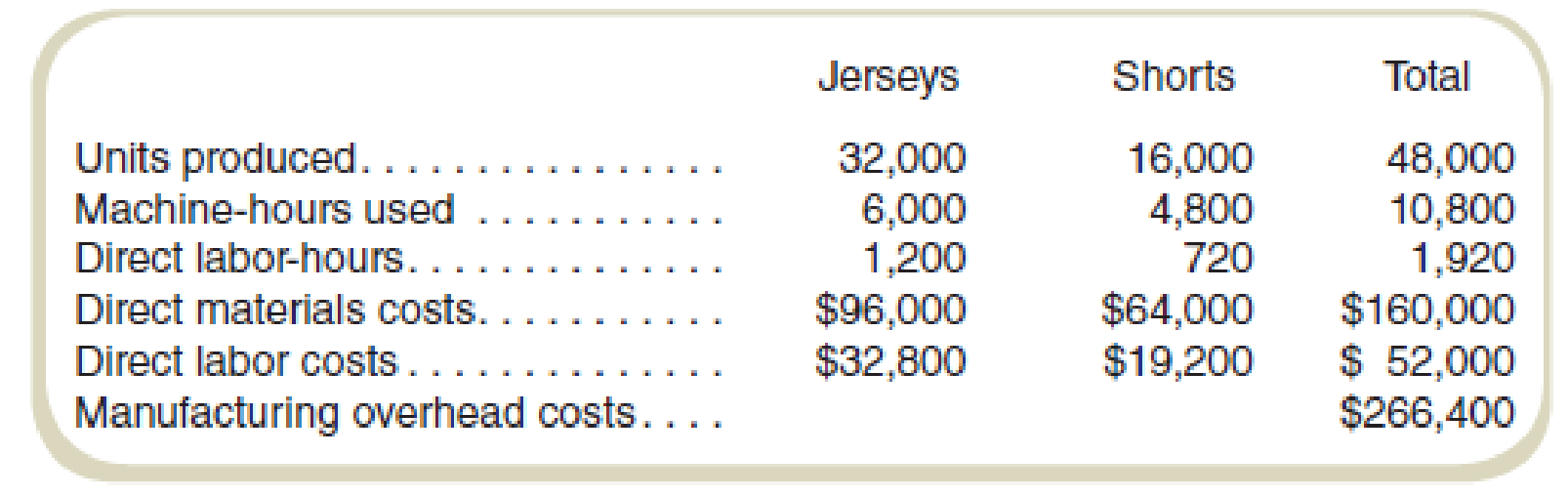

Donovan & Parents produces soccer shorts and jerseys for youth leagues. Most of the production is done by machine. Data on operations and costs for March follow:

Management asks the firm’s cost accountant to compute product costs. The accountant first assigns

Required

- a. Compute the predetermined overhead rates assuming that Donovan uses machine-hours to allocate machine-related overhead costs and materials costs to allocate materials-related overhead costs.

- b. Compute the total costs of production and the cost per unit for each of the two products for March.

a.

Find the predetermined overhead rates using machine-hours and materials costs for the allocation.

Answer to Problem 55P

The value of machine related predetermined overhead rate is $18.

The value of materials related predetermined overhead rate is 45% of the cost.

Explanation of Solution

Predetermined overhead rate:

The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation.

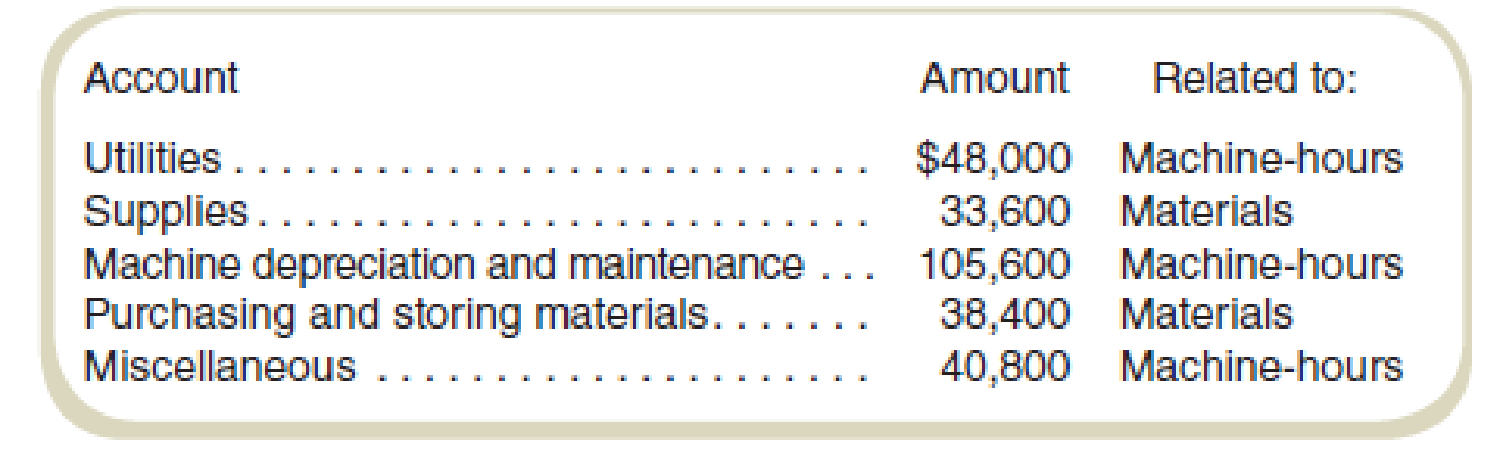

Analysis of overhead accounts by the cost accountant is as follows:

| Account | Amount | Related to: |

| Utilities | $ 48,000.00 | Machine-hours |

| Supplies | $ 33,600.00 | Materials |

| Machine depreciation and maintenance | $ 105,600.00 | Machine-hours |

| Purchasing and storing materials | $ 38,400.00 | Materials |

| Miscellaneous | $ 40,800.00 | Machine-hours |

Table (1)

Compute machine-hours related predetermined rate:

Hence, the machine-hours related predetermined rate is $18.

Compute materials cost related predetermined rate:

Thus, the materials cost related predetermined rate is 45% of the cost.

b.

Calculate the total costs of production and the cost per unit for the two products.

Answer to Problem 55P

The total cost of product J is $280,000 and for product S is $198,400.

Cost per unit of product J is $8.75 and for product S is $12.4.

Explanation of Solution

Compute total cost of product J:

Compute total cost of product S:

Thus, the value of total cost for the product J and product S are $198,400 and $280,000 respectively.

Compute cost per unit for product J:

Compute cost per unit for product S:

Thus, the cost per unit value for the product J and product S are $8.75 and $12.4 respectively.

Working note 1:

Compute machine related cost for product J:

Working note 2:

Computation materials related cost for product J:

Working note 3:

Compute machine related cost for product S:

Working note 4:

Computation materials related cost for product S:

Want to see more full solutions like this?

Chapter 6 Solutions

FUNDAME.OF COST ACCT. W/CONNECT

- Hilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forwardgeneral accountingarrow_forwardThe following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forward

- PLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forwardAssume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forwardwhat is the investment turnover?arrow_forward

- A California-based company had a raw materials inventory of $135,000 on December 31, 2022, and $115,000 on December 31, 2023. During 2023, the company purchased $160,000 worth of raw materials, incurred direct labor costs of $230,000, and manufacturing overhead costs of $340,000. What is the total manufacturing cost incurred by the company? A. $720,000 B. $750,000 C. $705,000 D. $735,000arrow_forwardPLEASE HELP WITH THIS PROBLEM. ALL RED CELLS ARE EMPTY OR INCORRECT.arrow_forwardSuppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forward

- provide correct answer accounting questionarrow_forwardKubin Company’s relevant range of production is 11,000 to 14,000 units. When it produces and sells 12,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 7.20 Direct labor $ 4.20 Variable manufacturing overhead $ 1.70 Fixed manufacturing overhead $ 5.20 Fixed selling expense $ 3.70 Fixed administrative expense $ 2.70 Sales commissions $ 1.20 Variable administrative expense $ 0.70 Required: For financial accounting purposes, what is the total product cost incurred to make 12,500 units? For financial accounting purposes, what is the total period cost incurred to sell 12,500 units? For financial accounting purposes, what is the total product cost incurred to make 14,000 units? For financial accounting purposes, what is the total period cost incurred to sell 11,000 units?arrow_forwardChoose a manufacturing company then discuss the following: First, name your company and list its main products and direct materials used. What is spoilage? Give an example of spoilage that might occur during the manufacturing of the company's product. What is scrap? Give an example of scrap that might occur during the manufacturing of the company's product. What does rework mean? Give an example of rework that might occur during the manufacturing of the company's product. A leading manufacturer recently said, "What has been regarded as normal spoilage in the past will not acceptable as normal spoilage in the future? What are they talking about? What do you think are the external or internal factors that may affect the level of normal spoilage in the future?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning