Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781337517386

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6.12E

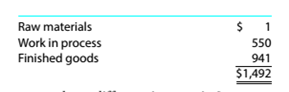

a.Why does Qualcomm report three different inventories?

b. What costs are included in each of the three inventory accounts?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please provide the correct answer to this financial accounting problem using accurate calculations.

I am searching for the right answer to this financial accounting question using proper techniques.

Please help me solve this financial accounting question using the right financial principles.

Chapter 6 Solutions

Survey of Accounting (Accounting I)

Ch. 6 - At the end of the fiscal year, before the accounts...Ch. 6 - At the end of the fiscal year, Accounts Receivable...Ch. 6 - Prob. 3SEQCh. 6 - The following units of a particular item were...Ch. 6 - Prob. 5SEQCh. 6 - Prob. 1CDQCh. 6 - What types of transactions give rise to accounts...Ch. 6 - In what section of the balance sheet should a note...Ch. 6 - Give two examples of other receivables.Ch. 6 - Carter’s Hardware is a small hardware store in the...

Ch. 6 - Which of the two methods of accounting for...Ch. 6 - Prob. 7CDQCh. 6 - After the accounts are adjusted at the end of the...Ch. 6 - Prob. 9CDQCh. 6 - How are manufacturing inventories different from...Ch. 6 - Prob. 11CDQCh. 6 - Does the term last-in in the LIFO method mean that...Ch. 6 - If inventory is being valued at cost and the price...Ch. 6 - Prob. 14CDQCh. 6 - Prob. 15CDQCh. 6 - Prob. 16CDQCh. 6 - Prob. 17CDQCh. 6 - Prob. 18CDQCh. 6 - Prob. 6.1ECh. 6 - Determine due date and interest on notes Determine...Ch. 6 - Nature of uncollectible accounts MGM Resorts...Ch. 6 - Uncollectible accounts, using direct write-off...Ch. 6 - Uncollectible receivables, using allowance method...Ch. 6 - Writing off accounts receivable Quantum...Ch. 6 - Estimating doubtful accounts Easy Rider...Ch. 6 - Entry for uncollectible accounts Using the data in...Ch. 6 - Providing for doubtful accounts At the end of the...Ch. 6 - Effect of doubtful accounts on net income During...Ch. 6 - Effect of doubtful accounts on net income Using...Ch. 6 - Qualcomm Incorporated (QCOM) is a leading...Ch. 6 - Film costs of DreamWorks DreamWorks Animation SKG...Ch. 6 - Inventory by three methods The units of an item...Ch. 6 - Inventory by three methods; cost of goods sold The...Ch. 6 - Comparing inventory methods Assume that a firm...Ch. 6 - Prob. 6.17ECh. 6 - Lower-of-cost-or-market inventory On the basis of...Ch. 6 - Inventory on the balance sheet Based on thy data...Ch. 6 - Allowance method for doubtful accounts Averys...Ch. 6 - Allowance method for doubtful accounts Averys...Ch. 6 - Allowance method for doubtful accounts Averys...Ch. 6 - Allowance method for doubtful accounts Averys...Ch. 6 - Allowance method for doubtful accounts Averys...Ch. 6 - Allowance method for doubtful accounts Averys...Ch. 6 - Estimate uncollectible accounts For several years....Ch. 6 - Estimate uncollectible accounts For several years....Ch. 6 - Compare two methods of accounting for...Ch. 6 - Compare Two methods of accounting for...Ch. 6 - Inventory by three cost flow methods Details...Ch. 6 - Inventory by three cost flow methods Details...Ch. 6 - Inventory by three cost flow methods Details...Ch. 6 - Inventory by three cost flow methods Details...Ch. 6 - Lower-of-cost-or market inventory Data on the...Ch. 6 - Prob. 6.1MBACh. 6 - Allowance method Using transactions listed in...Ch. 6 - Prob. 6.3MBACh. 6 - Prob. 6.4MBACh. 6 - Lower of cost or market Using data in E6-18,...Ch. 6 - Prob. 6.6.1MBACh. 6 - Prob. 6.6.2MBACh. 6 - Accounts receivable and inventory turnover The...Ch. 6 - Prob. 6.6.4MBACh. 6 - Prob. 6.6.5MBACh. 6 - Prob. 6.6.6MBACh. 6 - Prob. 6.7.1MBACh. 6 - Prob. 6.7.2MBACh. 6 - Prob. 6.7.3MBACh. 6 - Prob. 6.7.4MBACh. 6 - Prob. 6.7.5MBACh. 6 - Prob. 6.7.6MBACh. 6 - Prob. 6.8MBACh. 6 - Prob. 6.9.1MBACh. 6 - Prob. 6.9.2MBACh. 6 - Prob. 6.9.3MBACh. 6 - Prob. 6.9.4MBACh. 6 - Prob. 6.9.5MBACh. 6 - Prob. 6.9.6MBACh. 6 - Prob. 6.10.1MBACh. 6 - Prob. 6.10.2MBACh. 6 - Prob. 6.10.3MBACh. 6 - Prob. 6.10.4MBACh. 6 - Prob. 6.10.5MBACh. 6 - Prob. 6.10.6MBACh. 6 - Prob. 6.1CCh. 6 - Collecting accounts receivable The following is an...Ch. 6 - Ethics and professional conduct in business...Ch. 6 - LIFO and inventory flowInstructions The following...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this financial accounting problem with appropriate steps and explanations?arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I need assistance with this financial accounting problem using valid financial procedures.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forward

- Could you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License