Concept explainers

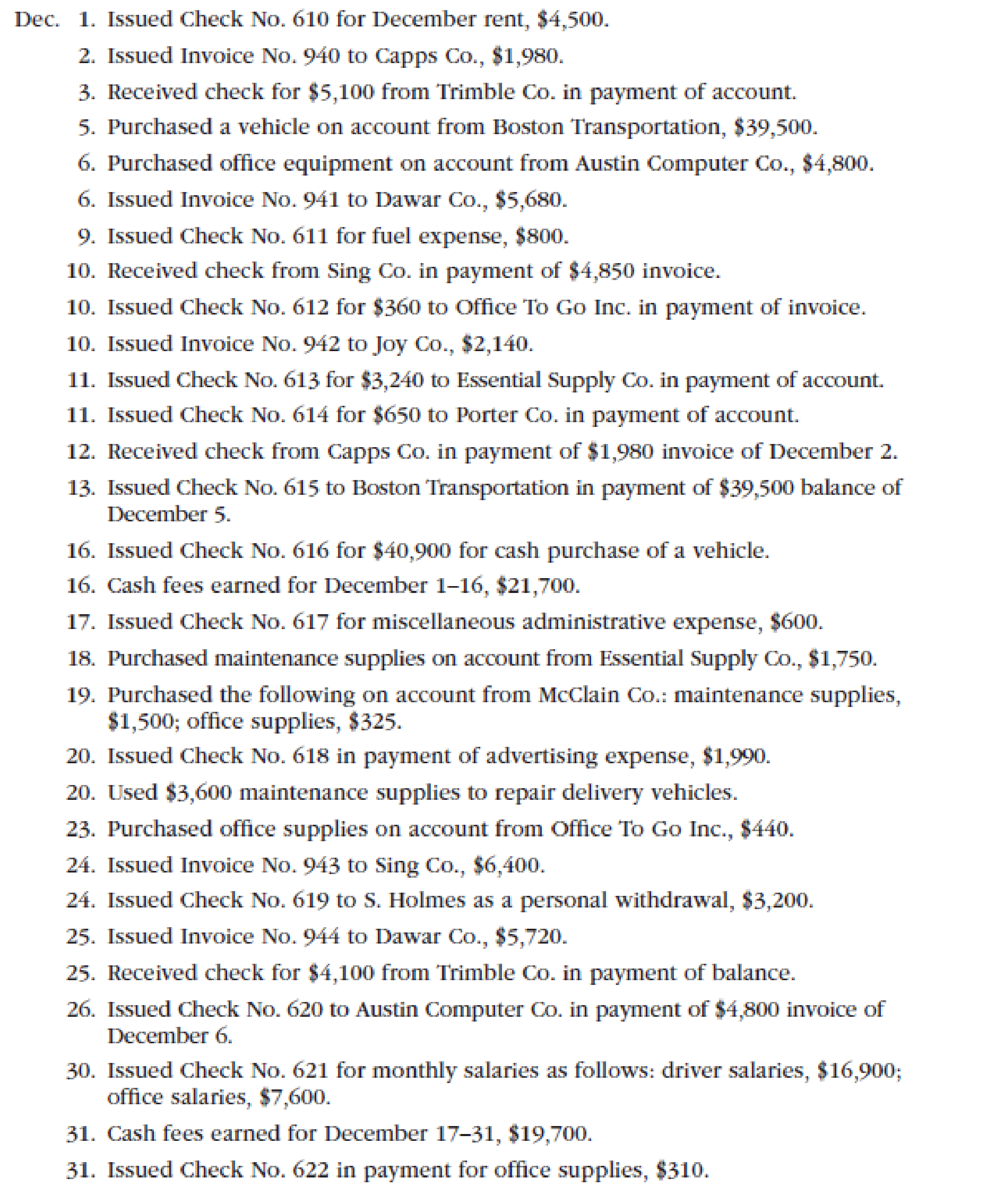

The transactions completed by Revere Courier Company during December 2016, the first month of the fiscal year, were as follows:

Instructions

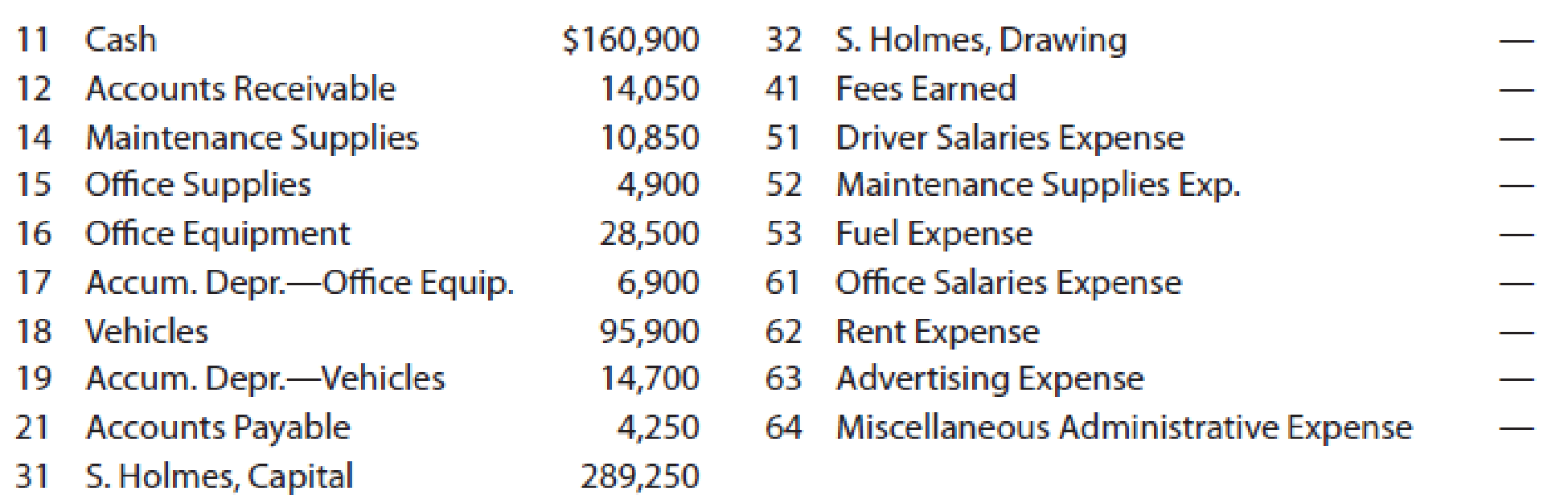

- 1. Enter the following account balances in the general ledger as of December 1:

- 2. Journalize the transactions for December 2016, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the

accounts receivable subsidiary ledger have been made. - 3. Post the appropriate individual entries to the general ledger.

- 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances.

- 5. Prepare a

trial balance .

1, 3 and 4.

Post account balances and individual entries to the appropriate general ledger accounts.

Explanation of Solution

General Ledger: General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Purchase journal: Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash receipts journal: Cash receipts journal refers to the journal that is used to record all transaction which involves the cash receipts. For example, the business received cash from rent.

Cash payments journal: Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

Revenue journal: Revenue journal refers to the journal that is used to record the fees earned on account. In the revenue journal, all revenue transactions are recorded only when the business performed service to customer on account (credit).

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

|

Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 1,60,900 | |||

| 31 | CR31 | 57,430 | 2,18,330 | ||||

| 31 | CP34 | 1,25,350 | 92,980 | ||||

Table (1)

|

Account: Accounts receivable | Account no. 12 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

|

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 14,050 | |||

| 31 | R35 | 21,920 | 35,970 | ||||

| 31 | CR31 | 16,030 | 19,940 | ||||

Table (2)

| Account: Maintenance Supplies | Account no. 14 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

|

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 10,850 | |||

| 20 | J1 | 3,600 | 7,250 | ||||

| 31 | P37 | 3,250 | 10,500 | ||||

Table (3)

| Account: Office Supplies | Account no. 15 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

|

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 4,900 | |||

| 31 | CP34 | 310 | 5,210 | ||||

| 31 | P37 | 765 | 5,975 | ||||

Table (4)

| Account: Office Equipment | Account no. 16 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

|

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 28,500 | |||

| 6 | P37 | 4,800 | 33,300 | ||||

Table (5)

|

Account: Accumulated Depreciation-Office Equip. | Account no. 17 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 6,900 | |||

