Concept explainers

Estimating

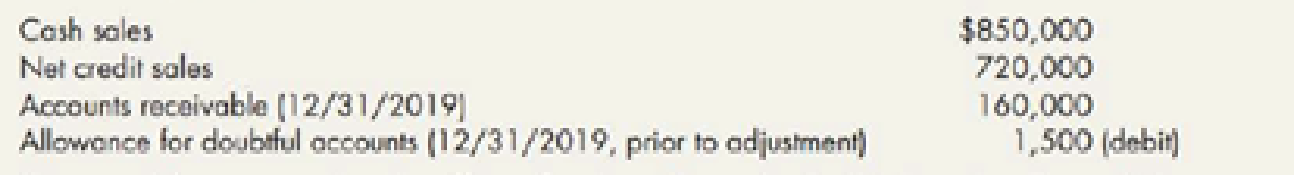

Keegan wishes to examine the effect of various alternative had debt estimation policies.

Required:

- 1. Prepare the

adjusting entry that would be required under each of the following methods:- a. Bad debts are estimated at 3% of net credit sales.

- b. Bad debts are estimated at 7.5% of gross

accounts receivable . - c. An aging of accounts receivable indicates that half of the outstanding accounts will incur a 3% loss, a quarter will incur a 6% loss, the remaining quarter will incur a 20% loss.

- 2. Next Level Discuss the difference between the income statement and

balance sheet approaches to estimating bad debts.

1. a

Record the adjusting entry if “bad debts are estimated at 3% of net credit sales”.

Explanation of Solution

Accounts receivable:

Accounts receivable refers to the amounts to be received within a short period from customers upon the sale of goods and services on account. In other words, accounts receivable are amounts customers owe to the business. Accounts receivable is an asset of a business.

Percentage of sales method:

Credit sales are recorded by debiting (increasing) accounts receivable account. The bad debts is a loss incurred out of credit sales, hence uncollectible accounts can be estimated as a percentage of credit sales or total sales.

It is a method of estimating the bad debts (expected loss on extending credit), by multiplying the expected percentage of uncollectible with the total amount of net credit sale (or total sales) for a specific period. Under percentage of sales method, estimated bad debts would be treated as a bad debt expense of the particular period.

Adjustment entries:

Adjusting entries are those entries which are made at the end of the year to update all the balances in the financial statements to show the true financial information and to maintain the records according to accrual basis principle.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Record the adjusting journal entry:

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| Bad debt expense (1) | 21,600 | ||

| Allowance for doubtful accounts | 21,600 | ||

| ( To record adjustment for bad debts expenses) |

Table (1)

- Bad debt expense is a component of stockholders’ equity and it is decreased. Therefore, debit bad debt expense account by $21,600.

- Allowance for doubtful accounts is a contra current asset account and it is increased. Therefore, credit allowance for doubtful accounts by $21,600.

Working note:

(1) Calculate the amount of bad debt expense:

1. b

Record the adjusting entry if “bad debts are estimated at 7.5% of gross accounts receivable”.

Explanation of Solution

Record the adjusting journal entry:

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| Bad debt expense (2) | 13,500 | ||

| Allowance for doubtful accounts | 13,500 | ||

| ( To record adjustment for bad debts expenses) |

Table (2)

- Bad debt expense is a component of stockholders’ equity and it is decreased. Therefore, debit bad debt expense account by $13,500.

- Allowance for doubtful accounts is a contra current asset account and it is increased. Therefore, credit allowance for doubtful accounts by $13,500.

Working note:

(2) Calculate the amount of bad debt expense:

1. c

Record the adjusting entry if “an aging of accounts receivable specifies that half of the outstanding accounts will incur a 3% loss, a quarter will incur a 6% loss, and the remaining quarter will incur a 20% loss”.

Explanation of Solution

Aging of accounts receivable:

Aging of accounts receivable is a method in which the company that “ages” its accounts receivable, initially categorizes the individual accounts receivable depending upon the length of time they are outstanding, and then the allowance for bad debts is estimated by applying proper percentage of bad debts to each age category.

Record the adjusting journal entry:

| Date | Account Titles and Explanation |

Debit (Amount in $) |

Credit (Amount in $) |

| Bad debt expense (3) | 14,300 | ||

| Allowance for doubtful accounts | 14,300 | ||

| ( To record adjustment for bad debts expenses) |

Table (3)

- Bad debt expense is a component of stockholders’ equity and it is decreased. Therefore, debit bad debt expense account by $14,300.

- Allowance for doubtful accounts is a contra current asset account and it is increased. Therefore, credit allowance for doubtful accounts by $14,300.

Working note:

(3) Calculate the amount of bad debt expense:

2.

Explain the difference between the income statement and balance sheet approaches to estimating bad debts.

Explanation of Solution

Difference between the income statement and the balance sheet approach in estimating bad debts:

- Income statement approach estimates bad debts in a straightforward manner and it uses percentage of credit sale. This approach do not report accounts receivable at net realizable value as the characteristics of the individual accounts which makes up the total receivables account are not taken into consideration.

- The balance sheet approach reports accounts receivables at expected net realizable value of the balance sheet and it uses percentage of outstanding accounts receivable or an aging analysis basis for evaluating bad debts. On the other hand, the balance sheet approach matches past expenses with current revenues, suppose if a portion of the receivables balance is outstanding more than a year.

Want to see more full solutions like this?

Chapter 6 Solutions

Intermediate Accounting: Reporting And Analysis

- Calculate the company's P/E ratioarrow_forwardLegal Corporation purchased a limited-life intangible asset for $600,000 on July 1, 2017. It has a useful life of 12 years. What total amount of amortization expense should have been recorded on the intangible asset by December 31, 2019?arrow_forwardTotal assets? General accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning