Financial Accounting

3rd Edition

ISBN: 9780133791129

Author: Jane L. Reimers

Publisher: Pearson Higher Ed

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5A, Problem 3EA

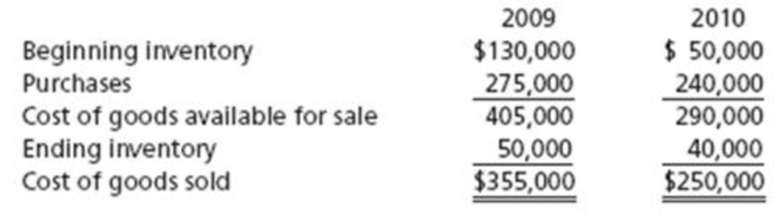

Ian’s Small Appliances reported cost of goods sold as follows:

Ian’s made two errors:

- 1. 2009 ending inventory was understated by $5,000.

- 2. 2010 ending inventory was overstated by $2,000.

Calculate the correct cost of goods sold for 2009 and 2010.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ayayai Hardware Limited reported the following amounts for its cost of goods sold and Inventory:

Cost of goods sold

Ending inventory

2018

Ending inventory

$169,200

Cost of goods sold

37,400

2017

Ayayai made two errors: (1) ending inventory for 2018 was overstated by $2,000 and (2) ending inventory for 2017 was understated

by $4,100. Assume that neither error has been found or corrected.

$152,900

Calculate the correct ending inventory and cost of goods sold amounts for each year.

$

29,400

2018

tA

$

LA

2017

Sheridan Hardware reported cost of goods sold as follows.

Beginning inventory

Cost of goods purchased

Cost of goods available for sale

Less: Ending inventory

Cost of goods sold

2022

Cost of goods sold $

$ 30,500

189,500

220,000

40,000

$180,000

Sheridan made two errors:

1.2021 ending inventory was overstated by $3,200.

2.2022 ending inventory was understated by $6,300.

Compute the correct cost of goods sold for each year.

2022

2021

$ 25,000

153,500

178,500

30,500

$148,000

$

2021

I need help.

Chapter 5A Solutions

Financial Accounting

Ch. 5A - Berry Corporation miscounted the ending inventory...Ch. 5A - How would each of the following inventory errors...Ch. 5A - How would each of the following inventory errors...Ch. 5A - Ians Small Appliances reported cost of goods sold...Ch. 5A - Tire Pro Companys records reported the following...Ch. 5A - Matrix Company uses a periodic, weighted average...Ch. 5A - Paiges Office Paper Company uses a perpetual...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company Edgar reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 12,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardIn its first year of business, Miss Take, the bookkeeper, erroneously recorded a $1,000 period cost as a product cost. Only 3/4 of the inventory has been sold. What effect does this error have on the following? Assets Cost of Goods Sold Gross Profit Operating Income A. Overstated B. Understatedarrow_forwardA company’s beginning inventory for 2005 was overstated by $37,000, and the endinginventory for 2005 was understated by $16,000. The income tax rate for the company is 30%.These errors will cause the 2006 net income to bea. Understated by $11,200.b. Understated by $25,900.c. Overstated by $11,200.d. Overstated by $25,900.arrow_forward

- Malcolm Lee Industries reported the following amounts in its December 31st financial statements: 2020 2021 Cost of Goods sold $270,100 $288,600 Ending Inventory 55,600 55,600 Errors were made in each year as follows: in 2020, ending inventory was overstated by $10,600 while in 2021, ending inventory was understated by $6,600. Explain the impact of these errors for 2021 profit and owners’ equity. Profits will be by $ . Owners’ equity will be by $ . Save for Later Last saved 1 day ago. Saved work will be auto-submitted on the due date. Attempts: 0 of 1 used Submit Answerarrow_forwardHelp mearrow_forwardPlease do not give solution in image format thankuarrow_forward

- Malcolm Lee Industries reported the following amounts in its December 31st financial statements: 2020 2021 Cost of Goods sold $280,000 $287,900 Ending Inventory 55,700 55,700 Errors were made in each year as follows: in 2020, ending inventory was overstated by $10,600 while in 2021, ending inventory was understated by $6,700. Explain the impact of these errors for 2021 profit and owners’ equity. Profits will be by $ . Owners’ equity will be by $ .arrow_forwardGet Answer please without AI toolarrow_forwardInstruction: Please use moving average in answering the questions (disregard FIFO)arrow_forward

- If a group of inventory items costing $3,200 had been double counted during the year-end inventory count, what impact would the error have on the following inventory calculations? Indicate the effect (and amount) as either (a) none, (b) understated $______, or (c) overstated $______. Table 10.2arrow_forwardIf Barcelona Companys ending inventory was actually $122,000, but the cost of consigned goods, with a cost value of $20,000 were accidentally included with the company assets, when making the year-end inventory adjustment, what would be the impact on the presentation of the balance sheet and income statement for the year that the error occurred, if any?arrow_forwardBhushan Company has been using LIFO for inventory purposes because it would prefer to keep gross profits low for tax purposes. In its second year of operation (20-2), the controller pointed out that this strategy did not appear to work and suggested that FIFO cost of goods sold would have been higher than LIFO cost of goods sold for 20-2. Is this possible? REQUIRED Using the information provided, compute the cost of goods sold for 20-1 and 20-2 comparing the LIFO and FIFO methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License