CASE 5A-12 Analysis of Mixed Costs in a Pricing Decision LO5-11

Maria Chavez owns a catering company that serves food and beverages at parties and business functions. Chavez’s business is seasonal, with a heavy schedule during the summer months and holidays and a lighter schedule at other times.

One of the major events Chavez’s customers request is a cocktail party. She offers a standard cocktail party and has estimated the cost per guest as follows:

Food and beverages.................................................$15.00

Labor (0.5 hrs. @ $10.00/hr.)…………………………………………………………………………………………………5.00

Total cost per guest………………………………………………………………………………………………………………$26.99

The standard cocktail party lasts three hours and Chavez hires one worker for every six guests, so that works out to one-half hour of labor per guest. These workers are hired only as needed and are paid only for the hours they actually work.

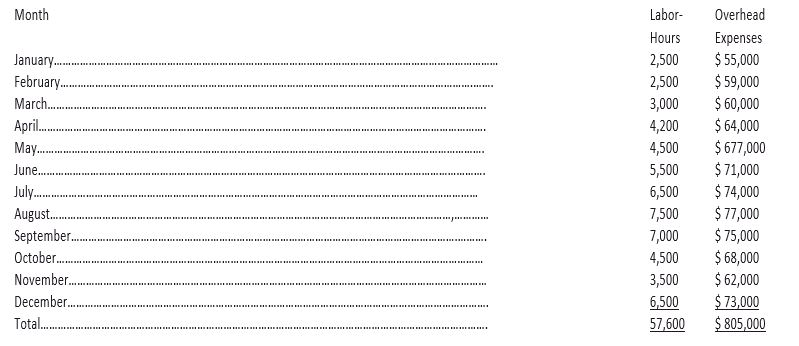

When bidding on cocktail parties. Chavez adds a 15% markup to yield a price of about $31 per guest. She is confident about her estimates of the costs of food and beverages and labor but is not as comfortable with the estimate of overhead cost. The $13.98 overhead cost per labor-hour was determined by dividing total overhead expenses for the last 12 months by total labor-hours for the same period. Monthly data concerning overhead costs and labor-hours follow:

Chavez has received a request to bid on a 180-guest fundraising cocktail party to be given next month by an important local charity. (The party would last the usual three hours.) She would like to win this contract because the guest list for this charity event includes many prominent individuals that she would like to secure as future clients. Maria is confident that these potential customers would be favorably impressed by her company’s services at the charity event.

Required:

- Prepare a scatter graph plot that puts labor-hours on the X-axis and overhead expenses on the Y-axis. What insights are revealed by your scattergraph?

- Use the least-squares regression method to estimate the fixed and variable components of overhead expenses. Express these estimates in the form Y=a+bX.

- If Chavez charges her usual price of $31 per guest for the 180-guest cocktail party, how much contribution margin will she earn by serving this event?

- How low could Chavez bid for the charity event in terms of a price per guest and still break even on the event itself?

- The individual who is organizing the charity’s fundraising event has indicated that he has already received a bid under $30 from another catering company. Do you think Chavez should bid below her normal $31 per guest price for the charity event? Why or why not?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

MANAGERIAL ACCT(LL)+CONNECT+PROCTORIO PL

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning