Concept explainers

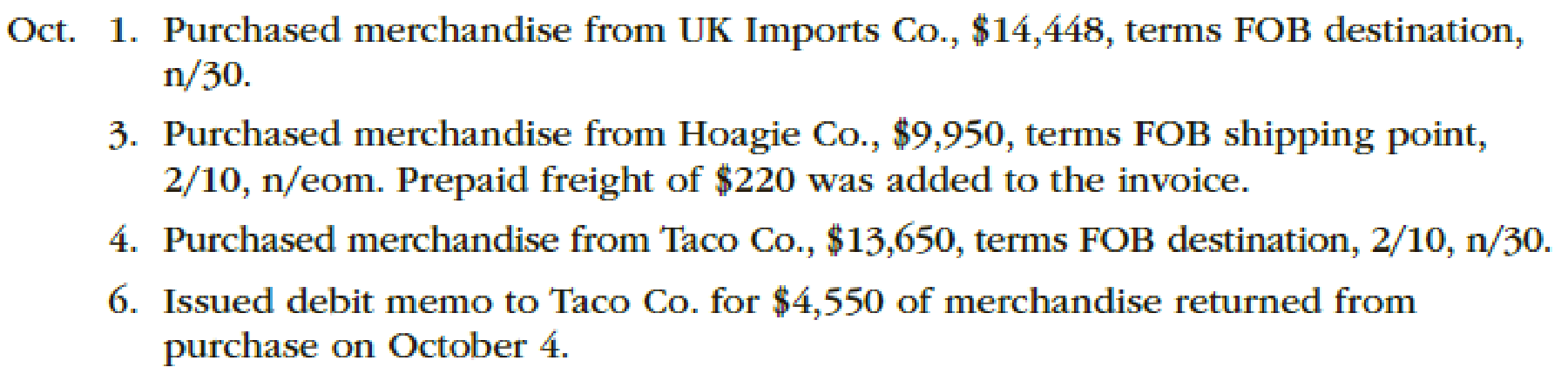

The following selected transactions were completed by Capers Company during October of the current year:

Instructions

Prepare journal entries to record the transactions of Company C during the month of October using perpetual inventory system.

Explanation of Solution

Perpetual Inventory System refers to the Merchandise Inventory system that maintains the detailed records of every Merchandise Inventory transactions related to purchases and sales on a continuous basis. It shows the exact on-hand-merchandise inventory at any point of time.

Record the journal entry of Company C during October.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 1 | Merchandise Inventory | 14,448 | ||

| Accounts payable | 14,448 | |||

| (To record purchase on account) |

Table (1)

- Merchandise Inventory is an asset and it is increased by $14,448. Therefore, debit Merchandise Inventory account with $14,448.

- Accounts payable is a liability and it is increased by $14,448. Therefore, credit accounts payable account with $14,448.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 3 | Merchandise Inventory | 9,971 | ||

| Accounts payable | 9,971 (1) | |||

| (To record purchase on account) |

Table (2)

- Merchandise Inventory is an asset and it is increased by $9,971. Therefore, debit Merchandise Inventory account with $9,971.

- Accounts payable is a liability and it is increased by $9,971. Therefore, credit accounts payable account with $9,971.

Working Note (1):

Calculate the amount of accounts payable.

Purchases = $9,950

Discount percentage = 2%

Freight charges = $220

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 4 | Merchandise Inventory | 13,377 | ||

| Accounts payable | 13,377 (2) | |||

| (To record purchase on account) |

Table (3)

- Merchandise Inventory is an asset and it is increased by $13,377. Therefore, debit Merchandise Inventory account with $13,377.

- Accounts payable is a liability and it is increased by $13,377. Therefore, credit accounts payable account with $13,377.

Working Note (2):

Calculate the amount of accounts payable.

Purchases = $13,650

Discount percentage = 2%

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 6 | Accounts payable | 4,459 (3) | ||

| Merchandise Inventory | 4,459 | |||

| (To record purchase return) |

Table (4)

- Accounts payable is a liability and it is decreased by $4,459. Therefore, debit accounts payable account with $4,459.

- Merchandise Inventory is an asset and it is decreased by $4,459. Therefore, credit Merchandise Inventory account with $4,459.

Working Note (3):

Calculate the amount of accounts payable.

Purchases return = $4,550

Discount percentage = 2%

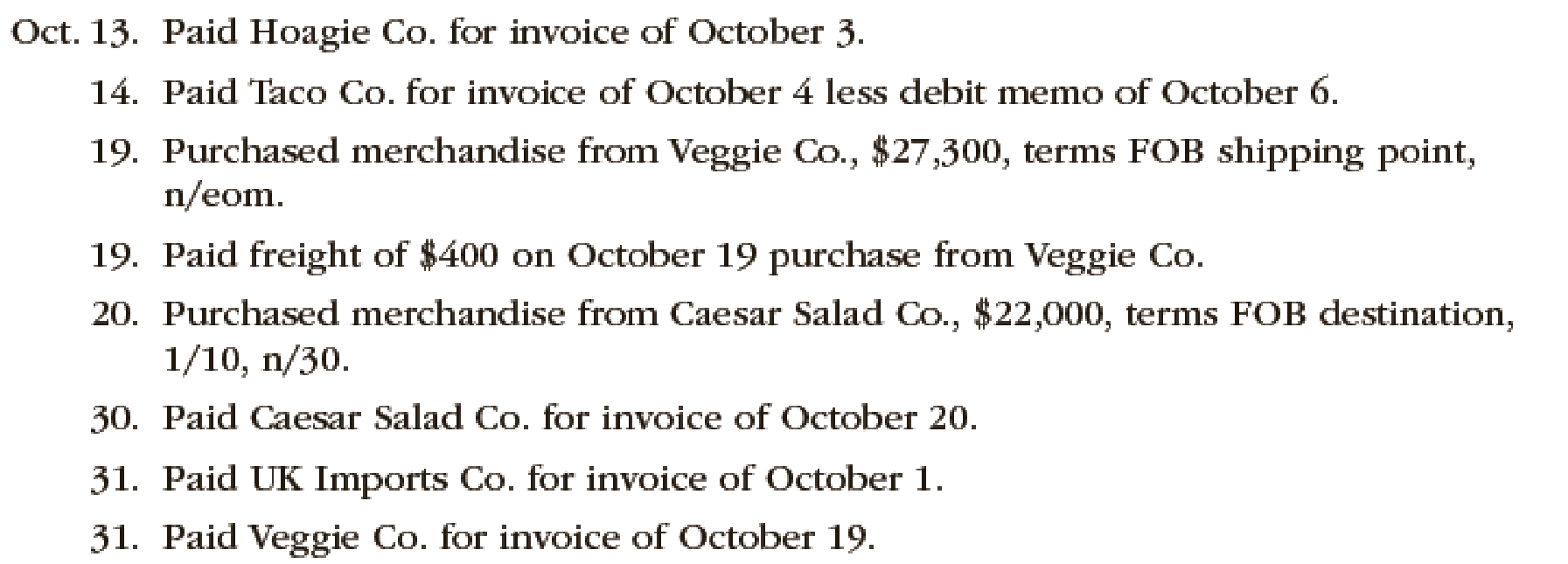

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 13 | Accounts payable | 9,971 | ||

| Cash | 9,971 | |||

| (To record payment made in full settlement less discounts) |

Table (5)

- Accounts payable is a liability and it is decreased by $9,971. Therefore, debit accounts payable account with $9,971.

- Cash is an asset and it is decreased by $9,971. Therefore, credit cash account with $9,971.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 14 | Accounts payable | 8,918 (4) | ||

| Cash | 8,918 | |||

| (To record payment made in full settlement less discounts) |

Table (6)

- Accounts payable is a liability and it is decreased by $8,918. Therefore, debit accounts payable account with $8,918.

- Cash is an asset and it is decreased by $8,918. Therefore, credit cash account with $8,918.

Working Note (4):

Calculate the amount of net accounts payable.

Merchandise Inventory = $13,377 (2)

Purchase returns = $4,459 (3)

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 19 | Merchandise Inventory | 27,300 | ||

| Accounts payable | 27,300 | |||

| (To record purchase on account) |

Table (7)

- Merchandise Inventory is an asset and it is increased by $27,300. Therefore, debit Merchandise Inventory account with $27,300.

- Accounts payable is a liability and it is increased by $27,300. Therefore, credit accounts payable account with $27,300.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 19 | Merchandise Inventory | 400 | ||

| Cash | 400 | |||

| (To record freight charges paid) |

Table (8)

- Merchandise Inventory is an asset and it is increased by $27,300. Therefore, debit Merchandise Inventory account with $27,300.

- Cash is an asset and it is decreased by $400. Therefore, credit cash account with $400.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 20 | Merchandise Inventory | 21,780 | ||

| Accounts payable | 21,780 (5) | |||

| (To record purchase on account) |

Table (9)

- Merchandise Inventory is an asset and it is increased by $21,780. Therefore, debit Merchandise Inventory account with $21,780.

- Accounts payable is a liability and it is increased by $21,780. Therefore, credit accounts payable account with $21,780.

Working Note (5):

Calculate the amount of accounts payable.

Purchases = $22,000

Discount percentage = 1%

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 30 | Accounts payable | 21,780 | ||

| Cash | 21,780 | |||

| (To record payment made in full settlement less discounts) |

Table (10)

- Accounts payable is a liability and it is decreased by $21,780. Therefore, debit accounts payable account with $21,780.

- Cash is an asset and it is decreased by $21,780. Therefore, credit cash account with $21,780.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 31 | Accounts payable | 14,448 | ||

| Cash | 14,448 | |||

| (To record payment made in full settlement less discounts) |

Table (11)

- Accounts payable is a liability and it is decreased by $14,448. Therefore, debit accounts payable account with $14,448.

- Cash is an asset and it is decreased by $14,448. Therefore, credit cash account with $14,448.

Record the journal entry of Company C.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| October 31 | Accounts payable | 27,300 | ||

| Cash | 27,300 | |||

| (To record payment made in full settlement less discounts) |

Table (12)

- Accounts payable is a liability and it is decreased by $27,300. Therefore, debit accounts payable account with $27,300.

- Cash is an asset and it is decreased by $27,300. Therefore, credit cash account with $27,300.

Want to see more full solutions like this?

Chapter 6 Solutions

FINANCIAL ACCOUNTING

- General accountingarrow_forwardGolden Star Cafe had a 12% return on a $60,000 investment in new dining furniture. The investment resulted in increased sales and an increase in income that was 3% of the increase in sales. What was the increase in sales?arrow_forwardThe cash proceeds received by the seller are _______.arrow_forward

- What was the cost of goods soldarrow_forwardCaldwell Electronic Devices produces smartphone accessories. Estimated sales (in units) are 62,000 in July, 54,000 in August, and 49,500 in September. Each unit is priced at $35. Caldwell wants to have 45% of the following month's sales in ending inventory. That requirement was met on July 1. Each accessory requires 3 components and 8 feet of specialized cabling. Components cost $4 each, and cabling is $0.75 per foot. Caldwell wants to have 30% of the following month's production needs in ending raw materials inventory. On July 1, Caldwell had 45,000 components and 120,000 feet of cabling in inventory. What is Caldwell's expected sales revenue for August?arrow_forwardCalculate adjusted cost of goods soldarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning