a)

Case summary:

The federal government of Country U is the largest debtor in the world. The Country U’s intra-governmental bodies, foreign investors and the individuals accounts for about more than one-third of the debt due to which the government has a massive demand for external financing. It is issuing T-bills, debt securities to feed these demand. The treasury securities are still regarded as the safest investment to date.

To explain: The pros and cons of this strategy.

a)

Explanation of Solution

Pros and cons:

The treasury department of Country US will face many considerations similar to those where a company is considering the revision of the average debt maturity. The short-term bills are lower reducing the total financing costs. But, if the Treasury relies on the short-term rates and its rise, the cost of financing will become higher. There is a higher risk where the government is unable to get new buyers for the new treasury bills when the old ones began to mature. The excessive demand for short-term securities might push up the seasonal loans higher hindering the revenues of the firm.

The government also has to worry about tarnishing the high regard possesses by the treasury bills. It is the closest to get to risk-free rate in the real world. If the investment in short-term financing increases it will lead to an increase in Treasury bill rates.

b)

To explain: The impact on the

b)

Explanation of Solution

The debt that is priced at a par rate provides a payment in the form of a coupon which is enough to pay the

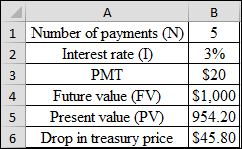

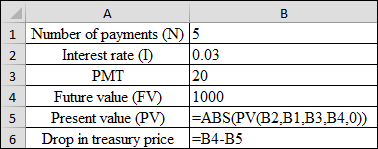

Excel formula:

The price of the Treasury has dropped by $45.80 or 4.58% and the new price is $954.20.

c)

To explain: The level of the market value of outstanding debt fall.

c)

Explanation of Solution

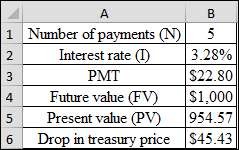

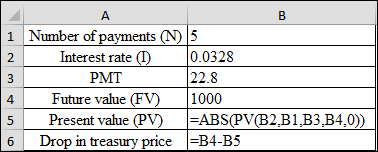

The $360 billion is the interest expense in 2012 and the national debt was about $15.8 trillion in 2012. The division of interest paid by the total debt has resulted in an interest rate of 2.28%. It is assumed that the treasuries are priced at par and it ends up being $22.80 being the annual payment required so that the treasuries are priced at par.

Excel formula:

The price of the Treasury has dropped by $45.43 or 4.5% and the new price is $954.57.

This will decrease the size of the federal debt by $756 billion (0.045 * $16.8 billion). If someone considers the size of the current budget as the deficit, there are incentives for the government to pursue policies which are leading to higher inflation. But, these higher prices will lead to higher cost of goods and other services in the future which are purchased by the government.

Want to see more full solutions like this?

Chapter 6 Solutions

Principles of Managerial Finance (14th Edition) (Pearson Series in Finance)

- Don't used Ai solutionarrow_forwardLiterature Review Based Essay on Contemporary Issues of Business Ethics and Corporate Social Responsibility Essay Format Cover Page with your Name Table of Content • Introduction ⚫ Objectives ⚫ Discussion with Literature Support • Conclusion References (10+) Words Limit-3000-3500 wordsarrow_forwardPlease don't use hand ratingarrow_forward

- "Dividend paying stocks cannot be growth stocks" Do you agree or disagree? Discuss choosing two stocks to help justify your view.arrow_forwardA firm needs to raise $950,000 but will incur flotation costs of 5%. How much will it pay in flotation costs? Multiple choice question. $55,500 $50,000 $47,500 $55,000arrow_forwardWhile determining the appropriate discount rate, if a firm uses a weighted average cost of capital that is unique to a particular project, it is using the Blank______. Multiple choice question. pure play approach economic value added method subjective approach security market line approacharrow_forward

- When a company's interest payment Blank______, the company's tax bill Blank______. Multiple choice question. stays the same; increases decreases; decreases increases; decreases increases; increasesarrow_forwardFor the calculation of equity weights, the Blank______ value is used. Multiple choice question. historical average book marketarrow_forwardA firm needs to raise $950,000 but will incur flotation costs of 5%. How much will it pay in flotation costs? Multiple choice question. $50,000 $55,000 $55,500 $47,500arrow_forward

- Question Mode Multiple Choice Question The issuance costs of new securities are referred to as Blank______ costs. Multiple choice question. exorbitant flotation sunk reparationarrow_forwardWhat will happen to a company's tax bill if interest expense is deducted? Multiple choice question. The company's tax bill will increase. The company's tax bill will decrease. The company's tax bill will not be affected. The company's tax bill for the next year will be affected.arrow_forwardThe total market value of a firm is calculated as Blank______. Multiple choice question. the number of shares times the average price the number of shares times the future price the number of shares times the share price the number of shares times the issue pricearrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education