Concept explainers

Frank Flynn is the payroll manager for Powlus Supply Company. During the budgeting process, Sam Kinder, director of finance, asked Flynn to arrive at a set percentage that could be applied to each budgeted salary figure to cover the additional cost that will be incurred by Powlus Supply for each employee. After some discussion, it was determined that the best way to compute this percentage would be to base these additional costs of payroll on the average salary paid by the company.

Kinder wants this additional payroll cost percentage to cover payroll taxes (FICA, FUTA, and SUTA) and other payroll costs covered by the company (workers’ compensation expense, health insurance costs, and vacation pay).

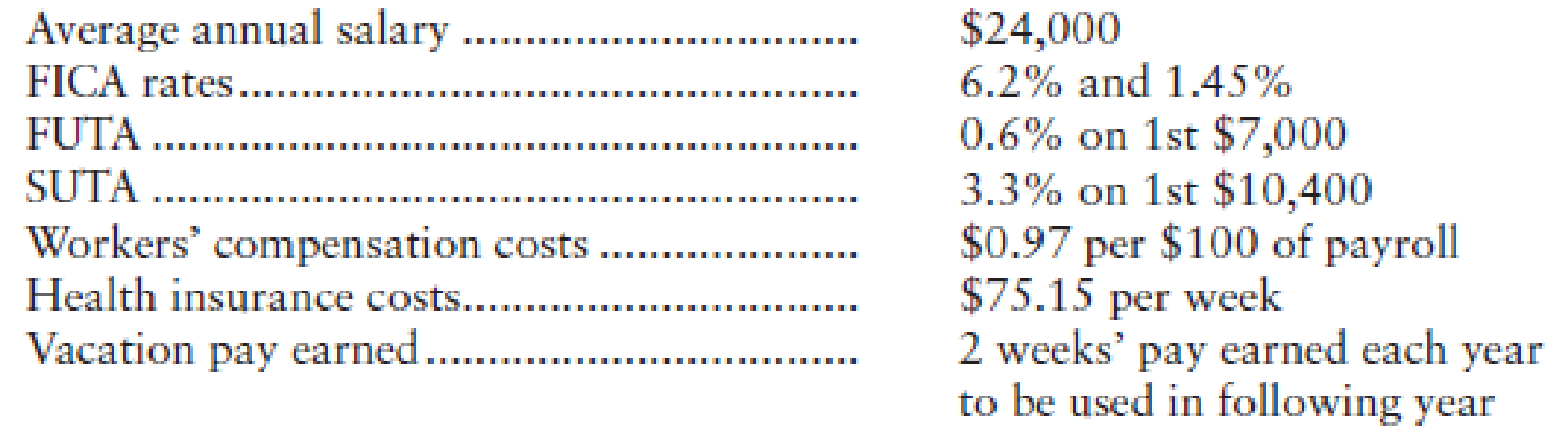

Flynn gathers the following information in order to complete the analysis:

Compute the percentage that can be used in the budget.

Trending nowThis is a popular solution!

Chapter 6 Solutions

Cengagenowv2, 1 Term Printed Access Card For Bieg/toland's Payroll Accounting 2019, 29th

- Accounting question is correct answer with solutionarrow_forwardThe industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardprovide correct answer of this General accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning