Mathematics For Machine Technology

8th Edition

ISBN: 9781337798310

Author: Peterson, John.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

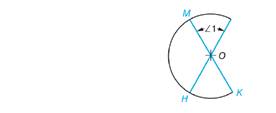

Chapter 56, Problem 14A

Solve the following exercises based on Principles 18 through 21, although an exercise may require the application oftwo or more of any of the principles. Where necessary, round linear answers in inches to 3 decimal places and millimeters to 2 decimal places. Round angular answers in decimal degrees to 2 decimal places and degrees and minutes to the nearest minute.

a. If∠1 = 63°, find

(1) HK

(2)HM

b. If∠1 = 59.47°, find

(1) DC

(1) HK

(2)HM

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Q4

3 Points

1

Let A =

2

3 7

5 11

Give one nontrivial solution X of the homogeneous system Ax = 0. (Your

vector x should have explicit numbers as its entries, as opposed to variables/parameters). Show

your work for how you found it.

Please select file(s) Select file(s)

Save Answer

4. Assume that a risk-free money market account is added to the market described in Q3.

The continuously compounded rate of return on the money market account is log (1.1).

(i) For each given μ, use Lagrange multipliers to determine the proportions (as a

function of μ) of wealth invested in the three assets available for the minimum

variance portfolio with expected return μ.

(ii) Determine the market portfolio in this market and calculate its Sharp ratio.

3. A market consists of two risky assets with rates of return R₁ and R2 and no risk-free

asset. From market data the following have been estimated: ER₁ = 0.25, ER2 = 0.05,

Var R₁ = 0.01, Var R2 = 0.04 and the correlation between R1 and R2 is p = -0.75.

(i) Given that an investor is targeting a total expected return of μ = 0.2. What

portfolio weights should they choose to meet this goal with minimum portfolio

variance? Correct all your calculations up to 4 decimal points.

(ii) Determine the global minimum-variance portfolio and the expected return and

variance of return of this portfolio (4 d.p.).

(iii) Sketch the minimum-variance frontier in the μ-σ² plane and indicate the efficient

frontier.

(iv) Without further calculation, explain how the minimum variance of the investor's

portfolio return will change if the two risky assets were independent.

Chapter 56 Solutions

Mathematics For Machine Technology

Ch. 56 - A pipe has an inside circumference of 82.50 mm and...Ch. 56 - Determine the length of AB, AC, and ED. Round the...Ch. 56 - Prob. 3ACh. 56 - What is the complement of a 7221'47" angle?Ch. 56 - Prob. 5ACh. 56 - Prob. 6ACh. 56 - Determine the unknown value for each of the...Ch. 56 - Determine the unknown value for each of the...Ch. 56 - Determine the unknown value for each of the...Ch. 56 - Determine the unknown value for each of the...

Ch. 56 - Determine the unknown value for each of the...Ch. 56 - Determine the unknown value for each of the...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Prob. 23ACh. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Prob. 29ACh. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...Ch. 56 - Solve the following exercises based on Principles...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Similar questions

- 2. A landlord is about to write a rental contract for a tenant which lasts T months. The landlord first decides the length T > 0 (need not be an integer) of the contract, the tenant then signs it and pays an initial handling fee of £100 before moving in. The landlord collects the total amount of rent erT at the end of the contract at a continuously compounded rate r> 0, but the contract stipulates that the tenant may leave before T, in which case the landlord only collects the total rent up until the tenant's departure time 7. Assume that 7 is exponentially distributed with rate > 0, λ‡r. (i) Calculate the expected total payment EW the landlord will receive in terms of T. (ii) Assume that the landlord has logarithmic utility U(w) = log(w - 100) and decides that the rental rate r should depend on the contract length T by r(T) = λ √T 1 For each given λ, what T (as a function of X) should the landlord choose so as to maximise their expected utility? Justify your answer. Hint. It might be…arrow_forwardPlease ensure that all parts of the question are answered thoroughly and clearly. Include a diagram to help explain answers. Make sure the explanation is easy to follow. Would appreciate work done written on paper. Thank you.arrow_forwardConsider the proof below: Proposition: If m is an even integer, then 5m +4 is an even integer. Proof: We see that |5m+4=10n+4 = 2(5n+2). Therefore, 5m+4 is an even integer. **Note: you may assume the proof is valid, just poorly written. Based upon the Section 1.3 screencast and the reading assignment, select all writing guidelines that are missing in the proof. Proof begins by stating assumptions ✓ Proof has an invitational tone/uses collective pronouns Proof is written in complete sentences Each step is justified ☐ Proof has a clear conclusionarrow_forward

- The general solution X'=Ax is given. Discuss the nature of the solutions in a neighborhood of (0,0) -2-2 (²) |a) A = (23) X(A) = (₁ (fi)e* + (2 (2) eht -2-5arrow_forwardPlease ensure that all parts of the question are answered thoroughly and clearly. Include a diagram to help explain answers. Make sure the explanation is easy to follow. Would appreciate work done written on paper. Thank you.arrow_forwardUsing the method of joints, determine the force in each member of the truss shown. Summarize the results on a force summation diagram, and indicate whether each member is in tension or compression. You may want to try the "quick" method hod.16 8m T or C CD CE AB EF BF гид B 6m i force in CE only (change top force to 8kn) 8 KN 8kNarrow_forward

- No chatgpt pls will upvotearrow_forwardPlease ensure that all parts of the question are answered thoroughly and clearly. Include a diagram to help explain answers. Make sure the explanation is easy to follow. Would appreciate work done written on paper. Thank you.arrow_forwardI just need help with f and garrow_forward

- Please ensure that all parts of the question are answered thoroughly and clearly. Include a diagram to help explain answers. Make sure the explanation is easy to follow. Would appreciate work done written on paper. Thank you.arrow_forwardYou are coming home hungry and look in your fridge. You find: 1 roll and 2 slices of bread, a jar ofpeanut butter, one single serve package each of mayo and mustard, a can of cheezewhiz, some slicedham, and some sliced turkey. How many different types of (edible) sandwiches can you make? Writedown any assumptions (order matters or not, repetitons allowed or not).arrow_forwardAlready got wrong chatgpt answer Plz don't use chatgpt answer will upvotearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Elementary Geometry For College Students, 7eGeometryISBN:9781337614085Author:Alexander, Daniel C.; Koeberlein, Geralyn M.Publisher:Cengage,

Elementary Geometry For College Students, 7eGeometryISBN:9781337614085Author:Alexander, Daniel C.; Koeberlein, Geralyn M.Publisher:Cengage, Elementary Geometry for College StudentsGeometryISBN:9781285195698Author:Daniel C. Alexander, Geralyn M. KoeberleinPublisher:Cengage Learning

Elementary Geometry for College StudentsGeometryISBN:9781285195698Author:Daniel C. Alexander, Geralyn M. KoeberleinPublisher:Cengage Learning Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,- Algebra & Trigonometry with Analytic GeometryAlgebraISBN:9781133382119Author:SwokowskiPublisher:Cengage

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning

Elementary Geometry For College Students, 7e

Geometry

ISBN:9781337614085

Author:Alexander, Daniel C.; Koeberlein, Geralyn M.

Publisher:Cengage,

Elementary Geometry for College Students

Geometry

ISBN:9781285195698

Author:Daniel C. Alexander, Geralyn M. Koeberlein

Publisher:Cengage Learning

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:9781133382119

Author:Swokowski

Publisher:Cengage

Trigonometry (MindTap Course List)

Trigonometry

ISBN:9781337278461

Author:Ron Larson

Publisher:Cengage Learning

Trigonometry (MindTap Course List)

Trigonometry

ISBN:9781305652224

Author:Charles P. McKeague, Mark D. Turner

Publisher:Cengage Learning

Orthogonality in Inner Product Spaces; Author: Study Force;https://www.youtube.com/watch?v=RzIx_rRo9m0;License: Standard YouTube License, CC-BY

Abstract Algebra: The definition of a Group; Author: Socratica;https://www.youtube.com/watch?v=QudbrUcVPxk;License: Standard Youtube License