Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.58P

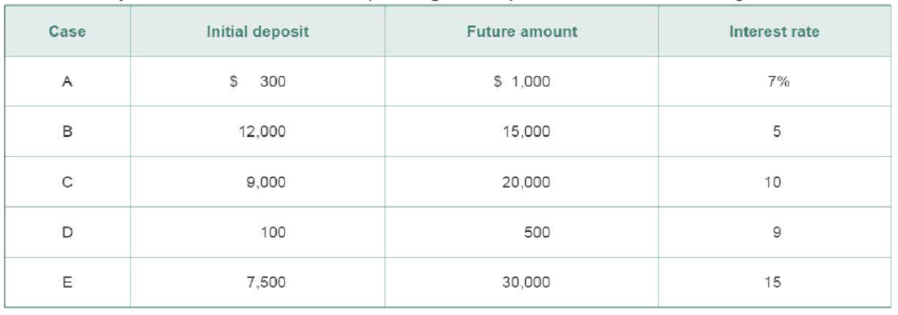

Number of years needed to acccumulate a future amount For each of the following cases, determine the number of years it will take for the initial deposit to grow to equal the future amount at the given interest rate.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

You are chairperson of the investment fund for the local closet. You are asked to set up a fund of semiannual payments to be compounded semiannually to accumulate a sum of $250,000 after nine years at a 10 percent annual rate (18 payments). The first payment into the fund is to take place six months from today, and the last payment is to take place at the end of the ninth year. Determine how much the semiannual payment should be. (a) On the day, after the sixth payment is made (the beginning of the fourth year), the interest rate goes up to a 12 percent annual rate, and you can earn a 12 percent annual rate on funds that have been accumulated as well as all future payments into the funds. Interest is to be compounded semiannually on all funds. Determine how much the revised semiannual payments should be after this rate change (there are 12 payments and compounding dates). The next payment will be in the middle of the fourth year.

If your Uncle borrows $60,000 from the bank at 10 percent interest over the seven-year life of the loan, what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest? How much of his first payment will be applied to interest? To principal? How much of his second payment will be applied to each?

Q1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…

Chapter 5 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 5.1 - What is the difference between future value and...Ch. 5.1 - Define and differentiate among the three basic...Ch. 5.2 - Prob. 5.3RQCh. 5.2 - Prob. 5.4RQCh. 5.2 - Prob. 5.5RQCh. 5.2 - Prob. 5.6RQCh. 5.2 - Prob. 5.7RQCh. 5.3 - What is the difference between an ordinary annuity...Ch. 5.3 - What are the most efficient ways to calculate the...Ch. 5.3 - How can the formula for the future value of an...

Ch. 5.3 - Prob. 5.13RQCh. 5.3 - What is a perpetuity? Why is the present value of...Ch. 5.4 - How do you calculate the future value of a mixed...Ch. 5.5 - What effect does compounding interest more...Ch. 5.5 - Prob. 5.21RQCh. 5.5 - Differentiate between a nominal annual rate and an...Ch. 5.6 - How can you determine the size of the equal,...Ch. 5.6 - Prob. 5.27RQCh. 5.6 - How can you determine the unknown number of...Ch. 5 - Learning Goals 2, 5 ST5-1 Future values for...Ch. 5 - Learning Goal 3 ST5-2 Future values of annuities...Ch. 5 - Prob. 5.3STPCh. 5 - Learning Goal 6 ST5-4 Deposits needed to...Ch. 5 - Assume that a firm makes a 2,500 deposit into a...Ch. 5 - Prob. 5.2WUECh. 5 - Prob. 5.3WUECh. 5 - Your firm has the option of making an investment...Ch. 5 - Joseph is a friend of yours. He has plenty of...Ch. 5 - Jack and Jill have just had their first child. If...Ch. 5 - Prob. 5.1PCh. 5 - Learning Goal 2 P5-2 Future value calculation...Ch. 5 - Prob. 5.4PCh. 5 - Prob. 5.5PCh. 5 - Learning Goal 2 P5- 6 Time value As part of your...Ch. 5 - Learning Goal 2 P5-7 Time value you can deposit...Ch. 5 - Learning Goal 2 P5-8 Time value Misty needs to...Ch. 5 - Learning Goal 2 P5- 9 Single-payment loan...Ch. 5 - Prob. 5.10PCh. 5 - Prob. 5.11PCh. 5 - Prob. 5.12PCh. 5 - Prob. 5.13PCh. 5 - Time value An Iowa state savings bond can be...Ch. 5 - Time value and discount rates You just won a...Ch. 5 - Prob. 5.16PCh. 5 - Cash flow investment decision Tom Alexander has an...Ch. 5 - Learning Goal 2 P5-18 Calculating deposit needed...Ch. 5 - Future value of an annuity for each case in the...Ch. 5 - Present value of an annuity Consider the following...Ch. 5 - Learning Goal 3 P5-21 Time value: Annuities Marian...Ch. 5 - Learning Goal 3 P5-22 Retirement planning Hal...Ch. 5 - Learning Goal 3 P5-23 Value of a retirement...Ch. 5 - Learning Goal 2, 3 P5-25 Value of an annuity...Ch. 5 - Prob. 5.26PCh. 5 - Prob. 5.30PCh. 5 - Learning Goal 4 P5-31 Value of a single amount...Ch. 5 - Value of mixed streams Find the present value of...Ch. 5 - Prob. 5.33PCh. 5 - Prob. 5.34PCh. 5 - Prob. 5.36PCh. 5 - Prob. 5.37PCh. 5 - Changing compounding frequency Using annual,...Ch. 5 - Prob. 5.39PCh. 5 - Prob. 5.40PCh. 5 - Compounding frequency and time value You plan to...Ch. 5 - Learning Goals 3, 5 P5-42 Annuities and...Ch. 5 - Prob. 5.43PCh. 5 - Prob. 5.44PCh. 5 - Prob. 5.45PCh. 5 - Prob. 5.46PCh. 5 - Prob. 5.47PCh. 5 - Loan amortization schedule Joan Messineo borrowed...Ch. 5 - Prob. 5.49PCh. 5 - Prob. 5.50PCh. 5 - Prob. 5.52PCh. 5 - Prob. 5.53PCh. 5 - Prob. 5.54PCh. 5 - Prob. 5.55PCh. 5 - Prob. 5.56PCh. 5 - Prob. 5.57PCh. 5 - Number of years needed to acccumulate a future...Ch. 5 - Prob. 5.59PCh. 5 - Prob. 5.60PCh. 5 - Time to repay Installment loan Mia Saito wishes to...

Additional Business Textbook Solutions

Find more solutions based on key concepts

A company has the opportunity to take over a redevelopment project in an industrial area of a city. No immediat...

Engineering Economy (17th Edition)

11-13. Discuss how your team is going to identify the existing competitors in your chosen market. Based on the ...

Business Essentials (12th Edition) (What's New in Intro to Business)

E8-13 Identifying internal controls

Learning Objective 1

Consider each situation separately. Identify the missi...

Horngren's Accounting (12th Edition)

Quick ratio and current ratio (Learning Objective 7) 1520 min. Consider the following data: COMPANY A B C D Cas...

Financial Accounting, Student Value Edition (5th Edition)

Communication Activity 9-1

In 150 words or fewer, explain the different methods that can be used to calculate d...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

How can a management accountant help formulate strategy?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forwardJerome Moore invests in a stock that will pay dividends of $2.00 at the end of the first year; $2.20 at the end of the second year; and $2.40 at the end of the third year. also, he believes that at the end of the third year he will be able to sell the stock for $33. what is the present value of all future benefits if a discount rate of 11 percent is applied?arrow_forward

- Q1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5.The required rate of return for NEWER stock is 14% compounded annually.What is NEWER’s stock price?The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8.The required rate of return for OLDER stock is 16% compounded annually.What is OLDER’s stock price?Now assume that both stocks have a required…arrow_forwardQ1: Blossom is 30 years old. She plans on retiring in 25 years, at the age of 55. She believes she will live until she is 105. In order to live comfortably, she needs a substantial retirement income. She wants to receive a weekly income of $5,000 during retirement. The payments will be made at the beginning of each week during her retirement. Also, Blossom has pledged to make an annual donation to her favorite charity during her retirement. The payments will be made at the end of each year. There will be a total of 50 annual payments to the charity. The first annual payment will be for $20,000. Blossom wants the annual payments to increase by 3% per year. The payments will end when she dies. In addition, she would like to establish a scholarship at Toronto Metropolitan University. The first payment would be $80,000 and would be made 3 years after she retires. Thereafter, the scholarship payments will be made every year. She wants the payments to continue after her death, therefore…arrow_forward

- True and False 1. There are no more than two separate phases to decision making and problem solving. 2. Every manager always has complete control over all inputs and factors. 3. Opportunity cost is only considered by accountants as a way to calculate profits 4. Standard error is always used to evaluate the overall strength of the regression model 5. The t-Stat is used in a similar way as the P-valued is used 6. The P-value is used as R-square is used. 7. R-square is used to evaluate the overall strength of the model. 8. Defining the problem is one of the last things that a manager considers Interpreting Regression Printouts (very brief answers) R² = .859 Intercept T N = 51 Coefficients 13.9 F= 306.5 Standard Error .139 SER=.1036 t Stat P value 99.8 0 .275 .0157 17.5 0 The above table examines the relationship between the nunber, of poor central city households in the U.S. and changes in the costs of college tuition from 1967 to 2019. 9. What is the direction of this relationship? 10.…arrow_forwardCARS Auto Co. Ltd – Alpha Branch Unadjusted Trial Balance December 31, 2024 A/C NAME TRIAL BALANCE DR CR cash 240,000 Accounts receivables 120,000 supplies 41,100 Lease hold improvement 200,000 Accumulated depreciation – Lease hold improvement 80,000 Furniture and fixtures 800,000 Accumulated depreciation - furniture and fixtures 380,000 Accounts payable 30,000 Salary payable Unearned service revenue 44,100 Cars, capital 649,000 Cars, withdrawal 165,100 Service revenue 450,000 Salary expense 48,400 Supplies expense Rent expense Depreciation expense – leasehold improvement Depreciation expense – furniture and fixtures Advertising expense 18,500 1,633,100 1,633,100 Data presented for the adjusting entries include the following: Rent expense of $160,000…arrow_forwardScenario: Jim played football for a famous club but, due to a long term injury and on medical advice, he retired from the game in January 2007. The club, grateful for Jim’s contribution to their success over the years, held a testimonial match in Jim’s honour. Jim received €150,000 from this testimonial match and he decided to open a shop selling sporting goods with the proceeds. On 1 May 2007, Jim opened a business bank account into which he paid the €150,000. In the first year of trading, he undertook the following transactions: 2 May 2007: Jim signed a five year lease on a shop in the town centre and paid €50,000 to cover the lease for the whole five years 3 May 2007: Jim paid shop fitters €10,000 for shelves and racking and for the electronic till in which to record sales. Jim expects these assets will also have a useful life of 5 years. He hired a part time assistant at a cost of €250 per month paid monthly by cheque from the business bank account. While his main business is to…arrow_forward

- Help with questions 7-24arrow_forwardCARS Auto Co. Ltd – Alpha Branch Unadjusted Trial Balance December 31, 2024 Data presented for the adjusting entries include the following: Rent expense of $160,000 paid for the year was debited to CARS withdrawal account because of an oversight on the part of the Data Entry Clerk and this remained unadjusted as at year end. The company paid $24,330 on account for a credit purchase made earlier in the year but this entry was not recorded at year end. Supplies on hand at year end, $1,100. Depreciation on Leasehold improvement, $20,000. Depreciation on Furniture and Fixtures, $80,000. Salaries owed but not yet paid, $64,450. Accrued service revenue, $65,420. $44,000 of the unearned service revenue has been earned. Requirements: Explain why adjusting entries are required. Prepare the adjusting journal entries at December 31st, 2024. Open the ledger accounts in T-account form with their unadjusted balances then post the adjusting entries to the affected accounts, then balance off each…arrow_forwardPlease help me answer 7-3 and 7 -4.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

5 Steps to Setting Achievable Financial Goals | Brian Tracy; Author: Brian Tracy;https://www.youtube.com/watch?v=aXDuLxEJqBo;License: Standard Youtube License