Table (6)

| Account: Vehicles | Account no.18 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 95,900 | |||

| 5 | P37 | 39,500 | 1,35,400 | ||||

| 16 | CP34 | 40,900 | 1,76,300 | ||||

Table (7)

|

Account: Accumulated Depreciation -Vehicles

| Account no. 19 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 14,700 | |||

Table (8)

| Account: Accounts Payable | Account Number 21 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 4,250 | |||

| 31 | P37 | 48,315 | 52,565 | ||||

| 31 | CP34 | 48,550 | 4,015 | ||||

Table (9)

| Account: S. Holmes, Capital | Account Number 31 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 2,89,250 | |||

Table (10)

| Account: S. Holmes, Drawing | Account Number 32 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 24 | CP34 | 3,200 | 3,200 | |||

Table (11)

| Account: Fees Earned | Account Number 41 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 16 | CR31 | 21,700 | 21,700 | |||

| 31 | CR31 | 19,700 | 41,400 | ||||

| 31 | R35 | 21,920 | 63,320 | ||||

Table (12)

| Account: Driver Salaries Expense | Account Number 51 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 30 | CP34 | 16,900 | 16,900 | |||

Table (13)

| Account: Maintenance Supplies Exp. | Account Number 52 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 20 | J1 | 3,600 | 3,600 | |||

Table (14)

| Account: Fuel Expense | Account Number 53 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 9 | CP34 | 800 | 800 | |||

Table (15)

| Account: Office Salaries Expense | Account Number 61 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 30 | CP34 | 7,600 | 7,600 | |||

Table (16)

| Account: Rent Expense | Account Number 62 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 1 | CP34 | 4,500 | 4,500 | |||

Table (17)

| Account: Advertising Expense | Account Number 63 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 20 | CP34 | 1,990 | 1,990 | |||

Table (18)

|

Account: Miscellaneous Administrative Expense | Account Number 64 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit($) | Balance | ||

| Debit($) | Credit($) | ||||||

| 2016 | |||||||

| Dec. | 17 | CP34 | 600 | 600 | |||

Table (19)

2 and 4.

Prepare purchase journal, Cash receipts journal, single column revenue journal, cash payments journal and two column general journal

Explanation of Solution

Purchase journal

Purchase journal of Company RC in the month of December, 2016 is as follows:

Purchase Journal

Page 37

| Date | Account Credited | Post Ref. | Accounts Payable Cr. | Maintenance SuppliesDr. | Office Supplies Dr. | Other AccountsDr. | Post Ref. | Amount($) | |

| Dec. | 5 | B Transportation | ✓ | 39,500 | Vehicles | 18 | 39,500 | ||

| 6 | A Computer Co. | ✓ | 4,800 | Office Equipment | 16 | 4,800 | |||

| 18 | E Supply Co. | ✓ | 1,750 | 1,750 | |||||

| 19 | M Co. | ✓ | 1,825 | 1,500 | 325 | ||||

| 23 | O T G Inc. | ✓ | 440 | 440 | |||||

| 31 | 48,315 | 3,250 | 765 | 44,300 | |||||

| (21) | (14) | (15) | ✓ | ||||||

Table (20)

Cash Receipt Journal

Cash receipts journal of Company RC in the month of December, 2016 is as follows:

Cash Receipts Journal

Page 31

| Date | Account Credited | Post Ref. | Other AccountsCr. | Accounts Receivable Cr. | CashDr. | |

| Dec. | 3 | T Co. | ✓ | 5,100 | 5,100 | |

| 10 | S Co. | ✓ | 4,850 | 4,850 | ||

| 12 | C Co. | ✓ | 1,980 | 1,980 | ||

| 16 | Fees Earned | 41 | 21,700 | 21,700 | ||

| 25 | T Co. | ✓ | 4,100 | 4,100 | ||

| 31 | Fees Earned | 41 | 19,700 | 19,700 | ||

| 31 | 41,400 | 16,030 | 57,430 | |||

| ✓ | (12) | (11) | ||||

Table (21)

Revenue Journal

Revenue journal of Company RC in the month of December, 2016 is as follows:

Revenue Journal

Page 35

| Date | Invoice No. | Accounts Debited | Post Ref. | Accounts Receivable Dr.Fees Earned Cr. | |

| Dec. | 2 | 940 | C Co. | ✓ | 1,980 |

| 6 | 941 | D Co. | ✓ | 5,680 | |

| 10 | 942 | J Co. | ✓ | 2,140 | |

| 24 | 943 | S Co. | ✓ | 6,400 | |

| 25 | 944 | D Co. | ✓ | 5,720 | |

| 31 | 21,920 | ||||

| (12)(41) | |||||

Table (22)

Cash Payment Journal

Cash payment journal of Company RC in the month of December is as follows:

Cash payment journal

Page 34

| Date | Ck No. | Account Credited | Post Ref. | Other AccountsDr. | Accounts PayableDr. | CashCr. | |

| Dec. | 1 | 610 | Rent Expense | 62 | 4,500 | 4,500 | |

| 9 | 611 | Fuel Expense | 53 | 800 | 800 | ||

| 10 | 612 | O T G Inc. | ✓ | 360 | 360 | ||

| 11 | 613 | E Supply Co. | ✓ | 3,240 | 3,240 | ||

| 11 | 614 | Porter Co. | ✓ | 650 | 650 | ||

| 13 | 615 | B Transportation | ✓ | 39,500 | 39,500 | ||

| 16 | 616 | Vehicles | 18 | 40,900 | 40,900 | ||

| 17 | 617 | Misc. Admin. Expense | 64 | 600 | 600 | ||

| 20 | 618 | Advertising Expense | 63 | 1,990 | 1,990 | ||

| 24 | 619 | S. Holmes, Drawing | 32 | 3,200 | 3,200 | ||

| 26 | 620 | A Computer Co. | ✓ | 4,800 | 4,800 | ||

| 30 | 621 | Driver Salaries Exp. | 51 | 16,900 | 16,900 | ||

| Office Salaries Exp. | 61 | 7,600 | 7,600 | ||||

| 31 | 622 | Office Supplies | 15 | 310 | 310 | ||

| 31 | 76,800 | 48,550 | 1,25,350 | ||||

| ✓ | (21) | (11) | |||||

Table (23)

3.

Prepare two column general journal to record individual entry of RC Company.

Explanation of Solution

General journal

General journal of Company RC in the month of December is as follows:

| Journal | Page 1 | ||||

| Date | Description | Post Ref. |

Debit ($) |

Credit ($) | |

| 2016 | |||||

| Dec. | 20 | Maintenance Supplies Expenses | 52 | 3,600 | |

| Maintenance Supplies | 14 | 3,600 | |||

| (To record the use of maintenance supplies to repair delivery vehicles) | |||||

Table (24)

5.

Prepare unadjusted Trial balances of RC Company at December 31, 2016.

Explanation of Solution

Unadjusted Trial balances of RC Company at December 31, 2016 is presented below:

| REVERE COURIER COMPANY | |||

| Unadjusted Trial Balance | |||

| December 31, 2016 | |||

| Account No. |

Debit Balances ($) |

Credit Balances ($) | |

| Cash | 11 | 92,980 | |

| Accounts Receivable | 12 | 19,940 | |

| Maintenance Supplies | 14 | 10,500 | |

| Office Supplies | 15 | 5,975 | |

| Office Equipment | 16 | 33,300 | |

| Accumulated Depreciation—Office Equipment | 17 | 6,900 | |

| Vehicles | 18 | 1,76,300 | |

| Accumulated Depreciation—Vehicles | 19 | 14,700 | |

| Accounts Payable | 21 | 4,015 | |

| S. Holmes, Capital | 31 | 2,89,250 | |

| S. Holmes, Drawing | 32 | 3,200 | |

| Fees Earned | 41 | 63,320 | |

| Driver Salaries Expense | 51 | 16,900 | |

| Office Salaries Expense | 61 | 7,600 | |

| Maintenance Supplies Expense | 52 | 3,600 | |

| Fuel Expense | 53 | 800 | |

| Rent Expense | 62 | 4,500 | |

| Advertising Expense | 63 | 1,990 | |

| Miscellaneous Administrative Expense | 64 | 600 | |

| 3,78,185 | 3,78,185 | ||

Table (25)

This problem will help us to understand the process of recording of accounting transactions in journal and its further posting into respective ledgers. Additionally, it shows the process of reporting of different ledger balances in unadjusted Trial balance.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial Accounting

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub