Concept explainers

CVP Applications; Contribution Margin Ratio: Degree of Operating Leverage L06−I , L06−3, L06−4, L06− 5, LOS−8

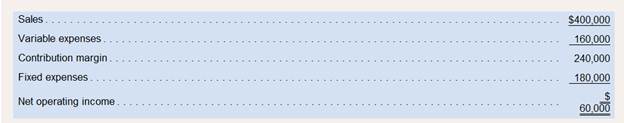

Feather Friends, Inc., distributes a high−quality that sells for S20 unit. Variable expenses are SS unit, fixed total S 180.000 per year. Its operating results for last year were as follows;

Required:

Answer each question independently based on the original data:

1. What is the product’s CM ratio?

2. Use the CM ratio to determine the break-even point in dollar sales.

3. If this year’s sales increase by $75,000 and fixed expenses do not change, how much will net Operating income increase?

4. a. What is the degree of operating leverage based on last year’s sales?

b. Assume the president expects this year’s sales to increase by 20%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year?

5. The sales manager is convinced that a 10% reduction in the selling price, combined with a $30,000 increase in advertising, would increase this year’s unit sales by 25%. If the sales manager is right what would be this year’s net operating income if his ideas are implemented? Do you recommend implementing the sales manager’s suggestions? Why?

6. The president does not want to change the selling price. Instead, he wants to increase the sales commission by $1 per unit. He thinks that this move, combined with some increase in advertising, would increase this year’s sales by 25%. How much could the president increase this veal’s advertising expense and still earn the same $60.000 net operating income as last year?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- Please provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardSynergy Works had a Work-in-Process balance of $160,000 on January 1, 2023. The year-end balance of Work-in-Process was $142,000, and the Cost of Goods Manufactured was $795,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub