a.

Whether to eliminate Division B.

a.

Explanation of Solution

Special order decisions: Special order decisions include circumstances in which the board must choose whether to acknowledge abnormal customer orders. These requests or orders normally necessitate special dispensation or include a demand for lesser price.

Outsourcing: It can be termed as conveying all or part of an activity to a supplier or a provider. While outsourcing was initially limited to fundamental activities, it as of now invades the administration of numerous organizations.

Opportunity cost: Opportunity cost is the forfeit of certain benefits such as cost savings, incomes, which is surrendered by not picking an option. Opportunity costs are applicable in decisions where the acknowledgment of one option disqualifies the likelihood of selecting different alternatives.

Determine the contribution to profit

Therefore the contribution to profit is-$9,000.

From the results obtained above, the contribution to profit is negative at-$9,000. Hence the Division B should be eliminated.

Therefore Division B should be eliminated.

Preparing the companywide income statement before and after eliminating Division B.

Explanation of Solution

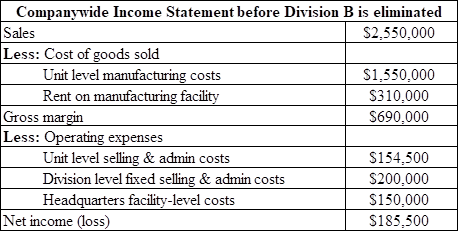

The companywide income statement before eliminating Division B is as follows:

Table(1)

(Refer excel for workings)

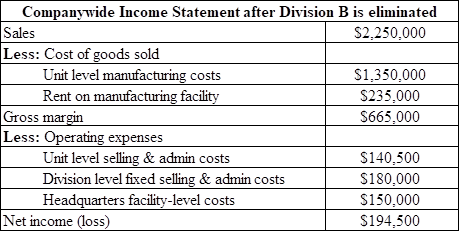

The companywide income statement after eliminating Division B is as follows:

Table (2)

(Refer excel for workings)

b.

Whether the recommendations in Requirement A changes if the units increase to 30,000 units by comparing differential avoidable cost and revenue for Division B.

b.

Explanation of Solution

Initiate by calculating the cost price per unit and the selling per unit that will change in respect to the quantity of units produced and traded. The result is divided with the total cost for respective group by 20,000 units to get cost per unit. The headquarters facility-level costs are not considered from the investigation since these costs are not avoidable.

Determine the selling price per unit

Therefore the selling price per unit is $15.

Determine the unit level

Therefore the unit level manufacturing costs is $10.

Determine the unit level selling and administrative costs

Therefore the unit level selling and administrative costs is $0.70.

Determine the contribution to profit

The comparison between differential revenue and avoidable cost is determined in the below step.

Therefore the contribution to profit is $34,000.

From the results obtained above, the profit contributed by Division B would be 30,000 units. Hence the division should not be eliminated. Additionally, it is vital to contemplate development prospective before choosing to eliminate a segment.

Therefore Division B should not be eliminated.

c.

Whether to operate the division with volume of 30,000 units or it should be closed.

c.

Explanation of Solution

Determine the profit or loss of the division

Therefore the loss of the division is -$51,000.

The reasons on whether to operate the division with volume of 30,000 units or it should be closed is as follows:

- It is mentioned that Company LM is paying $75,000 to lease the manufacturing facility for Division B.

- The business could earn $85,000 ($160,000-$75,000) by subleasing the manufacturing facility.

- By operating the division, the organization is allowing up the chance to sublease the office.

- This is an opportunity cost that would be avoidable by eradicating Division B.

- Consequently, it must be incorporated into the investigation. If the volume is 30,000 units Division B contributes $34,000 as profit.

When considering opportunity cost, the profit turns into a loss of $51,000. According to these conditions, Division B should be eliminated.

Therefore Division B should be eliminated.

Want to see more full solutions like this?

Chapter 6 Solutions

Fundamental Managerial Accounting Concepts

- provide correct answerarrow_forwardManagement anticipates fixed costs of $65,000 and variable costs equal to 35% of sales. What will pretax income equal if sales are $320,000? Helparrow_forwardBefore prorating the manufacturing overhead costs at the end of 2016, the Cost of Goods Sold and Finished Goods Inventory had applied overhead costs of $59,700 and $54,000 in them, respectively. There was no Work-in-Process at the beginning or end of 2016. During the year, manufacturing overhead costs of $88,000 were actually incurred. The balance in the Applied Manufacturing Overhead was $94,500 at the end of 2016. If the under-or overapplied overhead is prorated between the Cost of Goods Sold and the inventory accounts, how much will be the Cost of Goods Sold after the proration? (rounded answer)arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education