Concept explainers

Ontario, Inc. manufactures two products, Standard and Enhanced, and applies

Standard:

Estimated production volume, 3,000 units

Direct-material cost, $25 per unit

Direct labor per unit, 3 hours at $12 per hour

Enhanced:

Estimated production volume, 4,000 units

Direct-material cost, $40 per unit

Direct labor per unit, 4 hours at $12 per hour

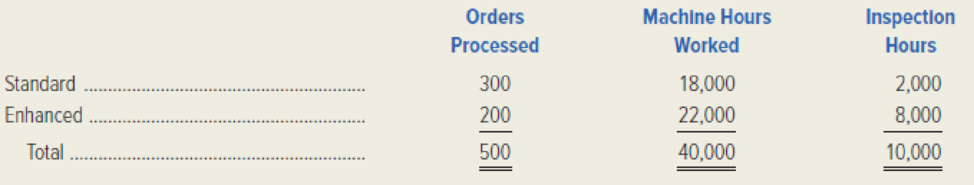

Ontario’s overhead of $800,000 can be identified with three major activities: order processing ($150,000), machine processing ($560,000), and product inspection ($90,000). These activities are driven by number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities follow.

Top management is very concerned about declining profitability despite a healthy increase in sales volume. The decrease in income is especially puzzling because the company recently undertook a massive plant renovation during which new, highly automated machinery was installed—machinery that was expected to produce significant operating efficiencies.

Required:

- 1. Assuming use of direct-labor hours to apply overhead to production, compute the unit

manufacturing costs of the Standard and Enhanced product if the expected manufacturing volume is attained. - 2. Assuming use of activity-based costing, compute the unit manufacturing costs of the Standard and Enhanced products it the expected manufacturing volume is attained.

- 3. Ontario’s selling prices are based heavily on cost.

a. By using direct-labor hours as an application base, which product is overcosted and which product is undercosted? Calculate the amount of the cost distortion for each product.

b. Is it possible that overcosting and undercosting (i.e., cost distortion) and the subsequent determination of selling prices are contributing to the company’s profit woes? Explain.

- 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements 1, 2. and 3(a) above. Show how the solution will change if the following data change: the overhead associated with order processing is $300,000 and the overhead associated with product inspection is $270,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Marketing: An Introduction (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- General Accountingarrow_forwardFinancial Accounting Questionarrow_forwardFlorida Kitchens produces high-end cooking ranges. The costs to manufacture and market the ranges at the company’s volume of 3,000 units per quarter are shown in the following table: Unit manufacturing costs Variable costs $ 1,440 Fixed overhead 720 Total unit manufacturing costs $ 2,160 Unit nonmanufacturing costs Variable 360 Fixed 840 Total unit nonmanufacturing costs 1,200 Total unit costs $ 3,360 The company has the capacity to produce 3,000 units per quarter and always operates at full capacity. The ranges sell for $4,000 per unit. Required: a. Florida Kitchens receives a proposal from an outside contractor, Burns Electric, who will manufacture 1,200 of the 3,000 ranges per quarter and ship them directly to Florida’s customers as orders are received from the sales office at Florida. Florida would provide the materials for the ranges, but Burns would assemble, box, and ship the ranges. The variable manufacturing costs would be…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,