Concept explainers

Analyzing financial statement effects of accounting for uncollectible accounts using the percent of revenue allowance method

Grover Inc. uses the allowance method to account for uncollectible accounts expense. Grover Inc. experienced the following four accounting events in 2018:

1. Recognized $92,000 of revenue on account.

2. Collected $78,000 cash from

3. Wrote off uncollectible accounts of $720.

4. Recognized uncollectible accounts expense. Grover estimated that uncollectible accounts expense will be 1 percent of sales on account.

Required

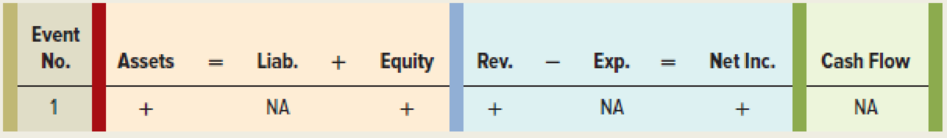

Show the effect of each event on the elements of the financial statements, using a horizontal statements model like the one shown here. Use + for increase, − for decrease, and NA for not affected. In the

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Survey Of Accounting

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardCan you explain the process for solving this General accounting question accurately?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning