Engineering Economy

16th Edition

ISBN: 9780133582819

Author: Sullivan

Publisher: DGTL BNCOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 13P

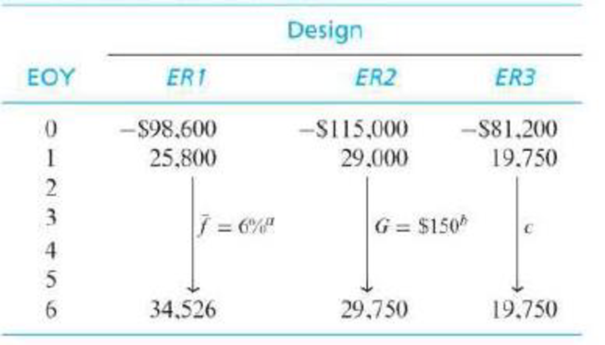

The alternatives for an engineering project to recover most of the energy presently being lost in the primary cooling stage of a chemical processing system have been reduced to three designs. The estimated capital investment amounts and annual expense savings are as follows:

Assume that the MARR is 12% per year, the study period is six years, and the market value is zero for all three designs.

a After year one, the annual savings are estimated to increase at the rate of 6% per year.

b After year one, the annual savings are estimated to increase $150 per year.

c Uniform sequence of annual savings.

Apply an incremental analysis method to determine the preferred alternative. (6.4)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

1. What are the basic information related to the BPO industry in the Philippines?

2. Top 15 BPO industries here in the Philippines.

3. Significance to certain economies.

4. What services are being outsourced?

Select a real-world case situation relevant to credit analysis and lending in Guyana. Use this case which you either know about already or have identified through research and address the following questions in essay format: i. Outline and discuss what “triggered” the regulatory body to intervene? ii. How effective do you think the response was to such a crisis? iii. Outline and discuss two ways that could be used to strengthen the current regulatory environment?

Home can produce a maximum of 400 apples or a maximum of 600 bananas.Foreign can produce a maximum of 160 apples or a maximum of 800 bananas.(a) Graph and label Homes PPF. Label each axis and the slope. Use numbers.1(b) In the

absence of trade, what is Homes autarky price of apples in terms of bananas?(c) Graph and label Foreigns production possibility frontier. Use numbers and label the slope.(d) Graph the world relative supply curve. Use numbers.23. (8 pts - RM) Now

suppose world relative demand for apples takes the following form:Demand for apples/demand for bananas - price of bananas/price of apples. That is, RDA = Pbananas Papples(a) Graph the relative demand and relative supply curves on the world

market diagram. Use numbers(b) What is the equilibrium (world) relative price of apples? (c) Show that both Home and Foreign gain from Trade and describe the pattern of trade.

Chapter 6 Solutions

Engineering Economy

Ch. 6 - Prob. 1PCh. 6 - The Consolidated Oil Company must install...Ch. 6 - Prob. 3PCh. 6 - Three mutually exclusive design alternatives are...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Fiesta Foundry is considering a new furnace that...Ch. 6 - Prob. 8PCh. 6 - Prob. 9PCh. 6 - Consider the following cash flows for two mutually...

Ch. 6 - Prob. 11PCh. 6 - Prob. 12PCh. 6 - The alternatives for an engineering project to...Ch. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Refer to the situation in Problem 6-16. Most...Ch. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - In the Rawhide Company (a leather products...Ch. 6 - Refer to Problem 6-2. Solve this problem using the...Ch. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Potable water is in short supply in many...Ch. 6 - Prob. 35PCh. 6 - Prob. 36PCh. 6 - In the design of a special-use structure, two...Ch. 6 - Prob. 38PCh. 6 - a. Compare the probable part cost from Machine A...Ch. 6 - Prob. 40PCh. 6 - Two mutually exclusive alternatives are being...Ch. 6 - Prob. 42PCh. 6 - IBM is considering an environmentally conscious...Ch. 6 - Three mutually exclusive earth-moving pieces of...Ch. 6 - A piece of production equipment is to be replaced...Ch. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 54PCh. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60PCh. 6 - Prob. 61PCh. 6 - Prob. 62PCh. 6 - Prob. 63PCh. 6 - Prob. 64PCh. 6 - Prob. 65PCh. 6 - Prob. 66PCh. 6 - Three models of baseball bats will be manufactured...Ch. 6 - Refer to Example 6-3. Re-evaluate the recommended...Ch. 6 - Prob. 69SECh. 6 - Prob. 70SECh. 6 - Prob. 71SECh. 6 - Prob. 72CSCh. 6 - Prob. 73CSCh. 6 - Prob. 74CSCh. 6 - Prob. 75FECh. 6 - Prob. 76FECh. 6 - Prob. 77FECh. 6 - Complete the following analysis of cost...Ch. 6 - Prob. 79FECh. 6 - For the following table, assume a MARR of 10% per...Ch. 6 - Prob. 81FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Prob. 83FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Consider the mutually exclusive alternatives given...Ch. 6 - Prob. 87FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A village has six residents, each of whom has accumulated savings of $100. Each villager can use this money either to buy a government bond that pays 18 percent interest per year or to buy a year-old llama, send it onto the commons to graze, and sell it after 1 year. The price the villager gets for the 2-year-old llama depends on the quality of the fleece It grows while grazing on the commons. That in turn depends on the animal's access to grazing, which depends on the number of llamas sent to the commons, as shown in the following table: Number of 11amas on the commons Price per 2- year-old 11ama ($) 1 125 2 119 3 116 4 113 5 6 111 109 The villagers make their investment decisions one after another, and their decisions are public. a. If each villager decides Individually how to Invest, how many llamas will be sent onto the commons, and what will be the resulting village Income? Number of llamas: [ 20 Instructions: Enter your response as a whole number. Village Income: $ 110 b. What is…arrow_forward5. Discrimination in the labor market The following table exhibits the name, gender, height, and minimum wage 10 people are willing to accept to work as travel nurses at a regional hospital. Name Gender Height Minimum Wage (Inches) (Dollars per week) Cho F 65 $297 Frances F 64 $316 Latasha F 68 $336 Dmitri M 70 $355 Jake M 71 $374 Rosa F 65 $393 Nick M 72 $420 Brian M 71 $439 Tim M 66 $451 Alyssa F 68 $478 The lowest weekly wage that the hospital can spend in order to hire five travel nurses is ________. Suppose the hiring director of the hospital prefers taller candidates because they think it will increase revenue, and so they impose a requirement that all newly hired travel nurses must have a height of at least 68 inches. With this mandate in place, the weekly wage rate the hospital now must pay in order to hire five travel nurses increases by ________.arrow_forward5. Discrimination in the labor market The following table exhibits the name, gender, height, and minimum wage 10 people are willing to accept to work as human resource specialists at a large financial firm. Name Gender Height Minimum Wage (Inches) (Dollars per week) Paolo M 67 $298 Ginny F 63 $311 Lucia F 66 $332 Eric M 71 $354 Kenji M 69 $375 Sharon F 66 $397 Paolo M 70 $411 Carlos M 70 $440 Van M 64 $452 Amy F 69 $474 The lowest weekly wage that the financial firm can spend in order to hire five human resource specialists is____. Suppose the hiring director of the financial firm prefers taller candidates because they think it will increase revenue, and so they impose a requirement that all newly hired human resource specialists must have a height of at least 67 inches. With this mandate in place, the weekly wage rate the financial firm now must pay in order to hire five human resource specialists increases by_____.arrow_forward

- No Al help please!! Please answer the following question for my economics paper: How technological skills and poverty are inversely related.arrow_forwardNot use aiarrow_forwardProblem 3 Stata Output Analysis Suppose a study investigates the causal effect of education on wages. Table 1 reports the results of an OLS regression of wages (wage per hour in dollars) on education (years in education). Table 1 Source SS df MS Number of obs = 3,017 F(1, 3015) = 298.39 Model Residual 18904467 191011981 1 18904467 3,015 63353.8909 Prob > F 0.0000 R-squared 0.0901 Adj R-squared 0.0898 Total 209916448 3,016 69600.9444 Root MSE 251.7 wage Coef. Std. Err. t P>|t| [95% Conf. Interval] education cons 29.56644 183.9342 1.711605 23.15976 17.27 0.000 7.94 0.000 26.21041 138.5237 32.92247 229.3447 a. How would you write this relationship using the Core Model? (5 points) b. What is the value for B₁, the coefficient on Education? (2 points) C. What is the standard error of ẞ₁? (2 points) d. What is the R squared for the model? (2 points) e. What is the t statistic for ₁at the 5% level of significance? (2 points) Λ f. What is the 95% confidence interval for B₁? (2 points) Λ g.…arrow_forward

- Problem 2 Hypothesis Testing Suppose you are interested in the effect of neighborhood crime incidents on high school graduation rates. You run the following regression model: Graduation; ßo+ß₁Crime; +ɛ¿ = You would like to test whether the neighborhood crime incidents have a statistically significant effect on high school graduation rate at the 5% level of significance (α = 0.05). You estimate the model and find that B₁ = -0.04 and se (B₁) = 0.008. a. Write down the null hypothesis and alternative hypothesis. (4 points) b. Calculate thet statistic of B₁. (5 points) C. What is the critical value of thet statistic for the 5% level of significance? (2 points) d. Calculate the 95% confidence interval for the coefficient on Crime? (6 points) e. Based on your answers to the questions b, c, and d, do you reject or fail to reject the null hypothesis you defined in question a? Justify your answer. (5 points) Λ f. Isẞ₁ statistically significant at the 5% level? (3 points)arrow_forwardProblem 1 Endogeneity & Bias The ACT (an abbreviation of American College Testing) is a standardized test used for college admissions in the United States. Suppose you are interested in whether ACT preparation improves ACT scores. Consider the following model: ACT=B+B Preparation,+e; where Preparation measures the number of hours spent on ACT preparation and ACT is ACT scores. Each student is denoted by the subscript i. Suppose you estimate = - 21 andß₁ = 0.9. a. What is the dependent variable? What is the independent variable? (3 points) b. How do you interpret ẞ = 21 in this context? (4 points) 0 C. How do you interpretß₁ = 0.9 in this context? (4 points) 1 d. Describe a scenario which can cause the independent variable to be endogenous. (4 points)arrow_forwardHow does mining raw materials fir tech companies like apple affect the humar right violation all over the worldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License