Concept explainers

From inception of operations to December 31, 2015, Harris Corporation provided for uncollectible

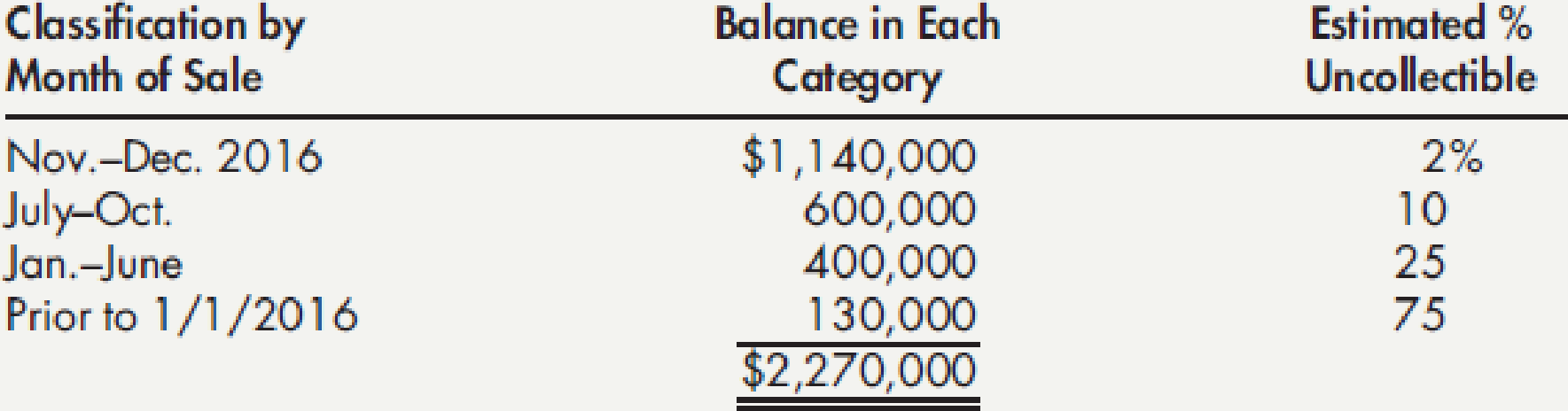

The balance in the Allowance for Doubtful Accounts was $130,000 at January 1, 2016. During 2016, credit sales totaled $9,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, $90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $15,000. Harris upgraded its computer facility in November 2016, and an aging of accounts receivable was prepared for the first time as of December 31, 2016. A summary of the aging is as follows:

Based on the review of collectibility of the account balances in the “prior to 1/1/2016” aging category, additional receivables totaling $60,000 were written off as of December 31, 2016. Effective with the year ended December 31, 2016, Harris adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Required:

- 1. Prepare a schedule analyzing the changes in the allowance for doubtful accounts for the year ended December 31, 2016. Show supporting computations in good form.

- 2. Prepare the

journal entry for the year-end adjustment to the Allowance for Doubtful Accounts balance as of December 31, 2016.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College