MANAGERIAL ACCT(LL)+CONNECT+PROCTORIO PL

17th Edition

ISBN: 9781265574826

Author: Garrison

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 21P

PROBLEM 5-21 Sales Mix; Multiproduct Break-Even Analysis LO5-9

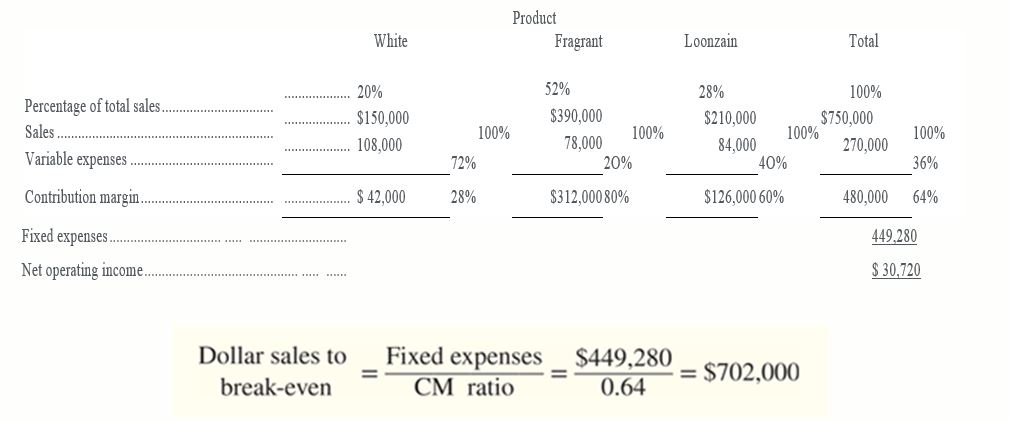

Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice—White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below:

As shown by these data, net operating income is budgeted at $30,720 for the month and the estimated break-even sales is $702,000.

Assume that actual sales for the month total $750,000 as planned. Actual sales by product are: White, $300,000: Fragrant, $180,000; and Loonzain, $270,000.

Required:

- Prepare a contribution format income statement for the month based on the actual sales data. Present the income statement in the format shown above.

- Compute the break-even point in dollar sales for the month based on your actual data.

- Considering the fact that the company met its $750,000 sales budget for the month, the president is shocked at the results shown on your income statement in (1) above. Prepare a brief memo for the president explaining why the net operating income (loss) and the break-even point in dollar sales are different from what was budgeted.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How much is hayes enterprises' break-evan point?

Please explain the correct approach for solving this general accounting question.

How can I solve this financial accounting problem using the appropriate financial process?

Chapter 5 Solutions

MANAGERIAL ACCT(LL)+CONNECT+PROCTORIO PL

Ch. 5.A - EXERCISE 5A-1 High-Low Method LO5-10 The Cheyenne...Ch. 5.A - EXERCISE 5A-2 Least-Squares Regression LO5-11...Ch. 5.A - EXERCISE 5A-3 Cost Behavior; High-Low Method...Ch. 5.A - Prob. 4ECh. 5.A - EXERCISE 5A-5 Least-Squares Regression LO5-11...Ch. 5.A - Prob. 6PCh. 5.A - Problem 5A-7 Cost Behavior; High-Low Method;...Ch. 5.A - Problem 5A-8 High-Low Method; Predicting Cost...Ch. 5.A - Prob. 9PCh. 5.A - Prob. 10P

Ch. 5.A - Case 5A-11 Mixed Cost Analysis and the Relevant...Ch. 5.A - CASE 5A-12 Analysis of Mixed Costs in a Pricing...Ch. 5 - Prob. 1QCh. 5 - Often the most direct route to a business decision...Ch. 5 - Prob. 3QCh. 5 - What is the meaning of operating leverage?Ch. 5 - What is the meaning of break-even point?Ch. 5 - 5-6 In response to a request from your immediate...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - Prob. 1AECh. 5 - Prob. 2AECh. 5 - Prob. 3AECh. 5 - Prob. 4AECh. 5 - Prob. 5AECh. 5 - Prob. 1F15Ch. 5 - Prob. 2F15Ch. 5 - Prob. 3F15Ch. 5 - Prob. 4F15Ch. 5 - Prob. 5F15Ch. 5 - Prob. 6F15Ch. 5 - Prob. 7F15Ch. 5 - Prob. 8F15Ch. 5 - Prob. 9F15Ch. 5 - Prob. 10F15Ch. 5 - Prob. 11F15Ch. 5 - Prob. 12F15Ch. 5 - Prob. 13F15Ch. 5 - Prob. 14F15Ch. 5 - Prob. 15F15Ch. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - EXERCISE 5-10 Multiproduct Break-Even Analysis...Ch. 5 - Prob. 11ECh. 5 - EXERCISE 5-12 Multiproduct Break-Even Analysis...Ch. 5 - EXERCISE 5-13 Changes in Selling Price, Sales...Ch. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Prob. 19PCh. 5 - PROBLEM 5-20 CVP Applications: Break-Even...Ch. 5 - PROBLEM 5-21 Sales Mix; Multiproduct Break-Even...Ch. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 -

PROBLEM 5-26 CVP Applications; Break-Even...Ch. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 -

PROBLEM 5-31 Interpretive Questions on the CVP...Ch. 5 - Prob. 32C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the total period cost for the month under variable costing?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardAlbert Crafts produces two types of handmade candles: Standard and Luxury. The Standard candle sells for $12 with variable costs of $8 per unit, while the Luxury candle sells for $25 with variable costs of $15 per unit. Albert Crafts maintains a sales mix ratio of 70% Standard and 30% Luxury candles. Monthly fixed costs total $42,000. How many total candles (of both types combined) must Albert Crafts sell to break even?helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY