Concept explainers

Missing Data; Basic CVP Concepts L06−1, L06−9

Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. (Hint: One way to find the missing amounts would be to prepare a contribution format income statement for each case, enter the known data, and then compute the missing items.)

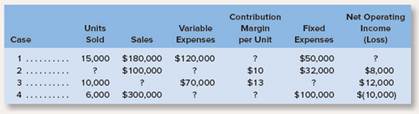

a. Assume that only one product is being sold in each of the four following case situations:

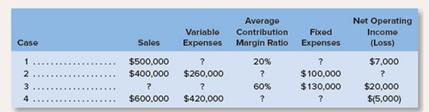

b. Assume that more than one product is being sold in each of the four following case situations:

Cost volume profit analysis: Cost volume profit analysis measures the effect on income of a company with the alteration of cost and volume of sales.

The missing amount in the table.

Answer to Problem 11E

Solution:

a) Assuming that only one product is being sold in each of the following case situations:

| Case | Units Sold | Sales | Variable

Expenses | Contribution

Margin per Unit | Fixed Expenses | Net Operating Income(loss) |

| 1 | 15,000 | $180,000 | $120,000 | $4 | $50,000 | $10,000 |

| 2 | 4,000 | $100,000 | $60,000 | $10 | $32,000 | $8,000 |

| 3 | 10,000 | $200,000 | $70,000 | $13 | $118,000 | $12,000 |

| 4 | 6,000 | $300,000 | $210,000 | $15 | $100,000 | ($10,000) |

Case 1

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (15,000 units) | $180,000 | $12.00 |

| Variable expenses | $120,000 | $8.00 |

| Contribution Margin | $60,000 | $4.00 |

| Fixed expenses | $50,000 | |

| Net operating income | $10,000 | |

Case 2

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (4,000 units) | $100,000 | $25.00 |

| Variable expenses | $60,000 | $15.00 |

| Contribution Margin | $40,000 | $10.00 |

| Fixed expenses | $32,000 | |

| Net operating income | $8,000 | |

Case 3

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (10,000 units) | $200,000 | $20.00 |

| Variable expenses | $70,000 | $7.00 |

| Contribution Margin | $130,000 | $13.00 |

| Fixed expenses | $118,000 | |

| Net operating income | $12,000 | |

Case 4

| Contribution format income statement | ||

| Total | Per Unit | |

| Sales (6,000 units) | $300,000 | $50.00 |

| Variable expenses | $210,000 | $35.00 |

| Contribution Margin | $90,000 | $15.00 |

| Fixed expenses | $100,000 | |

| Net operating income | ($10,000) | |

b) Assuming that more than one product is being sold in each of the four case situations:

| Case | Sales | Variable Expenses | Average

Contribution Margin Ratio | Fixed

Expenses | Net Operating

Income (loss) |

| 1 | $500,000 | $400,000 | 20% | $93,000 | $7,000 |

| 2 | $400,000 | $260,000 | 35% | $100,000 | $40,000 |

| 3 | $250,000 | $100,000 | 60% | $130,000 | $20,000 |

| 4 | $600,000 | $420,000 | 30% | $185,000 | ($5,000) |

Case 1

| Contribution format income statement | |

| Amounts | |

| Sales | $500,000 |

| Variable expenses | $400,000 |

| Contribution Margin | $100,000 |

| Fixed expenses | $93,000 |

| Net operating income | $7,000 |

| Contribution format income statement | |

| Amounts | |

| Sales | $400,000 |

| Variable expenses | $260,000 |

| Contribution Margin | $140,000 |

| Fixed expenses | $100,000 |

| Net operating income | $40,000 |

Case 3

| Contribution format income statement | |

| Amounts | |

| Sales | $250,000 |

| Variable expenses | $100,000 |

| Contribution Margin | $150,000 |

| Fixed expenses | $130,000 |

| Net operating income | $20,000 |

Case 4

| Contribution format income statement | |

| Amounts | |

| Sales | $600,000 |

| Variable expenses | $420,000 |

| Contribution Margin | $180,000 |

| Fixed expenses | $185,000 |

| Net operating income | ($5,000) |

Explanation of Solution

A contribution margin is calculated by deducting the variable expenses from the sales revenue. So, if the variable expense is missing, the contribution margin is deducted from the sales revenue and goes same in case of units. The net operating income is calculated by deducting the fixed expenses from the contribution margin. So, if the fixed expenses are missing, the operating income is deducted from the contribution margin. The contribution margin ratio is calculated by dividing the contribution margin by sales revenue. So, if the sales revenue is missing, it can be ascertained by dividing the contribution margin by the contribution margin ratio and if the contribution margin is missing, it is calculated by multiplying the contribution margin with the contribution margin ratio.

Given: a) Assume that only one product is being sold in each of the following case situations:

| Case | Units Sold | Sales | Variable

Expenses | Contribution

Margin per Unit | Fixed Expenses | Net Operating Income(loss) |

| 1 | 15,000 | $180,000 | $120,000 | ? | $50,000 | ? |

| 2 | ? | $100,000 | ? | $10 | $32,000 | $8,000 |

| 3 | 10,000 | ? | $70,000 | $13 | ? | $12,000 |

| 4 | 6,000 | $300,000 | ? | ? | $100,000 | ($10,000) |

b) Assume that more than one product is being sold in each of the four case situations:

| Case | Sales | Variable Expenses | Average

Contribution Margin Ratio | Fixed

Expenses | Net Operating

Income (loss) |

| 1 | $500,000 | ? | 20% | ? | $7,000 |

| 2 | $400,000 | $260,000 | ? | $100,000 | ? |

| 3 | ? | ? | 60% | $130,000 | $20,000 |

| 4 | $600,000 | $420,000 | ? | ? | ($5,000) |

The cost volume profit analysis aims determining an outcome of changes in the various variables of operations. A cost is the expenses incurred on the products which are being sold and the volume is the quantity of the products which is going to be sold. The profit is the difference between the cost incurred and sales revenue of a company. An analysis of cost volume profit helps in predicting or forecasting the various consequences of various decisions.

Want to see more full solutions like this?

Chapter 6 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Fundamentals of Management (10th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- Custom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $7,000, direct labor of $3,400, and applied overhead of $2,890. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $26,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Direct materials used Direct labor used $ 2,300 3,400 Job 121 $ 7,100 4,700 Job 122 $ 2,600 3,700 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June…arrow_forwardIn 2014, LL Bean sold 450,000 pairs of boots. At one point in 2014, it had a back order of 100,000. In 2015, LL Bean expects to sell 500,000 pairs of boots. As of late November 2015, it has a back order of 50,000.Question: When would LL Bean see sales revenue from the sale of its back order on the boots?arrow_forwardHelp me to solve this questionsarrow_forward

- correct answer pleasearrow_forwardGive this question financial accountingarrow_forward1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forward

- Nonearrow_forwardWhat was her capital gains yield? General accountingarrow_forwardL.L. Bean operates two factories that produce its popular Bean boots (also known as "duck boots") in its home state of Maine. Since L.L. Bean prides itself on manufacturing its boots in Maine and not outsourcing, backorders for its boots can be high. In 2014, L.L. Bean sold about 450,000 pairs of the boots. At one point during 2014, it had a backorder level of about 100,000 pairs of boots. L.L. Bean can manufacture about 2,200 pairs of its duck boots each day with its factories running 24/7. In 2015, L.L. Bean expects to sell more than 500,000 pairs of its duck boots. As of late November 2015, the backorder quantity for Bean Boots was estimated to be about 50,000 pairs. Question:arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education