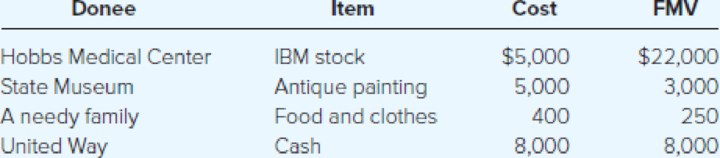

Calvin reviewed his cancelled checks and receipts this year for charitable contributions, which included an antique painting and IBM stock. He has owned the IBM stock and the painting since 2005.

Calculate Calvin’s charitable contribution deduction and carryover (if any) under the following circumstances.

- a) Calvin’s AGI is $100,000.

- b) Calvin’s AGI is $100,000 but the State Museum told Calvin that it plans to sell the painting.

- c) Calvin’s AGI is $50,000.

- d) Calvin’s AGI is $100,000 and Hobbs is a private nonoperating foundation.

- e) Calvin’s AGI is $100,000 but the painting is worth $10,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Loose Leaf for McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Bramwell Industries produces joint products C and D from Material X in a single operation. 500 gallons of Material X, costing $1,200, produce 300 gallons of Product C, selling for $2.00 per gallon, and 200 gallons of Product D, selling for $4.00 per gallon. The portion of the $1,200 cost that should be allocated to Product C using the value basis of allocation is____.arrow_forwardI don't know answer please find the correct answerarrow_forwardWhat was Parma's gross profitarrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT