ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

18th Edition

ISBN: 9781307515596

Author: RECK

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 21EP

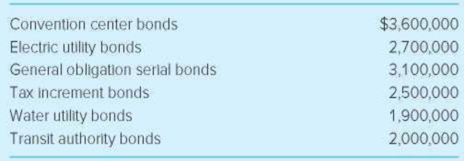

Legal Debt Margin and Direct and Overlapping Debt. (LO6-2) In preparation for a proposed bond sale, the city manager of the City of Appleton requested that you prepare a statement of legal debt margin and a schedule of direct and overlapping debt for the city as of the December 31 year end. You ascertain that the following bond issues are outstanding on that date:

You obtain other information that includes the following items:

- 1. Assessed valuation of real and taxable personal property in the city totaled $240,000,000.

- 2. The rate of debt limitation applicable to the City of Appleton was 6 percent of total real and taxable personal property valuation.

- 3. Electric utility, water utility, and transit authority bonds were all serviced by enterprise revenues. By law, such self-supporting debt is not subject to debt limitation.

- 4. The convention center bonds and tax increment bonds are subject to debt limitation.

- 5. The amount of assets segregated for debt retirement at December 31 is $1,800,000.

- 6. The city’s residents are also taxed by Clyde County for 25 percent of school district and health services debt. The school district has $15,000,000 in outstanding bonds, while health services has $8,000,000 in debt. Finally, one-third of the $2,400,000 of regional library outstanding debt is paid by taxes assessed on Appleton residents.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

What was the income using variable costing?

General Accounting Question please answer this one

Chapter 6 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturer estimates its factory overhead costs to be $51,000 and machine hours to be 7,300 for the year. If the actual hours worked on production total 4,550 and the actual factory overhead costs are $30,070, what is the amount of the over- or under applied factory overhead?arrow_forwardCompute the standard direct labor rate per hourarrow_forwardNeed help with this financial accounting questionarrow_forward

- The weighted average contribution marginarrow_forwardThe net profit of a company for a year on a variable costing basis is $92,000. On an absorption costing basis, the net profit is $78,800. Fixed manufacturing overhead costs per unit were the same in both the prior and current year (i.e. $1.10 per unit). What was the change in inventory over the year? a) Decrease of 9,500 units b) Increase of 12,000 units c) Decrease of 12,000 units d) Increase of 9,500 unitsarrow_forwardFinancial accountingarrow_forward

- Step by step given answer general accountingarrow_forwardAccounting problem with correct solutionarrow_forwardRaven Company has a target of earning $88,000 pre-tax income. The contribution margin ratio is 35%. What amount of dollar sales must be achieved to reach the goal if fixed costs are $52,000?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License