Concept explainers

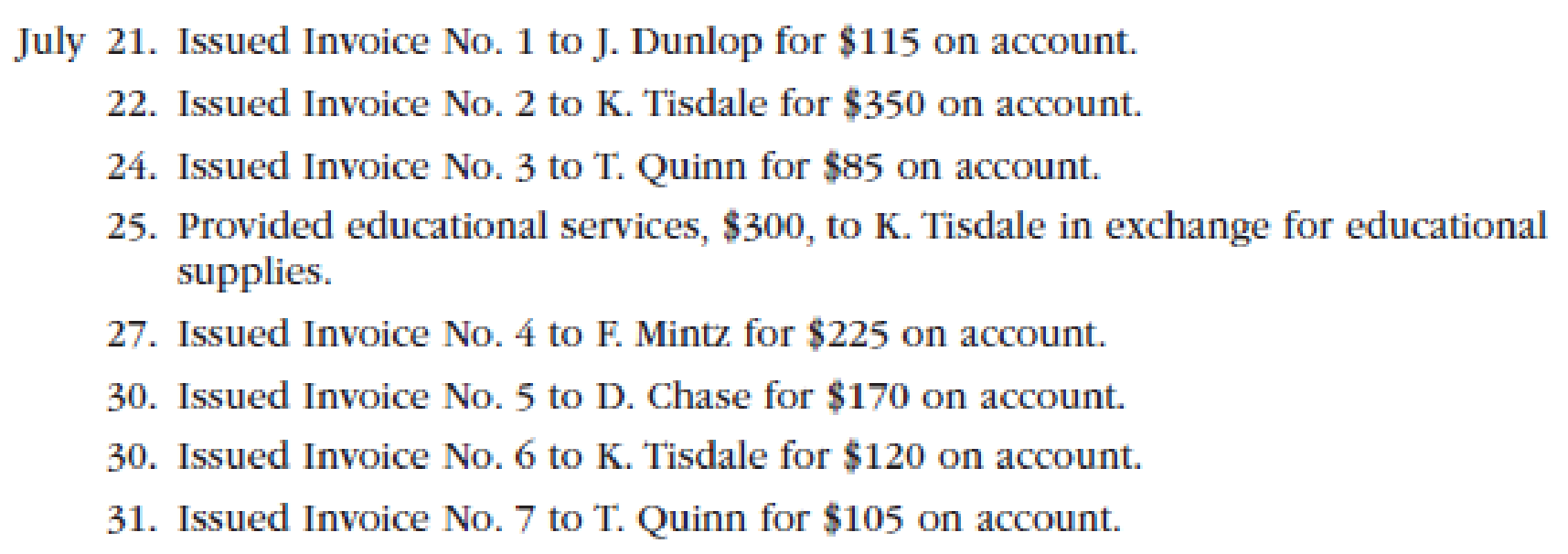

Sage Learning Centers was established on July 20, 2016, to provide educational services. The services provided during the remainder of the month are as follows:

Instructions

1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the

2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings:

3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31?

b. What is the balance of the accounts receivable controlling account at July 31?

4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?

(1) and (2)

Record the transactions in General journal, Revenue journal, Accounts Receivable subsidiary ledger, and General ledger.

Explanation of Solution

General Journal: The journal where the debit and credit entries of the accounting transactions are recorded in a chronological order are referred to as general journal.

Special Journal: Special journal records a single kind of transactions that occurs frequently. For example: Revenue Journal is a special journal which records all revenue earned on account.

General ledger: It is the primary ledger, which contains all balance sheet and income statement accounts. For example: Cash Account, Equipment Accounts, and Rent Accounts etc.

Subsidiary ledger: This is a ledger in which individual balance of every account is recorded. This is an expansion of the general ledger. The subsidiary ledger records the individual balances and hence there is no need to record the individual balances in the general ledger.

Controlling Account: Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. For example: Accounts Receivable Subsidiary ledger is represented in Accounts Receivable ledger.

The following table shows the revenue journal of SL Centers.

| Revenue Journal | |||||

| Date | Invoice No. | Accounts Debited | Post Ref. |

Accounts Receivable Dr. Fees Earned Cr. | |

| 2016 | |||||

| July | 21 | 1 | J D | ✓ | 115 |

| 22 | 2 | K T | ✓ | 350 | |

| 24 | 3 | T Q | ✓ | 85 | |

| 27 | 4 | F M | ✓ | 225 | |

| 30 | 5 | D C | ✓ | 170 | |

| 30 | 6 | K T | ✓ | 120 | |

| 31 | 7 | T Q | ✓ | 105 | |

| 31 | 1170 | ||||

| (12) (41) | |||||

Table (1)

The above transactions were transacted on account. Hence, they were posted in revenue journal.

The following table shows the general journal of SL Centers.

General Journal

| Date | Description | Post Ref. | Debit | Credit | |

| 2016 | |||||

| July | 25 | Supplies | 300 | ||

| Fees Earned | 300 | ||||

Table (2)

Supplies are assets for the business; it increases the assets of the business. So debit supplies. Fees earned are component of owners’ equity and it increases it. So credit fees earned.

Accounts Receivable Subsidiary Ledger

Name: D C

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| 2016 | |||||||

| July | 30 | R1 | 170 | 170 | |||

Table (3)

Name: F M

| Date | Items | Post Ref. | Debit | Credit | Balance | |||

| 2016 | ||||||||

| July | 27 | R1 | 225 | 225 | ||||

Table (4)

Name: J D

| Date | Items | Post Ref. | Debit | Credit | Balance | |||

| 2016 | ||||||||

| July | 21 | R1 | 115 | 115 | ||||

Table (5)

Name: K T

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| 2016 | |||||||

| July | 22 | 350 | 350 | ||||

| 30 | 120 | 470 | |||||

Table (6)

Name: T Q

| Date | Items | Post Ref. | Debit | Credit | Balance | |

| 2016 | ||||||

| July | 24 | 85 | 85 | |||

| 31 | 105 | 190 |

Table (7)

The above transactions were transacted on account. Hence they are posted in the account receivable subsidiary of D C, J D, F M, T Q, and K T.

General Ledger

Account: Account Receivable

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| July | 31 | R1 | 1,170 | 1,170 | |||

Table (8)

The general ledger records the summary of the subsidiary ledger accounts. So 1,170 from revenue journal are recorded in the general ledger.

Account: Supplies

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| July | 25 | J1 | 300 | 300 | |||

Table (9)

The general ledger records the summary of the subsidiary ledger accounts. So services provided for 300 to K T, in exchange of supplies are posted in supplies account.

Account: Fees Earned

| Date | Items | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 2016 | |||||||

| July | 25 | J1 | 300 | 300 | |||

| 31 | R1 | 1170 | 1170 | ||||

Table (10)

The general ledger records the summary of the subsidiary ledger accounts. So 300 from supplies account and 1,170 from revenue journal are recorded in the fees earned.

(3) a.

Determine the sum of the balances of the customer accounts in the subsidiary ledger at 31st July.

Answer to Problem 1PA

The sum of balances of customers’ accounts in subsidiary ledger accounts is shown in the following table.

| Customers Account | Amount |

| D C | 170 |

| F M | 225 |

| J D | 115 |

| K T | 470 |

| T Q | 190 |

| Total | 1170 |

Table (11)

Explanation of Solution

The sum of balances of customers’ accounts in subsidiary ledger accounts is calculated by adding the balances of customers’ accounts.

b.

Determine the balance of the accounts receivable controlling account.

Answer to Problem 1PA

The balance of the accounts receivable controlling account is 1,170.

Explanation of Solution

Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account. Since the balance of accounts receivable ledger is 1,170, so the balance of the accounts receivable controlling account is 1,170.

4.

Explain the benefits of the computerized system over the manual system.

Explanation of Solution

If SL Centers will start using computerized accounting system, then it can handle its accounting process more efficiently. Each sale transaction will record in electronic invoice form. The posting to accounts subsidiary ledgers as well as general ledgers will be automatic. There is no chance of double posting or clerical errors. Manual verification of controlling account with subsidiary ledger accounts is not required.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial Accounting

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardGolden Star Cafe had a 12% return on a $60,000 investment in new dining furniture. The investment resulted in increased sales and an increase in income that was 3% of the increase in sales. What was the increase in sales?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please provide the accurate solution to this financial accounting question using valid calculations.arrow_forwardPlease help me solve this financial accounting question using the right financial principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning