Concept explainers

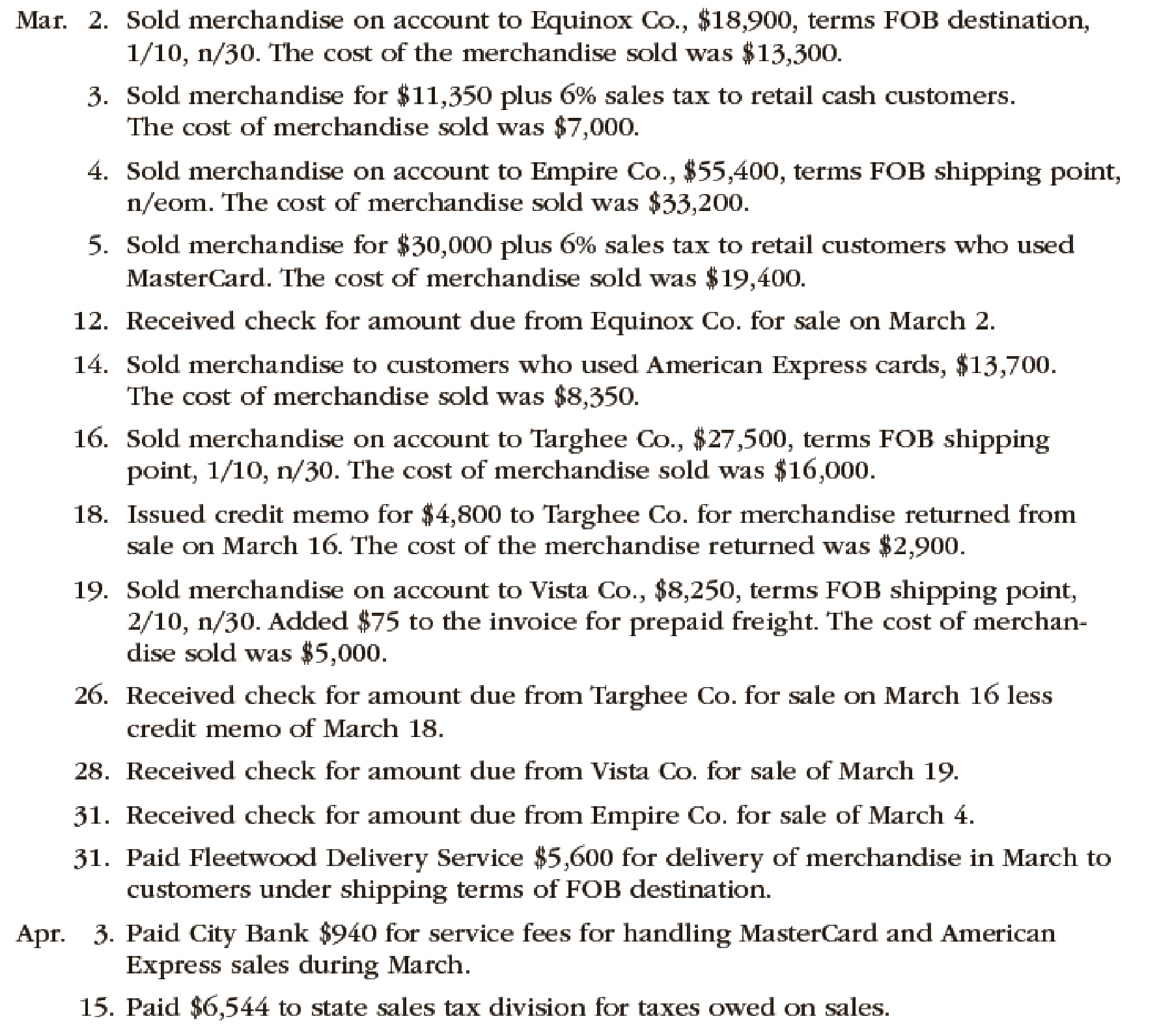

The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Record the sale transactions of the company.

Explanation of Solution

Sales is an activity of selling the merchandise inventory of a business.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Accounts receivable | 18,711 (1) | |

| Sales Revenue | 18,711 | ||

| (To record the sale of inventory on account) |

Table (1)

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

- Sales revenue is revenue and it increases the value of equity by $18,711. Therefore, credit sales revenue with $18,711.

Working Note (1):

Calculate the amount of accounts receivable.

Sales = $18,900

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 2 | Cost of Merchandise Sold | 13,300 | |

| Merchandise Inventory | 13,300 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $13,300. Therefore, debit cost of merchandise sold account with $13,300.

- Merchandise Inventory is an asset and it is decreased by $13,300. Therefore, credit inventory account with $13,300.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cash | 12,031 (3) | |

| Sales Revenue | 11,350 | ||

| Sales Tax Payable | 681 (2) | ||

| (To record the sale of inventory for cash) |

Table (3)

- Cash is an asset and it is increased by $12,031. Therefore, debit cash account with $12,031.

- Sales revenue is revenue and it increases the value of equity by $11,350. Therefore, credit sales revenue with $11,350.

- Sales tax payable is a liability and it is increased by $681. Therefore, credit sales tax payable account with $681.

Working Notes(2):

Calculate the amount of sales tax payable.

Sales revenue = $11,350

Sales tax percentage = 6%

Working Notes(3):

Calculate the amount of cash received.

Sales revenue = $11,350

Sales tax payable = $681 (2)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 3 | Cost of Merchandise Sold | 7,000 | |

| Merchandise Inventory | 7,000 | ||

| (To record the cost of goods sold) |

Table (4)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $7,000. Therefore, debit cost of merchandise sold account with $7,000.

- Merchandise Inventory is an asset and it is decreased by $7,000. Therefore, credit inventory account with $7,000.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Accounts receivable | 55,400 | |

| Sales Revenue | 55,400 | ||

| (To record the sale of inventory on account) |

Table (5)

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

- Sales revenue is revenue and it increases the value of equity by $55,400. Therefore, credit sales revenue with $55,400.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 4 | Cost of Merchandise Sold | 33,200 | |

| Merchandise Inventory | 33,200 | ||

| (To record the cost of goods sold) |

Table (6)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $33,200. Therefore, debit cost of merchandise sold account with $33,200.

- Merchandise Inventory is an asset and it is decreased by $33,200. Therefore, credit inventory account with $33,200.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cash | 31,800 (5) | |

| Sales Revenue | 30,000 | ||

| Sales Tax Payable | 1,800 (4) | ||

| (To record the sale of inventory for cash) |

Table (7)

- Cash is an asset and it is increased by $31,800. Therefore, debit cash account with $31,800.

- Sales revenue is revenue and it increases the value of equity by $30,000. Therefore, credit sales revenue with $30,000.

- Sales tax payable is a liability and it is increased by $1,800. Therefore, credit sales tax payable account with $1,800.

Working Note (4):

Calculate the amount of sales tax payable.

Sales revenue = $30,000

Sales tax percentage = 6%

Working Note (5):

Calculate the amount of cash received.

Sales revenue = $30,000

Sales tax payable = $1,800 (2)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 5 | Cost of Merchandise Sold | 19,400 | |

| Merchandise Inventory | 19,400 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $19,400. Therefore, debit cost of merchandise sold account with $19,400.

- Merchandise Inventory is an asset and it is decreased by $19,400. Therefore, credit inventory account with $19,400.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 12 | Cash | 18,711 | |

| Accounts Receivable | 18,711 | ||

| (To record the receipt of cash against accounts receivables) |

Table (9)

- Cash is an asset and it is increased by $18,711. Therefore, debit cash account with $18,711.

- Accounts Receivable is an asset and it is increased by $18,711. Therefore, debit accounts receivable with $18,711.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cash | 13,700 | |

| Sales Revenue | 13,700 | ||

| (To record the sale of inventory for cash) |

Table (10)

- Cash is an asset and it is increased by $13,700. Therefore, debit cash account with $13,700.

- Sales revenue is revenue and it increases the value of equity by $13,700. Therefore, credit sales revenue with $13,700.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 14 | Cost of Merchandise Sold | 8,350 | |

| Merchandise Inventory | 8,350 | ||

| (To record the cost of goods sold) |

Table (11)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $8,350. Therefore, debit cost of merchandise sold account with $8,350.

- Merchandise Inventory is an asset and it is decreased by $8,350. Therefore, credit inventory account with $8,350.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Accounts receivable | 27,225 (6) | |

| Sales Revenue | 27,225 | ||

| (To record the sale of inventory on account) |

Table (12)

- Accounts Receivable is an asset and it is increased by $27,225. Therefore, debit accounts receivable with $27,225.

- Sales revenue is revenue and it increases the value of equity by $27,225. Therefore, credit sales revenue with $27,225.

Working Note (6):

Calculate the amount of accounts receivable.

Sales = $27,500

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 16 | Cost of Merchandise Sold | 16,000 | |

| Merchandise Inventory | 16,000 | ||

| (To record the cost of goods sold) |

Table (13)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $16,000. Therefore, debit cost of merchandise sold account with $16,000.

- Merchandise Inventory is an asset and it is decreased by $16,000. Therefore, credit inventory account with $16,000.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 18 | Customer Refunds Payable | 4,752 (7) | ||

| Accounts Receivable | 4,752 | |||

| (To record sales returns) |

Table (14)

- Customer refunds payable is a liability account and it is decreased by $4,752. Therefore, debit customer refunds payable account with $4,752.

- Accounts Receivable is an asset and it is decreased by $4,752. Therefore, credit account receivable with $4,752.

Working Note (7):

Calculate the amount of refund owed to the customer.

Sales return = $4,800

Discount percentage = 1%

Record the journal entry for the return of the merchandise.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 18 | Merchandise Inventory | 2,900 | |

| Estimated Returns Inventory | 2,900 | ||

| (To record the return of the merchandise) |

Table (15)

- Merchandise Inventory is an asset and it is increased by $2,900. Therefore, debit inventory account with $2,900.

- Estimated retunrs inventory is an expense account and it increases the value of equity by $2,900. Therefore, credit estimated returns inventory account with $2,900.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Accounts receivable | 8,085 (8) | |

| Sales Revenue | 8,085 | ||

| (To record the sale of inventory on account) |

Table (16)

- Accounts Receivable is an asset and it is increased by $8,085. Therefore, debit accounts receivable with $8,085.

- Sales revenue is revenue and it increases the value of equity by $8,085. Therefore, credit sales revenue with $8,085.

Working Note (8):

Calculate the amount of accounts receivable.

Sales = $8,250

Discount percentage = 2%

Record the journal entry.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| March 19 | Accounts Receivable | 75 | ||

| Cash | 75 | |||

| (To record freight charges paid) |

Table (17)

- Accounts Receivable is an asset and it is increased by $75. Therefore, debit accounts receivable with $75.

- Cash is an asset and it is decreased by $75. Therefore, credit cash account with $75.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 19 | Cost of Merchandise Sold | 5,000 | |

| Merchandise Inventory | 5,000 | ||

| (To record the cost of goods sold) |

Table (18)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $5,000. Therefore, debit cost of merchandise sold account with $5,000.

- Merchandise Inventory is an asset and it is decreased by $5,000. Therefore, credit inventory account with $5,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 26 | Cash | 22,473 (9) | |

| Accounts Receivable | 22,473 | ||

| (To record the receipt of cash against accounts receivables) |

Table (19)

- Cash is an asset and it is increased by $22,473. Therefore, debit cash account with $22,473.

- Accounts Receivable is an asset and it is increased by $22,473. Therefore, debit accounts receivable with $22,473.

Working Note (9):

Calculate the amount of cash received.

Net accounts receivable = $22,473

Customer refunds payable = $4,752

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 28 | Cash | 8,160 (10) | |

| Accounts Receivable | 8,160 | ||

| (To record the receipt of cash against accounts receivables) |

Table (20)

- Cash is an asset and it is increased by $8,160. Therefore, debit cash account with $8,160.

- Accounts Receivable is an asset and it is increased by $8,160. Therefore, debit accounts receivable with $8,160.

Working Note (10):

Calculate the amount of cash received.

Net accounts receivable = $8,085

Freight charges = $75

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| March 31 | Cash | 55,400 | |

| Accounts Receivable | 55,400 | ||

| (To record the receipt of cash against accounts receivables) |

Table (21)

- Cash is an asset and it is increased by $55,400. Therefore, debit cash account with $55,400.

- Accounts Receivable is an asset and it is increased by $55,400. Therefore, debit accounts receivable with $55,400.

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| March 31 | Delivery expense | 5,600 | |

| Cash | 5,600 | ||

| (To record the payment of delivery expenses) |

Table (22)

- Delivery expense is an expense account and it decreases the value of equity by $5,600. Therefore, debit delivery expense account with $5,600.

- Cash is an asset and it is decreased by $5,600. Therefore, credit cash account with $5,600.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 3 | Credit card expense | 940 | |

| Cash | 940 | ||

| (To record the payment of credit card expenses) |

Table (23)

- Credit card expense is an expense account and it decreases the value of equity by $940. Therefore, debit credit card expense account with $940.

- Cash is an asset and it is decreased by $940. Therefore, credit cash account with $940.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| April 15 | Sales tax payable | 6,544 | |

| Cash | 6,544 | ||

| (To record the payment of credit card expenses) |

Table (24)

- Sales tax payable is a liability account and it is decreased by $6,544. Therefore, debit customer refunds payable account with $6,544.

- Cash is an asset and it is decreased by $6,544. Therefore, credit cash account with $6,544.

Want to see more full solutions like this?

Chapter 6 Solutions

FINANCIAL ACCOUNTING

- Critically analyse the role of financial reporting in investment decision-making,emphasizing the qualitative characteristics that enhance the usefulness of financialstatements. Discuss how financial reporting influences both investor confidence andregulatory decisions, using relevant examples.arrow_forwardHelp need!!arrow_forwardAnswer please correarrow_forward

- Answer should be coarrow_forwardSolve quiarrow_forwardAssess the role of modern accounting theories in guiding research in accounting.Discuss how contemporary theories, such as stakeholder theory, legitimacy theory, andbehavioral accounting theory, shape research questions, hypotheses formulation, andempirical analysis.arrow_forward

- Need answerarrow_forwardDefine research methodology in the context of accounting theory and discuss theimportance of selecting appropriate research methodology. Evaluate the strengths andlimitations of quantitative and qualitative approaches in accounting research.arrow_forwardCritically evaluate the progress and challenges in achieving a single set of globalaccounting standards. Discuss the benefits and drawbacks of globalization inaccounting, providing relevant examples.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage