Concept explainers

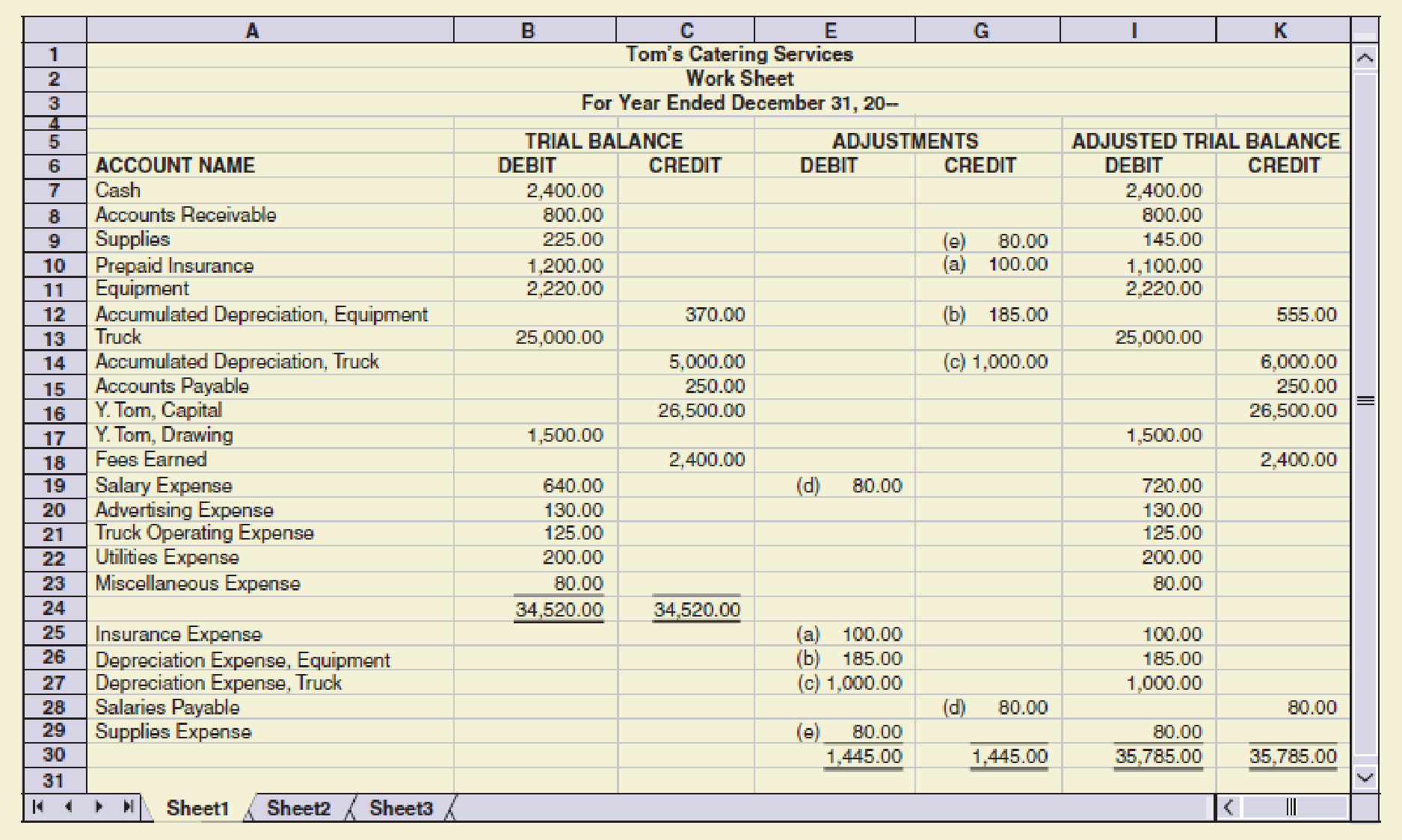

Tom’s Catering Services prepared the following work sheet for the year ended December 31, 20--.

Required

1. Complete the work sheet. (Skip this step if using QuickBooks or general ledger.)

2. Prepare an income statement.

3. Prepare a statement of owner’s equity; assume that there was an additional investment of $2,500 on December 1. (Skip this step if using QuickBooks. The additional investment assumption has already been completed in the data file.)

4. Prepare a

5. Journalize the closing entries with the four steps in the correct sequence.

6. Prepare a post-closing

Check Figure

Net income, $19,567

Trending nowThis is a popular solution!

Chapter 5 Solutions

College Accounting - With Quickbooks 2015 CD and Access

- Novelli's Nursery has developed the following data for lower of cost and net realizable valuation for its products: Selling Price Cost Broad leaf trees: Ash Beech Needle leaf trees: $ 1,800 $ 1,700 2,200 1,600 Cedar Fir $2,500 $1,750 3,600 3,350 Fruit trees: Apple $ 1,800 $1,400 Cherry 2,300 1,800 The costs to sell are 10% of selling price. Required: Determine the reported inventory value assuming the lower of cost and net realizable value rule is applied to individual trees.arrow_forwardFinancial accountingarrow_forwardFinancial Account - On March 1, 2019, Baltimore Company's beginning work in process inventory had 6,500 units. This is its only production department. Beginning WIP units were 50% complete's to conversion costs. Baltimore introduces direct materials at the beginning of the production process. During March, a total of 28,800 units were started and the ending WIP inventory had 7,800 units which were 30% complete's to conversion costs. Baltimore uses the weighted average method. Use this information to determine for March 2019 the equivalent units of production for conversion costs.arrow_forward

- I won't to this question answer general Accountingarrow_forwardNot use ai solution this question general Accountingarrow_forwardConsider the information below for Indigo Corporation for three recent fiscal years. Calculate the cost of goods sold for 2017. 2017 2016 2015 Inventory $ 5,49,239 $ 5,72,539 $3,36,727 Net sales 19,59,923 17,22,590 13,04,341 Cost of goods sold 15,44,780 12,80,357 9,45,022arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub