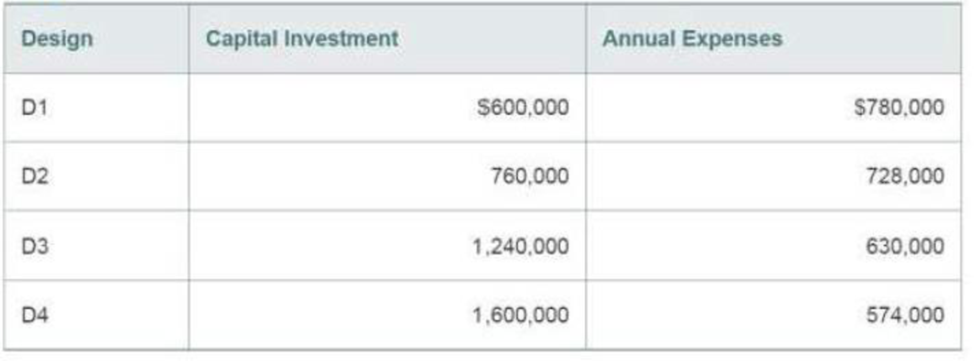

The Consolidated Oil Company must install antipollution equipment in a new refinery to meet federal clean-air standards. Four design alternatives are being considered, which will have capital investment and annual operating expenses as shown below. Assuming a useful life of 8 years for each design, no market value, a desired MARR of 10% per year, determine which design should be selected on the basis of the PW method. Confirm your selection by using the FW and AW methods. Which rule (Section 6.2.2) applies? Why? (6.4)

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Engineering Economy

Additional Business Textbook Solutions

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Marketing: An Introduction (13th Edition)

- O’Leary Engineering Corp. has been depreciating a $50,000 machine for the last 3 years. The asset was just sold for 60% of its first cost. What is the size of the recaptured depreciation or loss at disposal using the following depreciation methods?(a) Straight-line with N = 8 and S = 2000(b) Double declining balance with N = 8(c) 40% bonus depreciation with the balance using 7-year MACRS Please show every step and formula, don't use excel. The answer should be (a) $2000 loss, (b) $8000 deo recap, (c) $14257 dep recap, thank you.arrow_forwardThe cost of garbage pickup in Green Gulch is $4,500,000 for Year 1. The population is increasing at 6%, the nominal cost per ton is increasing at 5%, and the general inflation rate is estimated at 4%.(a) Estimate the cost in Year 4 in Year-1 dollars and in nominal dollars.(b) Reference a data source for trends in volume of garbage per person. How does including this change your answer? Please show every step and formula, don't use excel. The answer should be $6.20M, $5.2M, thank you.arrow_forwardPlease show each step with formulas, don't use Excel. The answer should be 4 years, $16,861.arrow_forward

- Assume general inflation is 2.5% per year. What is the price tag in 8 years for an item that has an inflation rate of 4.5% that costs $700 today? Please show every step and formula, don't use excel. The answer should be $1203, thank you.arrow_forwardThe average cost of a certain model car was $22,000 ten years ago. This year the average cost is $35,000.(a) Calculate the average monthly inflation rate (fm) for this model.(b) Given the monthly rate fm, what is the effective annual rate, f, of inflation for this model?(c) Estimate what these will sell for 10 years from now, expressed in today’s dollars. Please show all steps and formulas, don't use excel. The answer should be (a) 0.3877%, (b) 4.753%, (c) $55,682arrow_forwardA mining corporation purchased $120,000 of production machinery and depreciated it using 40% bonus depreciation with the balance using 5-year MACRS depreciation, a 5-year depreciable life, and zero salvage value. The corporation is a profitable one that has a 22% combined incremental tax rate. At the end of 5 years the mining company changed its method of operation and sold the production machinery for $40,000. During the 5 years the machinery was used, it reduced mine operation costs by $32,000 a year before taxes. If the company MARR is 12% after taxes, was the investment in the machinery a satisfactory one? Please show every step with formulas and don't use excel. The answer should be 14.8%, thank you.arrow_forward

- An engineer is working on the layout of a new research and experimentation facility. Two operators will be required. If, however, an additional $100,000 of instrumentation and remote controls were added, the plant could be run by a single operator. The total before-tax cost of each plant operator is projected at $35,000 per year. The instrumentation and controls will be depreciated by means of a modified accelerated cost recovery system (MACRS). If this corporation (22% combined corporate tax rate) invests in the additional instrumentation and controls. how long will it take for the after-tax benefits to equal the $100,000 cost? In other words, what is the after-tax payback period? Please write out every step and formula, don't use excel. The answer should be 3.08 years, thank you.arrow_forwardThe effective combined tax rate in a firm is 28%. An outlay of $2 million for certain new assets is under consideration. Over the next 9 years, these assets will be responsible for annual receipts of $650,000 and annual disbursements (other than for income tax) of $225,000. After this time, they will be used only for stand-by purposes with no future excess of receipts over disbursements. (a) What is the prospective rate of return before income taxes? (b)What is the prospective rate of return after taxes if straight-line depreciation can be used to write off these assets for tax purposes in 9 years? (c) What is the prospective rate of return after taxes if it is assumed that these assets must be written off for tax purposes over the next 20 years, using straight-line depreciation? Please write out each step with formulas and don't use Excel. The answers should be (a)15.4% (b) 11.5% (c) 10.0%, thank youarrow_forward- 1. (Maximum length one page) Consider an infectious disease with the following characteristics: Individuals can exist in three states, susceptible, infected, and recovered. Once recovered, an individual cannot be re-infected and remains immune for life. The transmission rate, t, is 1/20. The recovery rate, k, is 1/5. Each person interacts randomly with others in the population and has contacts with 10 people each time period. There is no birth or death in the population. -Initially all people are susceptible. - No one dies from the disease and there is no treatment. a) Draw a compartmental model for this infectious disease.arrow_forward

- Consider an obstetrician who can perform two types of deliveries: normal deliveries and cesarean deliveries. Each typeof delivery provides different levels of income for the physician, and the physician has some ability to induce patientsto opt for cesarean deliveries. The model is as follows:The physician’s utility is defined as:U = U(Y, I)where:• Y is the income from performing deliveries.• I is the total disutility from inducementThe income Y from deliveries depends on the type of delivery:Y = Yn · N + YC · Cwhere:• Yn is the income per normal delivery, Yn = 1, 000• YC is the income per cesarean delivery, Yc = 1, 500,• Initial number of births Binitial = 100,• Post-shock number of births Bshock = 90,• a(i) = 0.1 + 0.05i is the fraction of total births that are cesareans, which increases with inducement level i,• the physician sets the inducement level to i = 2.• N = B · (1 − a(i)) is the number of normal deliveries,• C = B · a(i) is the number of cesarean deliveriesDue to a…arrow_forwardConsider an obstetrician who can perform two types of deliveries: normal deliveries and cesarean deliveries. Each typeof delivery provides different levels of income for the physician, and the physician has some ability to induce patientsto opt for cesarean deliveries. The model is as follows:The physician’s utility is defined as:U = U(Y, I)where:• Y is the income from performing deliveries.• I is the total disutility from inducementThe income Y from deliveries depends on the type of delivery:Y = Yn · N + YC · Cwhere:• Yn is the income per normal delivery, Yn = 1, 000• YC is the income per cesarean delivery, Yc = 1, 500,• Initial number of births Binitial = 100,• Post-shock number of births Bshock = 90,• a(i) = 0.1 + 0.05i is the fraction of total births that are cesareans, which increases with inducement level i,• the physician sets the inducement level to i = 2.• N = B · (1 − a(i)) is the number of normal deliveries,• C = B · a(i) is the number of cesarean deliveriesDue to a…arrow_forwardepidemiology. 2 to 3 setences max for each questionarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education