ACCOUNTING F/GOV.+..(LL)-W/CODE>CUSTOM<

18th Edition

ISBN: 9781264107919

Author: RECK

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 15C

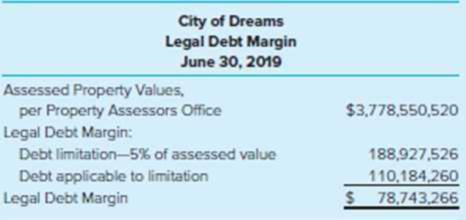

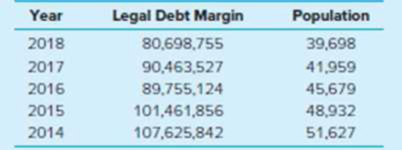

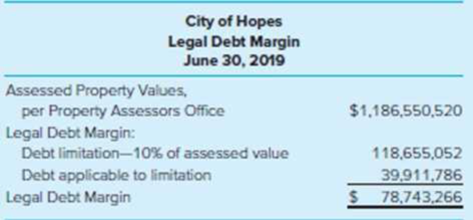

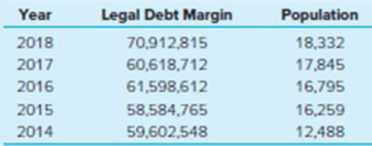

Evaluating Legal Debt Margins. (LO6-2) You’ll be moving to a nearby state after graduation and are focusing on two cities near your new job. After reading this chapter, you decide to look at the debt held by each of the governments. Disclosures of the legal debt margin for each city over the past few years are reproduced below.

Five-year trend information:

Five-year trend information:

Required

Compare the legal debt margin of the two cities. What are your observations regarding the debt position of the two governments?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

general accounting final

Can you help me with accounting questions

Calculate the amount of cash paid to employees... General accounting

Chapter 6 Solutions

ACCOUNTING F/GOV.+..(LL)-W/CODE>CUSTOM<

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

The Main Types of Mortgages (EXPLAINED); Author: Bankrate;https://www.youtube.com/watch?v=tp284BA6Zxg;License: Standard Youtube License