Concept explainers

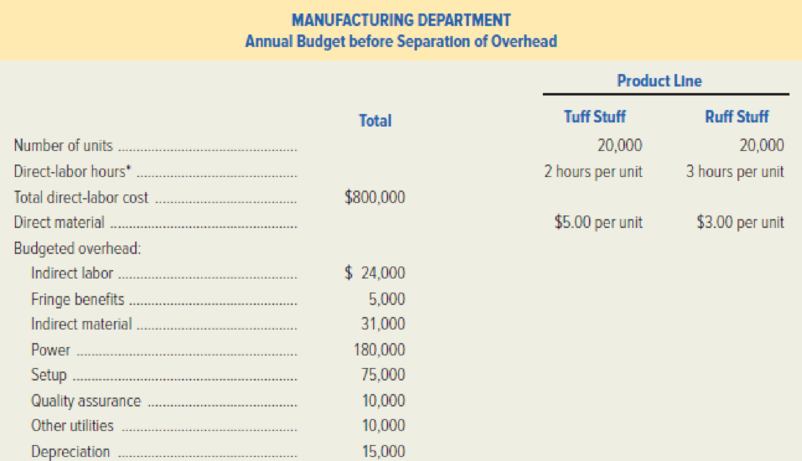

Marconi Manufacturing produces two items in its Trumbull Plant: Tuff Stuff and Ruff Stuff. Since inception, Marconi has used only one manufacturing-

The two major indirect

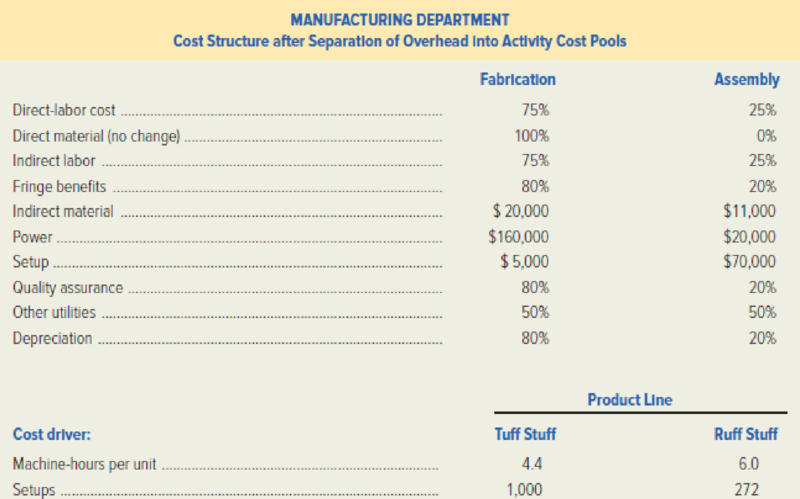

A decision was made to separate the Manufacturing Department costs into two activity cost pools as follows:

Fabrication: machine hours will be the cost driver.

Assembly: number of setups will be the cost driver.

The controller has gathered the following information.

*Direct-labor hourly rate is the same in both departments.

Required:

- 1. Assigning overhead based on direct-labor hours, calculate the following:

- a. Total budgeted cost of the Manufacturing Department.

- b. Unit cost of Tuff Stuff and Ruff Stuff.

- 2. After separation of overhead into activity cost pools, compute the total budgeted cost of each activity: Fabrication and Assembly.

- 3. Using activity-based costing, calculate the unit costs for each product. (In computing the pool rates for the Fabrication and Assembly activity cost pools, round to the nearest cent. Then, in computing unit product costs, round to the nearest cent.)

- 4. Discuss how a decision regarding the production and pricing of Ruff Stuff will be affected by the results of your calculations in the preceding requirements.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Assume that 5% of the L.L. Bean boots are returned by customers for various reasons. L. Bean has a 100% refund policy for returns, no matter what the reason. What would the journal entry be to accrue L.L. Bean's sales returns for this one pair of boots? (Note: L.L. Bean most likely will make monthly/quarterly adjusting entries for the total sales returns accruals, but here we will just look at the accrual associated with the sale of one pair of boots.)arrow_forwardWhat was the percentage rate of return on plan aasetsarrow_forwardQuestion 25arrow_forward

- Subject: Financial Accountingarrow_forwardNonearrow_forwardFor the current year ended March 31, Cosgrove Company expects fixed costs of $579,000, a unit variable cost of $68, and a unit selling price of $89. a. Compute the anticipated break-even sales (units). b. Compute the sales (units) required to realize an operating income of $134,000. (Round your answer to nearest units)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning