College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 1CP

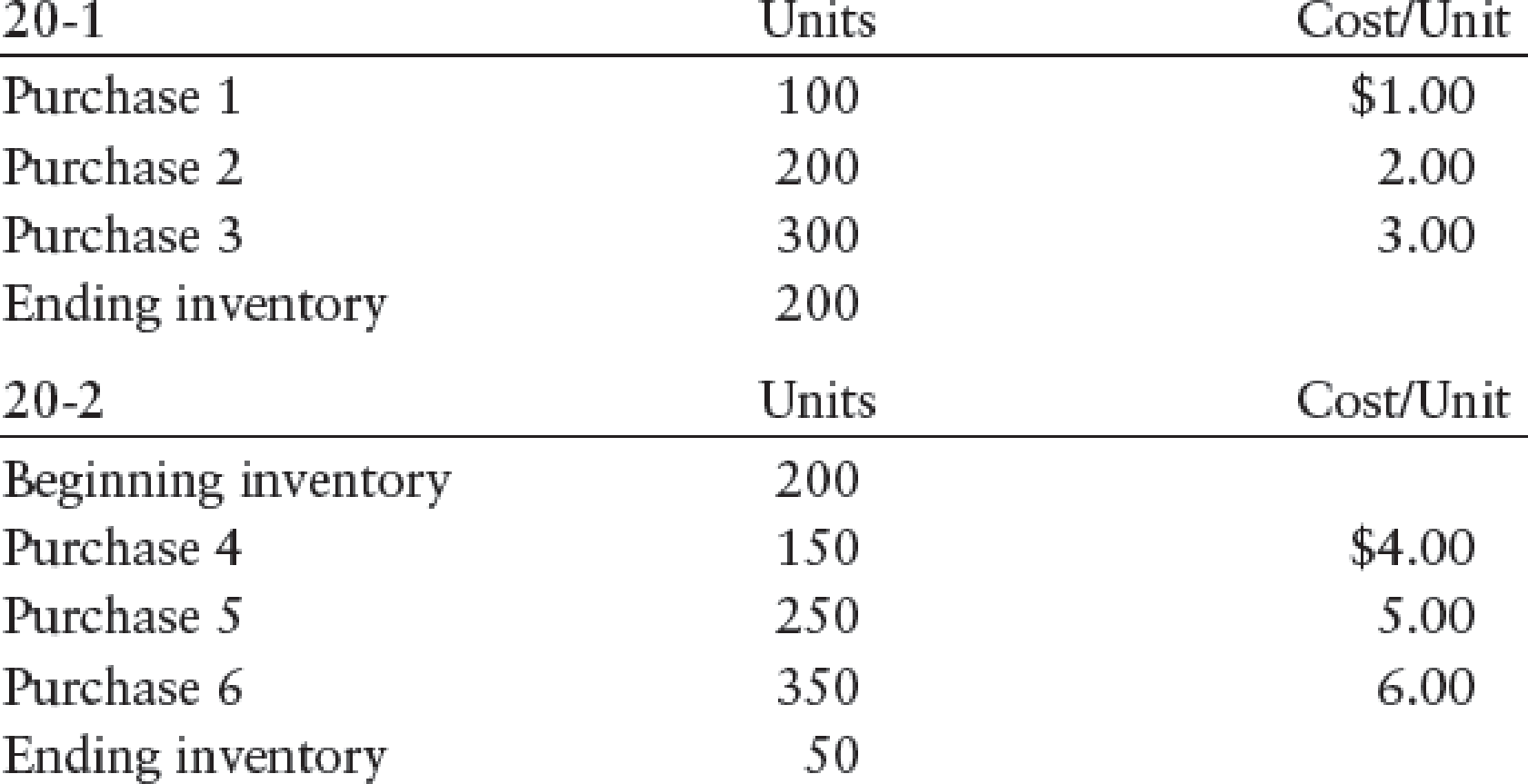

Bhushan Company has been using LIFO for inventory purposes because it would prefer to keep gross profits low for tax purposes. In its second year of operation (20-2), the controller pointed out that this strategy did not appear to work and suggested that FIFO cost of goods sold would have been higher than LIFO cost of goods sold for 20-2. Is this possible?

REQUIRED

Using the information provided, compute the cost of goods sold for 20-1 and 20-2 comparing the LIFO and FIFO methods.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the predetermined overhead rate for the year 2021?

Please need answer the financial accounting question

What is the net income of this financial accounting question?

Chapter 13 Solutions

College Accounting, Chapters 1-27

Ch. 13 - An overstatement of ending inventory in the year...Ch. 13 - An understatement of ending inventory in the year...Ch. 13 - LO2 Under the perpetual system of accounting for...Ch. 13 - LO3 A fiscal year that starts and ends at the time...Ch. 13 - LO3 If goods are shipped FOB shipping point, the...Ch. 13 - An understatement of ending inventory in the year...Ch. 13 - Prob. 2MCCh. 13 - In rimes of rising prices, the inventory cost...Ch. 13 - In rimes of rising prices, the inventory cost...Ch. 13 - In the application of lower-of-cost-or-market,...

Ch. 13 - LO1 If the ending inventory is overstated by...Ch. 13 - Using the following information, compute the...Ch. 13 - Use the following information to compute cost of...Ch. 13 - Kulsrud Company would like to estimate the current...Ch. 13 - What financial statements are affected by an error...Ch. 13 - What is the main difference between the periodic...Ch. 13 - Is a physical inventory necessary under the...Ch. 13 - Is a physical inventory necessary under the...Ch. 13 - In a period of rising prices, which inventory...Ch. 13 - What two factors are taken into account by the...Ch. 13 - Which inventory method always follows the actual...Ch. 13 - When lower-of-cost-or-market is assigned to the...Ch. 13 - List the three steps followed under the gross...Ch. 13 - List the five steps followed under the retail...Ch. 13 - INVENTORY ERRORS Assume that in year 1, the ending...Ch. 13 - JOURNAL ENTRIESPERIODIC INVENTORY Paul Nasipak...Ch. 13 - JOURNAL ENTRIESPERPETUAL INVENTORY Joan Ziemba...Ch. 13 - ENDING INVENTORY COSTS Sandy Chen owns a small...Ch. 13 - LOWER-OF-COST-OR-MARKET Stalberg Companys...Ch. 13 - SPECIFIC IDENTIFICATION, FIFO, LIFO, AND...Ch. 13 - COST ALLOCATION AND LOWER-OF-COST-OR-MARKET...Ch. 13 - Prob. 8SPACh. 13 - RETAIL INVENTORY METHOD The following information...Ch. 13 - INVENTORY ERRORS Assume that in year 1, the ending...Ch. 13 - JOURNAL ENTRIESPERIODIC INVENTORY Amy Douglas owns...Ch. 13 - JOURNAL ENTRIESPERPETUAL INVENTORY Doreen Woods...Ch. 13 - ENDING INVENTORY COSTS Danny Steele owns a small...Ch. 13 - LOWER-OF-COST-OR-MARKET Bouie Companys beginning...Ch. 13 - SPECIFIC IDENTIFICATION, FIFO, LIFO, AND...Ch. 13 - COST ALLOCATION AND LOWER-OF-COST-OR-MARKET Hall...Ch. 13 - GROSS PROFIT METHOD A flood completely destroyed...Ch. 13 - RETAIL INVENTORY METHOD The following information...Ch. 13 - Hurst Companys beginning inventory and purchases...Ch. 13 - Bhushan Company has been using LIFO for inventory...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I have been looking and trying to figure out this accounting problem for over 3 hours. Please help explain Goodwill, consolidated net income, and consolidated net income for controlling vs noncontrolling interest. It would be much appreciated. Thank you. :)arrow_forwardNet income isarrow_forwardI want to correct answer general accounting questionarrow_forward

- Financial Accountingarrow_forwardprovide correct answer general accountarrow_forwardSycamore Corp. bases its manufacturing overhead budget on budgeted direct labor hours. The direct labor budget indicates that 7,500 direct labor hours will be required in July. The variable overhead rate is $4.20 per direct labor hour. The company's budgeted fixed manufacturing overhead is $95,000 per month, which includes depreciation of $8,200. All other fixed manufacturing overhead costs represent current cash flows. The July cash disbursements for manufacturing overhead on the manufacturing overhead budget should be _.arrow_forward

- Sycamore Corp. bases its manufacturing overhead budget on budgeted direct labor hours. The direct labor budget indicates that 7,500 direct labor hours will be required in July. The variable overhead rate is $4.20 per direct labor hour. The company's budgeted fixed manufacturing overhead is $95,000 per month, which includes depreciation of $8,200. All other fixed manufacturing overhead costs represent current cash flows. The July cash disbursements for manufacturing overhead on the manufacturing overhead budget should be _. Answerarrow_forwardCompute the net incremental cost or saving of buying the componentarrow_forwardDon't use ai given answer accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License