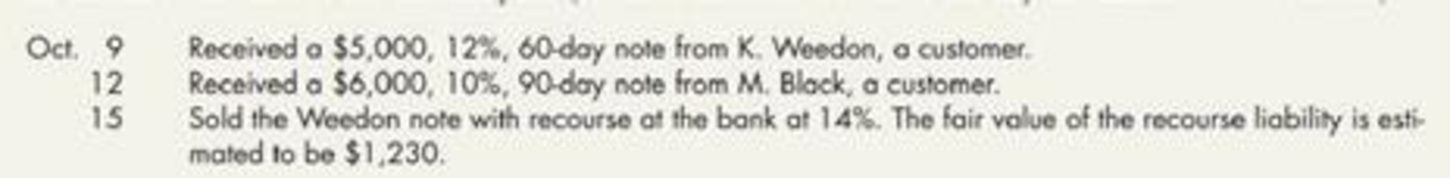

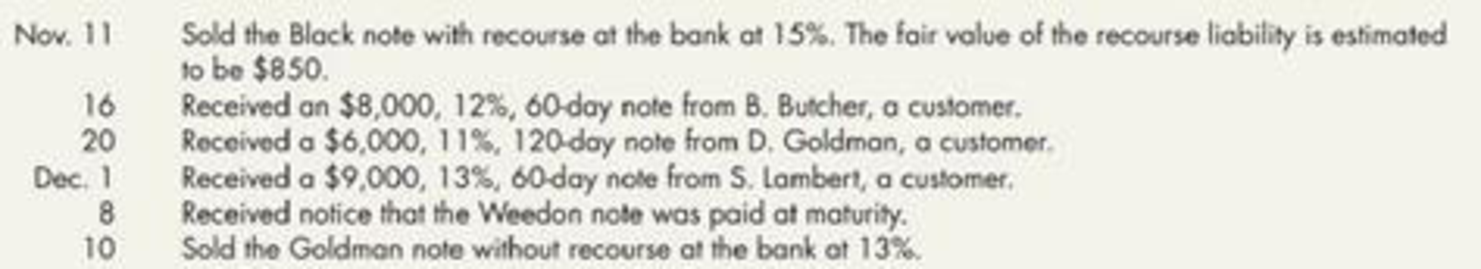

Notes Receivable Transactions The following notes receivable transactions occurred for Harris Company during the last three months of the current year. (Assume all notes are dated the day the transaction occurred.)

Required:

- 1. Prepare the

journal entries to record the preceding note transactions and the necessaryadjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) - 2. Show how Harris’ notes receivable would be disclosed on the December 31

balance sheet . (Assume these are the only note transactions encountered by Harris during the year.)

1.

Record journal entries for previous note transactions and prepare the adjusting entries.

Explanation of Solution

Note receivable:

Note receivable refers to a written promise for the amounts to be received within a stipulated period of time. This written promise is issued by a debtor or, borrower to the lender or creditor. Notes receivable is an asset of a business.

Accounts receivable:

Accounts receivable refers to the amounts to be received within a short period from customers upon the sale of goods and services on account. In other words, accounts receivable are amounts customers owe to the business. Accounts receivable is an asset of a business.

| Date | Account Title and Explanation | Debit | Credit |

| December 1 | Notes receivable | $9,000 | |

| Accounts receivable | $9,000 | ||

| (To record the notes receivable) |

Table (1)

- Notes receivable is an asset and it is increased. Therefore, debit notes receivable account by $9,000.

- Accounts receivable is an asset and it is decreased. Therefore, credit accounts receivable account by $9,000.

| Date | Account Title and Explanation | Debit | Credit |

| December 8 | Recourse liability | $1,230 | |

| Gain from sale of notes | $1,230 | ||

| (To record the fair value of recourse liability) |

Table (2)

- Recourse liability is a liability and it is decreased. Therefore, debit recourse liability account by $1,230.

- Gain from sale of notes is a component of stockholders’ equity and it is increased. Therefore, credit gain from sale of notes account by $1,230.

| Date | Account Title and Explanation | Debit | Credit |

| December 10 | Cash (1) | $5,995.39 | |

| Loss from sale of receivable (1) | $41.28 | ||

| Notes receivable | $6,000 | ||

| Interest income (5) | $36.67 | ||

| (To record note discounted on November 20 ) |

Table (3)

- Cash is an asset and it is increased. Therefore, debit cash account by $5,995.39

- Loss from sale of receivable is a component of stockholders’ equity and it is decreased. Therefore, debit loss from sale of receivables by $41.28

- Notes receivable is an asset and it is increased. Therefore, credit notes receivable account by $6,000.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $36.67.

| Date | Account Title and Explanation | Debit | Credit |

| December 31 | Interest receivable | $217.50 | |

| Interest income(6) | $217.50 | ||

| (To record the interest income of note) |

Table (4)

- Interest receivable is an asset and it is increased. Therefore, debit interest receivable account by $217.50.

- Interest income is a component of stockholders’ equity and it is increased. Therefore, credit interest income account by $217.50.

Working note:

(1) Calculate the amount of loss from receivable:

| Particulars | Amount ($) |

| Face value of the note | 6,000 |

| Interest to maturity (2) | 220 |

| Maturity value of note | 6,220 |

| Less: Discount (3) | ($224.61) |

| Proceeds | 5,995.39 |

| Less: Book value of note (4) | (6,036.67) |

| Loss from sale of receivable | 41.28 |

Table (5)

(2) Calculate the interest to maturity:

(3) Calculate the amount of discount:

Note: 20 days is calculated from November 1 to November 20.

(4) Calculate the book value of note:

(5) Calculate accrued interest income:

Note: 20 days is calculated from November 1 to November 20.

(6) Calculate the interest income of note:

2.

State the manner in which the notes receivable of Company H will be disclosed on the balance sheet on December 31.

Explanation of Solution

Disclose the notes receivable in the balance sheet of Company H:

| Assets (Partial) | Amount |

| Notes Receivable | $17,000 |

| Interest Receivable | $217.50 |

| Liabilities (Partial) | |

| Recourse liability | $850 |

Table (6)

Want to see more full solutions like this?

Chapter 6 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Question 11 - HW 5 (Ch 5-6) - Connect ezto.mheducation.com V 5 (Ch 5-6) 11 nts Saved Help Save & Exit Submit Check my work The most recent financial statements for Crosby, Incorporated, ollow. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Assume the firm is operating at full capacity and the debt-equity ratio is held constant. Skipped Sales Costs eBook Hint eferences C raw 115 CROSBY, INCORPORATED 2023 Income Statement Other expenses Earnings before interest and taxes Interest paid Taxable income Taxes (22%) $ 765,000 621,000 30,000 $ 114,000 14,800 $ 99,200 21,824 Net income Dividends Addition to retained earnings $ 77,376 $ 35,940 41,436 CROSBY, INCORPORATED Balance Sheet as of December 31, 2023 Assets Liabilities and Owners' Equity Current assets Cash Accounts receivable Inventory Total Fixed assets $ 25,440 34,880…arrow_forwardKindly help me with accounting questionsarrow_forwardQuick answer of this accounting questionsarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College