Assume that Atlas Sporting Goods Inc. has

a. Compute the anticipated return after financing costs with the most aggressive asset financing mix.

b. Compute the anticipated return after financing costs with the most conservative asset financing mix.

c. Compute the anticipated return after financing costs with the two moderate approaches to the asset financing mix.

d. If the firm used the most aggressive asset financing mix described in part a and had the anticipated return you computed for part a, what would earnings per share be if the tax rate on the anticipated return was 30 percent and there were 20,000 shares outstanding?

e. Now assume the most conservative asset financing mix described in part b will be utilized. The tax rate will be 30 percent. Also assume there will only be 5,000 shares outstanding. What will earnings per share be? Would it be higher or lower than the earnings per share computed for the most aggressive plan computed in part d?

a.

To calculate: The anticipated return, after deducting the finance costs, with the most aggressive approach of the asset financing mix.

Introduction:

Anticipated return:

It is the amount that an individual or company has estimated to earn from an investment. It is one of the factors taken into account by an investor before selecting an investment plan.

Aggressive approach:

When a company selects a plan of low liquidity with high return and long-term financing, it is termed as an aggressive approach.

Answer to Problem 11P

The anticipated return, after deducting the finance costs, with the most aggressive approach of the asset financing mix is $50,400.

Explanation of Solution

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the low liquidity plan is as follows.

The calculation of the finance cost of short-term financing is as follows.

b.

To calculate: The anticipated return, after deducting the finance costs, with the most conservative approach of the asset financing mix.

Introduction:

Conservative approach:

When a company selects a plan of high liquidity with low return and short-term financing, it is termed as a conservative approach.

Answer to Problem 11P

The anticipated return, after deducting the finance costs, with the most conservative approach of the asset financing mix is $8,400.

Explanation of Solution

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the high liquidity plan is as follows.

The calculation of the finance cost of long-term financing is as follows.

c.

To calculate: The anticipated return, after deducting the finance costs, with the two moderate approaches of the asset financing mix.

Introduction:

Moderate approach:

When a company selects a plan of low liquidity with high return and short-term financing or one of high liquidity with low return and long-term financing, it is termed as a moderate approach.

Answer to Problem 11P

The anticipated return, after deducting the finance costs, with the moderate approach of the low liquidity plan and long-term financing of the asset financing mix is $33,600.

The anticipated return, after deducting the finance costs, with the moderate approach of the high liquidity plan and short-term financing of the asset financing mix is $25,200.

Explanation of Solution

Anticipated return in the moderate approach of the low liquidity plan and long-term financing of the asset financing mix:

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the low liquidity plan is as follows.

The calculation of the finance costs of long-term financing is as follows.

Anticipated return in the moderate approach of the high liquidity plan and short-term financing of the asset financing mix:

The calculation of the anticipated return is as follows.

Working notes:

The calculation of the return from the high-liquidity plan is as follows.

The calculation of the finance costs of short-term financing is as follows.

d.

To calculate: The earnings per share if Atlas Sporting Goods Inc. uses the aggressive approach of the asset financing mix with the anticipated return computed in part (a).

Introduction:

Earnings per share:

It is a measurement of the company's profitability. It is calculated by dividing the net income less dividend paid for the prefernece stock by the average number of outstanding shares.

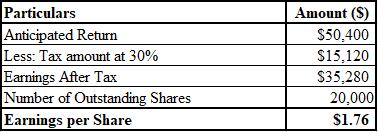

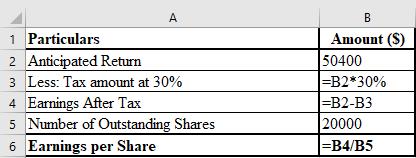

Answer to Problem 11P

The calculation of the earnings per share is as follows.

If Atlas Sporting Goods Inc. uses the aggressive approach of the asset financing mix with the anticipated return computed in part (a), its earnings per share is $1.76.

Explanation of Solution

The calculation of the earnings per share using Excel is as follows.

e.

To calculate: The earnings per share if Atlas Sporting Goods Inc. uses the conservative approach of the asset financing mix with the anticipated return computed in part (b) as well as to check whether it is higher or lower than the earnings per share computed in part (d).

Introduction:

Earnings per share:

It is a measurement of the company's profitability. It is calculated by dividing the net income less dividend paid for the preference stock by the average number of outstanding shares.

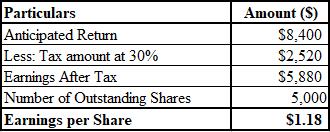

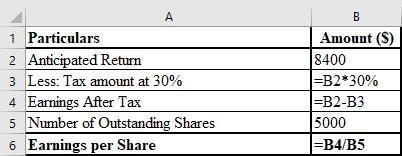

Answer to Problem 11P

The calculation of the earnings per share is as follows.

If Atlas Sporting Goods Inc. uses the conservative approach of the asset financing mix with the anticipated return computed in part (b), its earnings per share is $1.18.

The earnings per share by the conservative approach of the asset financing mix, that is, $1.18 is lower that by the aggressive approach of the asset financing mix, that is, $1.97.

Explanation of Solution

The formula used for the calculation of the earnings per share using Excel is as follows.

Want to see more full solutions like this?

Chapter 6 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Your firm is considering an expansion of its operations into a nearby geographic area that the firm is currently not serving. This would require an up-front investment (startup cost) of $989,060.00, to be made immediately. Here are the forecasts that were prepared for this project, shown in the image. The long-term growth rate for cash flows after year 4 is expected to be 4.73%. The cost of capital appropriate for this project is 12.48%. What is the NPV, Profitability Index, IRR and payback in this case?arrow_forwardUse the binomial method to determine the value of an American Put option at time t = 0. The option expires at time t = T = 1/2 and has exercise price E = 55. The current value of the underlying is S(0) = 50 with the underlying paying continuous dividends at the rate D = 0.05. The interest rate is r = 0.3. Use a time step of St = 1/6. Consider the case of p = 1/2 and suppose the volatility is σ = 0.3. Perform all calculations using a minimum of 4 decimal places of accuracy. =arrow_forwardConsider a European chooser option with exercise price E₁ and expiry date T₁ where the relevant put and call options, which depend on the value of the same underlying asset S, have the same exercise price E2 and expiry date T₂. Determine, in terms of other elementary options, the value of the chooser option for the special case when T₁ = T2. Clearly define all notation that you use.arrow_forward

- The continuous conditional probability density function pc(S, t; S', t') for a risk neutral lognormal random walk is given by Pc(S, t; S', t') = 1 σS'√2π(t' - t) - (log(S/S) (ro²)(t − t)] exp 202 (t't) In the binomial method, the value of the underlying is Sm at time step môt and the value of the underlying at time step (m + 1)St is Sm+1. For this case evaluate Ec[(Sm+1)k|Sm] = [°° (S')*pc(S™, mdt; S', (m + 1)8t)dS' showing all steps, where k is a positive integer with k ≥ 1. You may assume that 1 e (x-n)2 2s2dx = 1 for all real numbers n and s with s > 0.arrow_forwardJohn and Jane Doe, a married couple filing jointly, have provided you with their financial information for the year, including details of federal income tax withheld. They need assistance in preparing their tax return. W-2 Income: John earns $150,000 with $35,000 withheld for federal income tax. Jane earns $85,000 with $15,500 withheld for federal income tax. Interest Income: They received $2500 in interest from a savings account, with no tax withheld. Child Tax Credit: They have two children under the age of 17. Mortgage Interest: Paid $28,000 in mortgage interest on their primary residence. Property Taxes: Paid $4,800 in property taxes on their primary residence. Charitable Donations: Donated $22,000 to qualifying charitable organizations. Other Deductions: They have no other deductions to claim. You will gather the appropriate information and complete the forms provided in Blackboard (1040, Schedule A, and Schedule B in preparation of their tax file.arrow_forwardOn the issue date, you bought a 20-year maturity, 5.85% semi-annual coupon bond. The bond then sold at YTM of 6.25%. Now, 5 years later, the similar bond sells at YTM of 5.25%. If you hold the bond now, what is your realized rate of return for the 5-year holding period?arrow_forward

- Bond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 11% coupon rate, payable semiannually. The bonds mature in 17 years, have a face value of $1,000, and a yield to maturity of 9.5%. What is the price of the bonds? Round your answer to the nearest cent.arrow_forwardanalyze at least three financial banking products from both the liability side (like time deposits, fixed income, stocks, structure products, etc). You will need to examine aspects such as liquidity, risk, and profitability from a company and an individual point of view.arrow_forwardHow a does researcher ensure that consulting recommendations are data-driven? What does make it effective, and sustainable? Please help explain and give the example How does DMAC help researchers to improve their business processes? How to establish feedback loops for ongoing refinement. Please give the examplesarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education