Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.32P

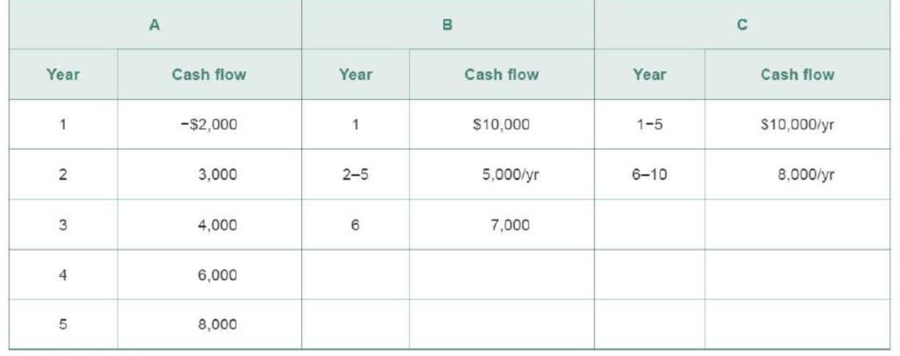

Value of mixed streams Find the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

find the balance after 7years if $55000 is invested at 6% p.a. compound annually

How does risk-adjusted return, such as the Sharpe Ratio, influence portfolio selection beyond just expected return?

Please provide a reference

How do investors determine an acceptable level of risk when building their portfolios? Is it purely based on financial goals, or are there specific models that guide these decisions?

Please provide a reference

Chapter 5 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 5.1 - What is the difference between future value and...Ch. 5.1 - Define and differentiate among the three basic...Ch. 5.2 - Prob. 5.3RQCh. 5.2 - Prob. 5.4RQCh. 5.2 - Prob. 5.5RQCh. 5.2 - Prob. 5.6RQCh. 5.2 - Prob. 5.7RQCh. 5.3 - What is the difference between an ordinary annuity...Ch. 5.3 - What are the most efficient ways to calculate the...Ch. 5.3 - How can the formula for the future value of an...

Ch. 5.3 - Prob. 5.13RQCh. 5.3 - What is a perpetuity? Why is the present value of...Ch. 5.4 - How do you calculate the future value of a mixed...Ch. 5.5 - What effect does compounding interest more...Ch. 5.5 - Prob. 5.21RQCh. 5.5 - Differentiate between a nominal annual rate and an...Ch. 5.6 - How can you determine the size of the equal,...Ch. 5.6 - Prob. 5.27RQCh. 5.6 - How can you determine the unknown number of...Ch. 5 - Learning Goals 2, 5 ST5-1 Future values for...Ch. 5 - Learning Goal 3 ST5-2 Future values of annuities...Ch. 5 - Prob. 5.3STPCh. 5 - Learning Goal 6 ST5-4 Deposits needed to...Ch. 5 - Assume that a firm makes a 2,500 deposit into a...Ch. 5 - Prob. 5.2WUECh. 5 - Prob. 5.3WUECh. 5 - Your firm has the option of making an investment...Ch. 5 - Joseph is a friend of yours. He has plenty of...Ch. 5 - Jack and Jill have just had their first child. If...Ch. 5 - Prob. 5.1PCh. 5 - Learning Goal 2 P5-2 Future value calculation...Ch. 5 - Prob. 5.4PCh. 5 - Prob. 5.5PCh. 5 - Learning Goal 2 P5- 6 Time value As part of your...Ch. 5 - Learning Goal 2 P5-7 Time value you can deposit...Ch. 5 - Learning Goal 2 P5-8 Time value Misty needs to...Ch. 5 - Learning Goal 2 P5- 9 Single-payment loan...Ch. 5 - Prob. 5.10PCh. 5 - Prob. 5.11PCh. 5 - Prob. 5.12PCh. 5 - Prob. 5.13PCh. 5 - Time value An Iowa state savings bond can be...Ch. 5 - Time value and discount rates You just won a...Ch. 5 - Prob. 5.16PCh. 5 - Cash flow investment decision Tom Alexander has an...Ch. 5 - Learning Goal 2 P5-18 Calculating deposit needed...Ch. 5 - Future value of an annuity for each case in the...Ch. 5 - Present value of an annuity Consider the following...Ch. 5 - Learning Goal 3 P5-21 Time value: Annuities Marian...Ch. 5 - Learning Goal 3 P5-22 Retirement planning Hal...Ch. 5 - Learning Goal 3 P5-23 Value of a retirement...Ch. 5 - Learning Goal 2, 3 P5-25 Value of an annuity...Ch. 5 - Prob. 5.26PCh. 5 - Prob. 5.30PCh. 5 - Learning Goal 4 P5-31 Value of a single amount...Ch. 5 - Value of mixed streams Find the present value of...Ch. 5 - Prob. 5.33PCh. 5 - Prob. 5.34PCh. 5 - Prob. 5.36PCh. 5 - Prob. 5.37PCh. 5 - Changing compounding frequency Using annual,...Ch. 5 - Prob. 5.39PCh. 5 - Prob. 5.40PCh. 5 - Compounding frequency and time value You plan to...Ch. 5 - Learning Goals 3, 5 P5-42 Annuities and...Ch. 5 - Prob. 5.43PCh. 5 - Prob. 5.44PCh. 5 - Prob. 5.45PCh. 5 - Prob. 5.46PCh. 5 - Prob. 5.47PCh. 5 - Loan amortization schedule Joan Messineo borrowed...Ch. 5 - Prob. 5.49PCh. 5 - Prob. 5.50PCh. 5 - Prob. 5.52PCh. 5 - Prob. 5.53PCh. 5 - Prob. 5.54PCh. 5 - Prob. 5.55PCh. 5 - Prob. 5.56PCh. 5 - Prob. 5.57PCh. 5 - Number of years needed to acccumulate a future...Ch. 5 - Prob. 5.59PCh. 5 - Prob. 5.60PCh. 5 - Time to repay Installment loan Mia Saito wishes to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your firm is considering an expansion of its operations into a nearby geographic area that the firm is currently not serving. This would require an up-front investment (startup cost) of $989,060.00, to be made immediately. Here are the forecasts that were prepared for this project, shown in the image. The long-term growth rate for cash flows after year 4 is expected to be 4.73%. The cost of capital appropriate for this project is 12.48%. What is the NPV, Profitability Index, IRR and payback in this case?arrow_forwardUse the binomial method to determine the value of an American Put option at time t = 0. The option expires at time t = T = 1/2 and has exercise price E = 55. The current value of the underlying is S(0) = 50 with the underlying paying continuous dividends at the rate D = 0.05. The interest rate is r = 0.3. Use a time step of St = 1/6. Consider the case of p = 1/2 and suppose the volatility is σ = 0.3. Perform all calculations using a minimum of 4 decimal places of accuracy. =arrow_forwardConsider a European chooser option with exercise price E₁ and expiry date T₁ where the relevant put and call options, which depend on the value of the same underlying asset S, have the same exercise price E2 and expiry date T₂. Determine, in terms of other elementary options, the value of the chooser option for the special case when T₁ = T2. Clearly define all notation that you use.arrow_forward

- The continuous conditional probability density function pc(S, t; S', t') for a risk neutral lognormal random walk is given by Pc(S, t; S', t') = 1 σS'√2π(t' - t) - (log(S/S) (ro²)(t − t)] exp 202 (t't) In the binomial method, the value of the underlying is Sm at time step môt and the value of the underlying at time step (m + 1)St is Sm+1. For this case evaluate Ec[(Sm+1)k|Sm] = [°° (S')*pc(S™, mdt; S', (m + 1)8t)dS' showing all steps, where k is a positive integer with k ≥ 1. You may assume that 1 e (x-n)2 2s2dx = 1 for all real numbers n and s with s > 0.arrow_forwardJohn and Jane Doe, a married couple filing jointly, have provided you with their financial information for the year, including details of federal income tax withheld. They need assistance in preparing their tax return. W-2 Income: John earns $150,000 with $35,000 withheld for federal income tax. Jane earns $85,000 with $15,500 withheld for federal income tax. Interest Income: They received $2500 in interest from a savings account, with no tax withheld. Child Tax Credit: They have two children under the age of 17. Mortgage Interest: Paid $28,000 in mortgage interest on their primary residence. Property Taxes: Paid $4,800 in property taxes on their primary residence. Charitable Donations: Donated $22,000 to qualifying charitable organizations. Other Deductions: They have no other deductions to claim. You will gather the appropriate information and complete the forms provided in Blackboard (1040, Schedule A, and Schedule B in preparation of their tax file.arrow_forwardOn the issue date, you bought a 20-year maturity, 5.85% semi-annual coupon bond. The bond then sold at YTM of 6.25%. Now, 5 years later, the similar bond sells at YTM of 5.25%. If you hold the bond now, what is your realized rate of return for the 5-year holding period?arrow_forward

- Bond Valuation with Semiannual Payments Renfro Rentals has issued bonds that have an 11% coupon rate, payable semiannually. The bonds mature in 17 years, have a face value of $1,000, and a yield to maturity of 9.5%. What is the price of the bonds? Round your answer to the nearest cent.arrow_forwardanalyze at least three financial banking products from both the liability side (like time deposits, fixed income, stocks, structure products, etc). You will need to examine aspects such as liquidity, risk, and profitability from a company and an individual point of view.arrow_forwardHow a does researcher ensure that consulting recommendations are data-driven? What does make it effective, and sustainable? Please help explain and give the example How does DMAC help researchers to improve their business processes? How to establish feedback loops for ongoing refinement. Please give the examplesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Economic Value Added EVA - ACCA APM Revision Lecture; Author: OpenTuition;https://www.youtube.com/watch?v=_3hpcMFHPIU;License: Standard Youtube License