Concept explainers

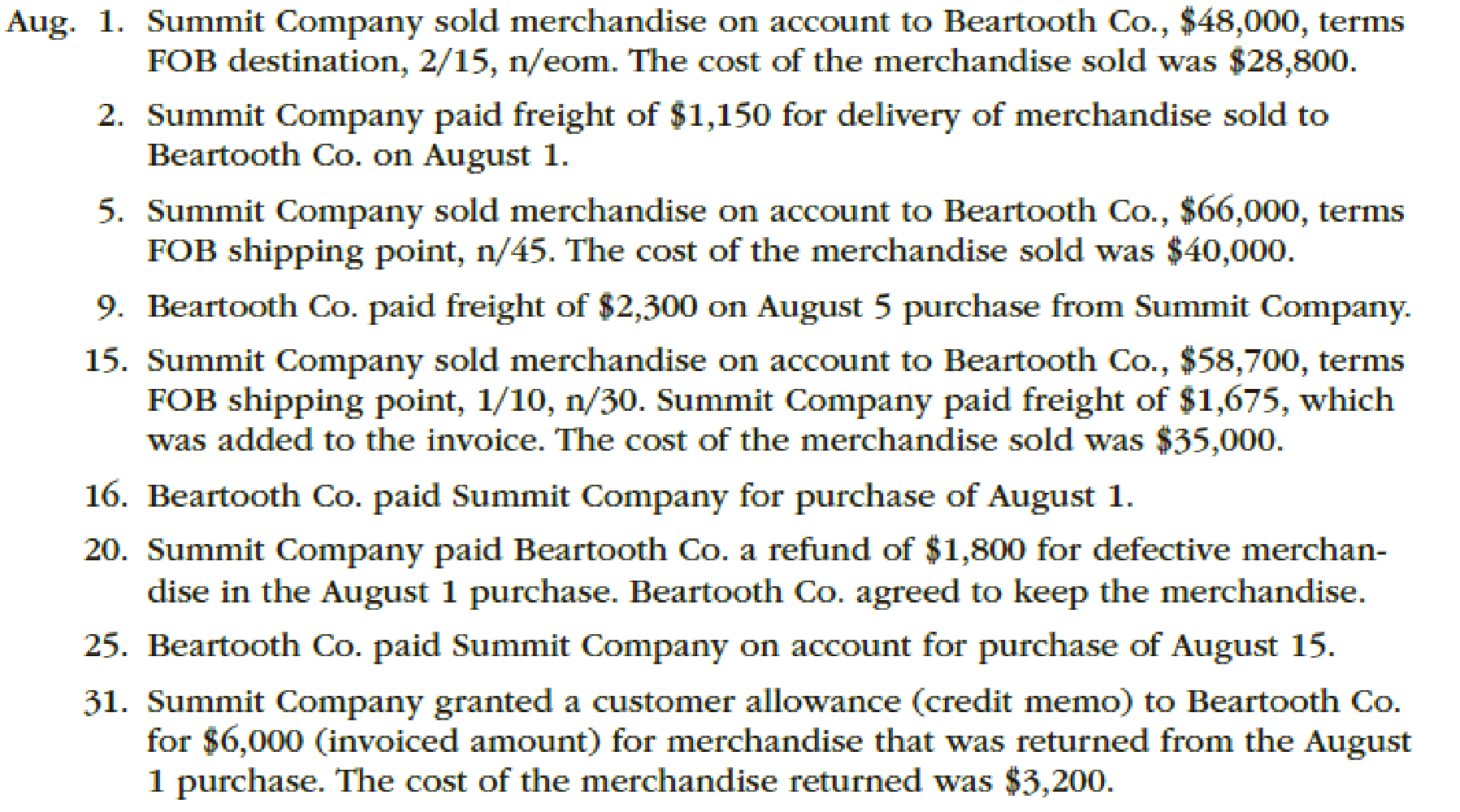

The following selected transactions were completed during August between Summit Company and Beartooth Co.:

Instructions

Journalize the August transactions for (1) Summit Company and (2) Beartooth Co.

(1)

Prepare journal entries to record the transactions of Company S during the month of August using perpetual inventory system.

Explanation of Solution

Perpetual Inventory System refers to the Merchandise Inventory system that maintains the detailed records of every Merchandise Inventory transactions related to purchases and sales on a continuous basis. It shows the exact on-hand-merchandise inventory at any point of time.

Journal entry: Journal is the book of original entry whereby all the financial transactions are recorded in chronological order. Under this method each transaction has two sides, debit side and credit side. Total amount of debit side must be equal to the total amount of credit side. In addition, it is the primary books of accounts for any entity to record the daily transactions and processed further till the presentation of the financial statements.

The following are the rules of debit and credit:

- 1. Increase in assets and expenses accounts are debited. Decrease in liabilities and stockholders’ equity accounts are debited.

- 2. Increase in liabilities, revenues, and stockholders’ equity accounts are credited. Decreases in all asset accounts are credited.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 1 | Accounts Receivable | 47,040 (1) | |

| Sales Revenue | 47,040 | ||

| (To record the sale of inventory on account) |

Table (1)

Working Note (1):

Calculate the amount of accounts receivable.

Sales = $48,000

Discount percentage = 2%

- Accounts receivable is an asset and it is increased by $47,040. Therefore, debit accounts receivable with $47,040.

- Sales revenue is revenue and it increases the value of equity by $47,040. Therefore, credit sales revenue with $47,040.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 1 | Cost of Merchandise Sold | 28,800 | |

| Merchandise Inventory | 28,800 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $28,800. Therefore, debit cost of merchandise sold account with $28,800.

- Merchandise Inventory is an asset and it is decreased by $28,800. Therefore, credit inventory account with $28,800.

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 2 | Delivery expense | 1,150 | |

| Cash | 1,150 | ||

| (To record the payment of delivery expenses) |

Table (3)

- Delivery expense is an expense account and it decreases the value of equity by $1,150. Therefore, debit delivery expense account with $1,150.

- Cash is an asset and it is decreased by $1,150. Therefore, credit cash account with $1,150.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 5 | Accounts Receivable | 66,000 | |

| Sales Revenue | 66,000 | ||

| (To record the sale of inventory on account) |

Table (4)

- Accounts receivable is an asset and it is increased by $66,000. Therefore, debit accounts receivable with $66,000.

- Sales revenue is revenue and it increases the value of equity by $66,000. Therefore, credit sales revenue with $66,000.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 5 | Cost of Merchandise Sold | 40,000 | |

| Merchandise Inventory | 40,000 | ||

| (To record the cost of goods sold) |

Table (5)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $40,000. Therefore, debit cost of merchandise sold account with $40,000.

- Merchandise Inventory is an asset and it is decreased by $40,000. Therefore, credit inventory account with $40,000.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 15 | Accounts Receivable | 58,113 (2) | |

| Sales Revenue | 58,113 | ||

| (To record the sale of inventory on account) |

Table (6)

- Accounts receivable is an asset and it is increased by $58,113. Therefore, debit accounts receivable with $58,113.

- Sales revenue is revenue and it increases the value of equity by $58,113. Therefore, credit sales revenue with $58,113.

Working Note (2):

Calculate the amount of accounts receivable.

Sales = $58,700

Discount percentage = 1%

Record the journal entry for the freight paid.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 15 | Accounts Receivable | 1,675 | |

| Cash | 1,675 | ||

| (To record the freight paid) |

Table (7)

- Accounts receivable is an asset and it is increased by $1,675. Therefore, debit accounts receivable with $1,675.

- Cash is an asset and it is decreased by $1,675. Therefore, credit cash account with $1,675.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 15 | Cost of Merchandise Sold | 35,000 | |

| Merchandise Inventory | 35,000 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $35,000. Therefore, debit cost of merchandise sold account with $35,000.

- Merchandise Inventory is an asset and it is decreased by $35,000. Therefore, credit inventory account with $35,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 16 | Cash | 47,040 | |

| Accounts Receivable | 47,040 | ||

| (To record the receipt of cash against accounts receivables) |

Table (9)

- Cash is an asset and it is increased by $47,040. Therefore, debit cash account with $47,040.

- Accounts Receivable is an asset and it is increased by $47,040. Therefore, debit accounts receivable with $47,040.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 20 | Customer Refunds Payable | 1,800 | ||

| Cash | 1,800 | |||

| (To record sales returns) |

Table (10)

- Customer refunds payable is a liability account and it is decreased by $1,800. Therefore, debit customer refunds payable account with $1,800.

- Accounts Receivable is an asset and it is decreased by $1,800. Therefore, credit account receivable with $1,800.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 25 | Cash | 59,788 (3) | |

| Accounts Receivable | 59,788 | ||

| (To record the receipt of cash against accounts receivables) |

Table (11)

- Cash is an asset and it is increased by $59,788. Therefore, debit cash account with $59,788.

- Accounts Receivable is an asset and it is increased by $59,788. Therefore, debit accounts receivable with $59,788.

Working Note (3):

Calculation the amount of cash receipt.

Net accounts receivable = $58,113

Accounts receivable for freight paid = $1,675

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 31 | Customer Refunds Payable | 5,880 (4) | ||

| Accounts Receivable | 5,880 | |||

| (To record sales returns) |

Table (12)

- Customer refunds payable is a liability account and it is decreased by $5,880. Therefore, debit customer refunds payable account with $5,880.

- Accounts Receivable is an asset and it is decreased by $5,880. Therefore, credit account receivable with $5,880.

Working Note (4):

Calculate the amount of refund owed to the customer.

Sales return = $6,000

Discount percentage = 2%

Record the journal entry for the return of the merchandise.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 31 | Merchandise Inventory | 3,200 | |

| Estimated Returns Inventory | 3,200 | ||

| (To record the return of the merchandise) |

Table (13)

- Merchandise Inventory is an asset and it is increased by $3,200. Therefore, debit inventory account with $3,200.

- Estimated returns inventory is an expense account and it increases the value of equity by $3,200. Therefore, credit estimated returns inventory account with $3,200.

(2)

Prepare journal entries to record the transactions of Company B during the month of August using perpetual inventory system.

Explanation of Solution

Record the journal entry of Company B during August.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 1 | Merchandise Inventory | 47,040 | ||

| Accounts payable | 47,040 | |||

| (To record purchase on account) |

Table (14)

- Merchandise Inventory is an asset and it is increased by $47,040. Therefore, debit Merchandise Inventory account with $47,040.

- Accounts payable is a liability and it is increased by $47,040. Therefore, credit accounts payable account with $47,040.

Record the journal entry of Company B during August.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 5 | Merchandise Inventory | 66,000 | ||

| Accounts payable | 66,000 | |||

| (To record purchase on account) |

Table (15)

- Merchandise Inventory is an asset and it is increased by $66,000. Therefore, debit Merchandise Inventory account with $66,000.

- Accounts payable is a liability and it is increased by $66,000. Therefore, credit accounts payable account with $66,000.

Record the journal entry of Company B during August.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 9 | Merchandise Inventory | 2,300 | ||

| Cash | 2,300 | |||

| (To record freight paid) |

Table (16)

- Merchandise Inventory is an asset and it is increased by $2,300. Therefore, debit Merchandise Inventory account with $2,300.

- Cash is an asset and it is decreased by $2,300. Therefore, credit cash account with $2,300.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 15 | Merchandise Inventory | 59,788 | ||

| Accounts payable | 59,788 (5) | |||

| (To record purchase on account) |

Table (17)

Working Note (5):

Calculate the amount of accounts payable.

Purchases = $58,700

Discount percentage = 1%

Freight charges = $1,675

- Merchandise Inventory is an asset and it is increased by $59,788. Therefore, debit Merchandise Inventory account with $59,788.

- Accounts payable is a liability and it is increased by $59,788. Therefore, credit accounts payable account with $59,788.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 16 | Accounts payable | 47,040 | ||

| Cash | 47,040 | |||

| (To record payment made in full settlement less discounts) |

Table (18)

- Accounts payable is a liability and it is decreased by $47,040. Therefore, debit accounts payable account with $47,040.

- Cash is an asset and it is decreased by $47,040. Therefore, credit cash account with $47,040.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 20 | Cash | 1,800 | ||

| Merchandise Inventory | 1,800 | |||

| (To record purchase return) |

Table (19)

- Cash is an asset and it is increased by $1,800. Therefore, debit cash account with $1,800.

- Merchandise Inventory is an asset and it is decreased by $1,800. Therefore, credit Merchandise Inventory account with $1,800.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 25 | Accounts payable | 59,788 | ||

| Cash | 59,788 | |||

| (To record payment made in full settlement less discounts) |

Table (20)

- Accounts payable is a liability and it is decreased by $59,788. Therefore, debit accounts payable account with $59,788.

- Cash is an asset and it is decreased by $59,788. Therefore, credit cash account with $59,788.

Record the journal entry of Company B.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| August 31 | Accounts payable | 5,880 (6) | ||

| Merchandise Inventory | 5,880 | |||

| (To record purchase return) |

Table (21)

- Accounts payable is a liability and it is decreased by $5,880. Therefore, debit accounts payable account with $5,880.

- Merchandise Inventory is an asset and it is decreased by $5,880. Therefore, credit Merchandise Inventory account with $5,880.

Working Note (6):

Calculate the amount of accounts payable.

Purchases return = $6,000

Discount percentage = 2%

Want to see more full solutions like this?

Chapter 6 Solutions

FINAN.ACCOUNTING-W/DGT ACCESS (LOOSE)

- The following is a list of balances relating to Phiri Properties Ltd during 2024. The company maintains a memorandum debtors and creditors ledger in which the individual account of customers and suppliers are maintained. These were as follows: Debit balance in debtors account 01/01/2024 66,300 Credit balance in creditors account 01/01/2024 50,600 Sunday credit balance on debtors ledger Goods purchased on credit 724 257,919 Goods sold on credit Cash received from debtors Cash paid to suppliers Discount received Discount allowed Cash purchases Cash sales Bad Debts written off Interest on overdue account of customers 323,614 299,149 210,522 2,663 2,930 3,627 5,922 3,651 277 Returns outwards 2,926 Return inwards 2,805 Accounts settled by contra between debtors and creditors ledgers 1,106 Credit balances in debtors ledgers 31/12/2024. 815 Debit balances in creditors ledger 31/12/2024.698 Required: Prepare the debtors control account as at 31/12/2024. Prepare the creditors control account…arrow_forwardSolnarrow_forwardSolution neededarrow_forward

- a) Define research methodology in the context of accounting theory and discuss the importance of selecting appropriate research methodology. Evaluate the strengths and limitations of quantitative and qualitative approaches in accounting research. b) Assess the role of modern accounting theories in guiding research in accounting. Discuss how contemporary theories, such as stakeholder theory, legitimacy theory, and behavioral accounting theory, shape research questions, hypotheses formulation, and empirical analysis. Question 4 Critically analyse the role of financial reporting in investment decision-making, emphasizing the qualitative characteristics that enhance the usefulness of financial statements. Discuss how financial reporting influences both investor confidence and regulatory decisions, using relevant examples.arrow_forwardFastarrow_forwardCODE 14 On August 1, 2010, Cheryl Newsome established Titus Realty, which completed the following transactions during the month: a. Cheryl Newsome transferred cash from a personal bank account to an account to be used for the business in exchange for capital stock, $25,000. b. Paid rent on office and equipment for the month, $2,750. c. Purchased supplies on account, $950. d. Paid creditor on account, $400. c. Earned sales commissions, receiving cash, $18,100. f. Paid automobile expenses (including rental charge) for month, $1,000, and miscel- laneous expenses, $600. g. Paid office salaries, $2,150. h. Determined that the cost of supplies used was $575. i. Paid dividends, $2,000. REQUIREMENTS: 1. Determine increase - decrease of each account and new balance 2. Prepare 3 F.S: Income statement; Retained Earnings Statement; Balance Sheet Scanned with CamScannerarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub