Concept explainers

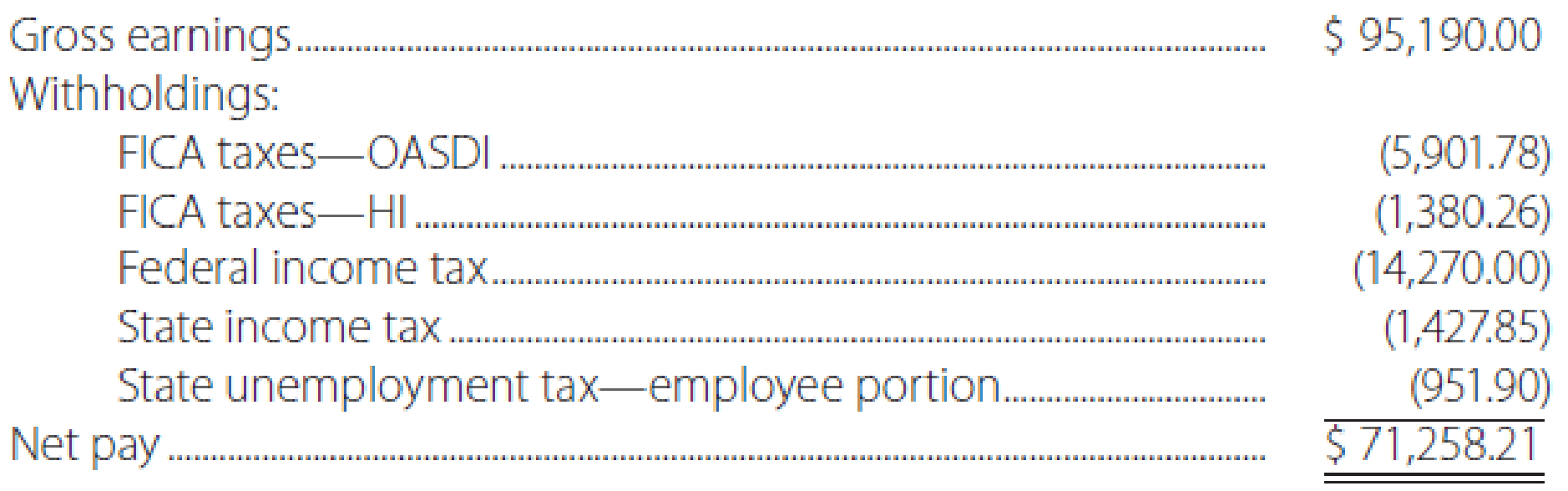

The totals from the payroll register of Olt Company for the week of January 25 show:

Journalize the payroll entry for Company O.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Federal Insurance Contributions Act (FICA) tax: Federal government imposes taxes on the employees’ pay to provide benefits to retired, old age, orphans, and disabled. This tax is also referred to as Social Security tax because the program is devised to benefit the society. FICA tax includes two components, OASDI (Old age, survivors, and disability insurance), and HI (health insurance). 6.2 % is levied as OASDI component, and 1.45% as HI component. So, the total of FICA tax rate is 7.65%

State unemployment compensation tax (SUTA): This is the compensation provided to the unemployed people by the state government from the taxes collected from the employers, as a percentage based on the state contribution rate on employees’ payrolls.

Journalize the weekly payroll entry for Company O.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Salaries Expense | 95,190.00 | |||||

| FICA Taxes Payable–OASDI | 5,901.78 | |||||

| FICA Taxes Payable–HI | 1,380.26 | |||||

| Employee Federal Income Tax Payable | 14,270.00 | |||||

| Employee State Income Tax Payable | 1,427.85 | |||||

| SUTA Taxes Payable | 951.90 | |||||

| Cash | 71,258.21 | |||||

| (Record payment of weekly pay) | ||||||

Table (1)

Description:

- Salaries Expense is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- FICA Taxes Payable–OASDI is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- FICA Taxes Payable–HI is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Employee Federal Income Tax Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Employee State Income Tax Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- SUTA Taxes Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Cash is an asset account. The amount is decreased because cash is paid, and a decrease in asset is credited.

Want to see more full solutions like this?

Chapter 6 Solutions

Cengagenowv2, 1 Term Printed Access Card For Bieg/toland's Payroll Accounting 2019, 29th

- This is an individual assignment. You are required to create a formal topic-to-sentence outline and a full five-paragraph essay [containing an introductory paragraph, 3 body paragraphs and a concluding paragraph], followed by an appropriate Works Cited list, and an annotated bibliography of one source used in the essay. Your essay must be based on ONE of the following prompts. EITHER A. What are the qualities of a socially responsible individual? OR B. Discuss three main groupings of life skills required by Twenty-first Century employers. Additionally, you will state which one of the expository methods [Analysis by Division OR Classification] you chose to guide development of your response to the question selected, and then provide a two or three sentence justification of that chosen method. Your essay SHOULD NOT BE LESS THAN 500 words and SHOULD NOT EXCEED 700 words. You are required to use three or four scholarly / reliable sources of evidence to support the claims made in your…arrow_forwardWhat is the gross profit rate on these general accounting question?arrow_forwardProvide answer this following requirements on these financial accounting questionarrow_forward

- PLEASE DO THE LAST ROW!!arrow_forwardFILL ALL CELLS PLEASE HELParrow_forwardLuctor Actual overhead costs Actual qty of the allocation base used Estimated overhead costs Estimated qty of the allocation base Predetermined OH allocation rate Data table Activity Allocation Base Supplies Number of square feet Travel Number of customer sites Allocation Rate $0.07 per square foot $23.00 per site Print Done Clear all Check answer 12:58 PMarrow_forward

- Were the overheads over applied or under applied and by how much for this general accounting question?arrow_forwardThe Trainer Tire Company provided the following partial trial balance for the current year ended December 31. The company is subject to a 45% income tax rate.arrow_forwardProvide correct answer this general accounting questionarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning