Concept explainers

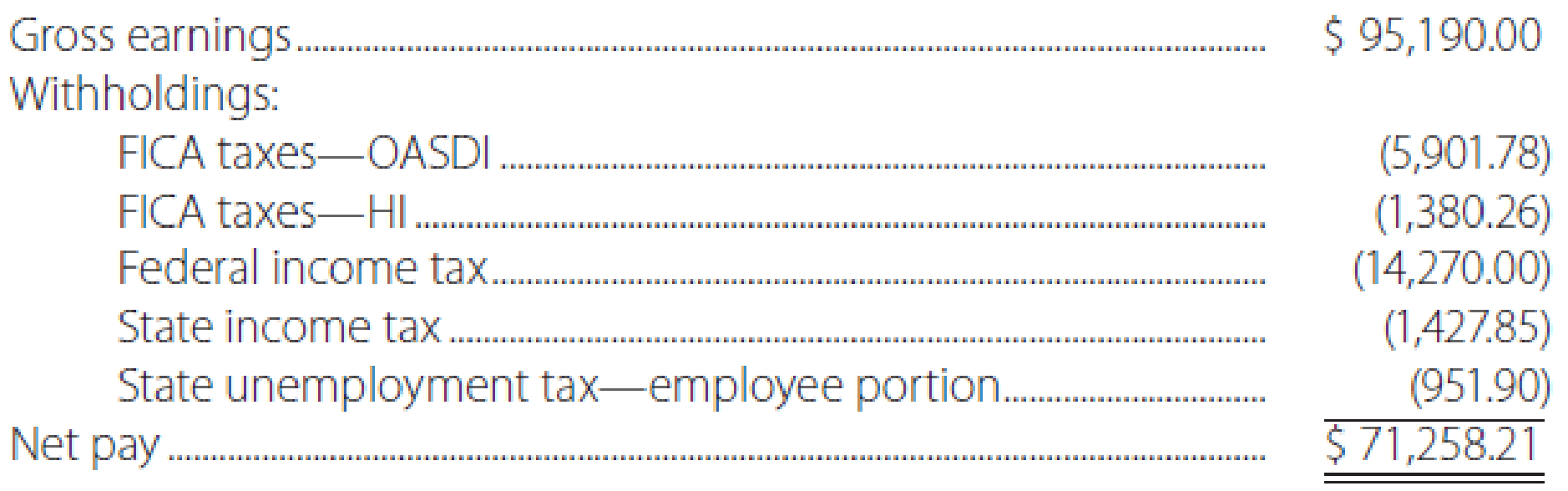

The totals from the payroll register of Olt Company for the week of January 25 show:

Journalize the payroll entry for Company O.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Federal Insurance Contributions Act (FICA) tax: Federal government imposes taxes on the employees’ pay to provide benefits to retired, old age, orphans, and disabled. This tax is also referred to as Social Security tax because the program is devised to benefit the society. FICA tax includes two components, OASDI (Old age, survivors, and disability insurance), and HI (health insurance). 6.2 % is levied as OASDI component, and 1.45% as HI component. So, the total of FICA tax rate is 7.65%

State unemployment compensation tax (SUTA): This is the compensation provided to the unemployed people by the state government from the taxes collected from the employers, as a percentage based on the state contribution rate on employees’ payrolls.

Journalize the weekly payroll entry for Company O.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Salaries Expense | 95,190.00 | |||||

| FICA Taxes Payable–OASDI | 5,901.78 | |||||

| FICA Taxes Payable–HI | 1,380.26 | |||||

| Employee Federal Income Tax Payable | 14,270.00 | |||||

| Employee State Income Tax Payable | 1,427.85 | |||||

| SUTA Taxes Payable | 951.90 | |||||

| Cash | 71,258.21 | |||||

| (Record payment of weekly pay) | ||||||

Table (1)

Description:

- Salaries Expense is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- FICA Taxes Payable–OASDI is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- FICA Taxes Payable–HI is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Employee Federal Income Tax Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Employee State Income Tax Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- SUTA Taxes Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Cash is an asset account. The amount is decreased because cash is paid, and a decrease in asset is credited.

Want to see more full solutions like this?

Chapter 6 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning