Concept explainers

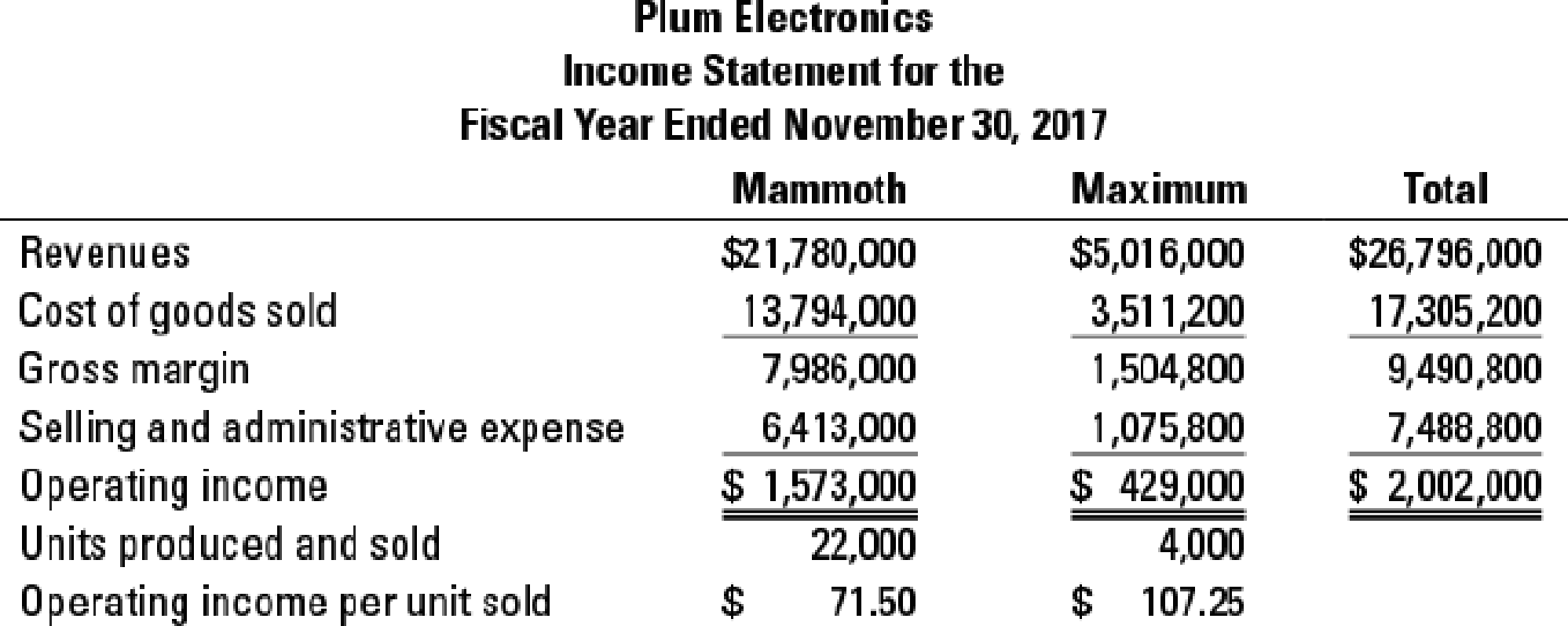

ABC, implementation, ethics. (CMA, adapted) Plum Electronics, a division of Berry Corporation, manufactures two large-screen television models: the Mammoth, which has been produced since 2013 and sells for $990, and the Maximum, a newer model introduced in early 2015 that sells for $1,254. Based on the following income statement for the year ended November 30, 2017, senior management at Berry have decided to concentrate Plum’s marketing resources on the Maximum model and to begin to phase out the Mammoth model because Maximum generates a much bigger operating income per unit.

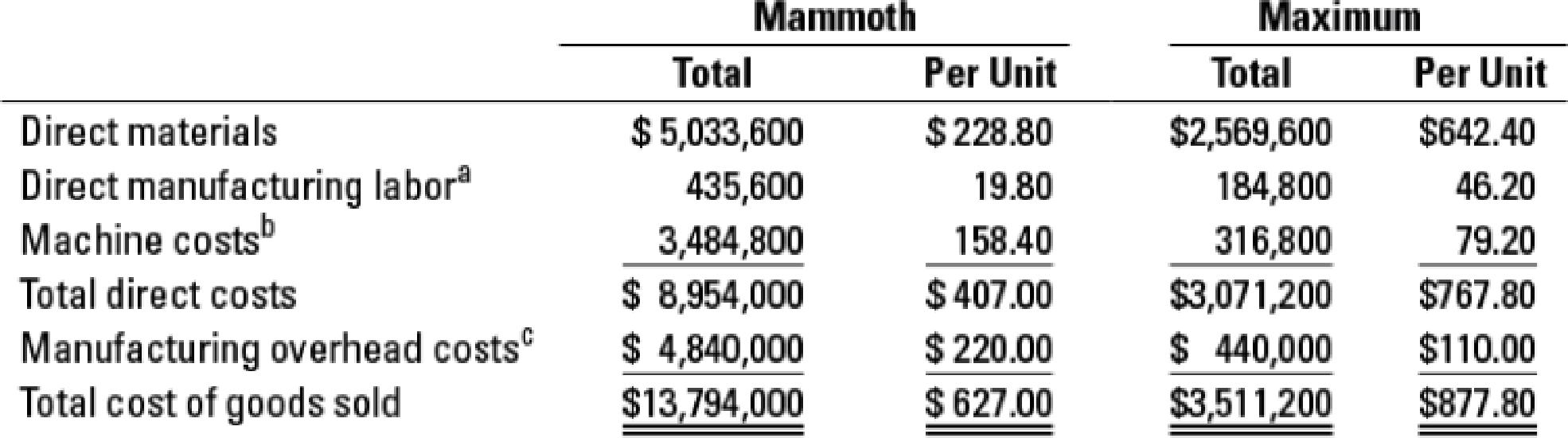

Details for cost of goods sold for Mammoth and Maximum are as follows:

a Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct

b Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.80 per hour.

c Manufacturing

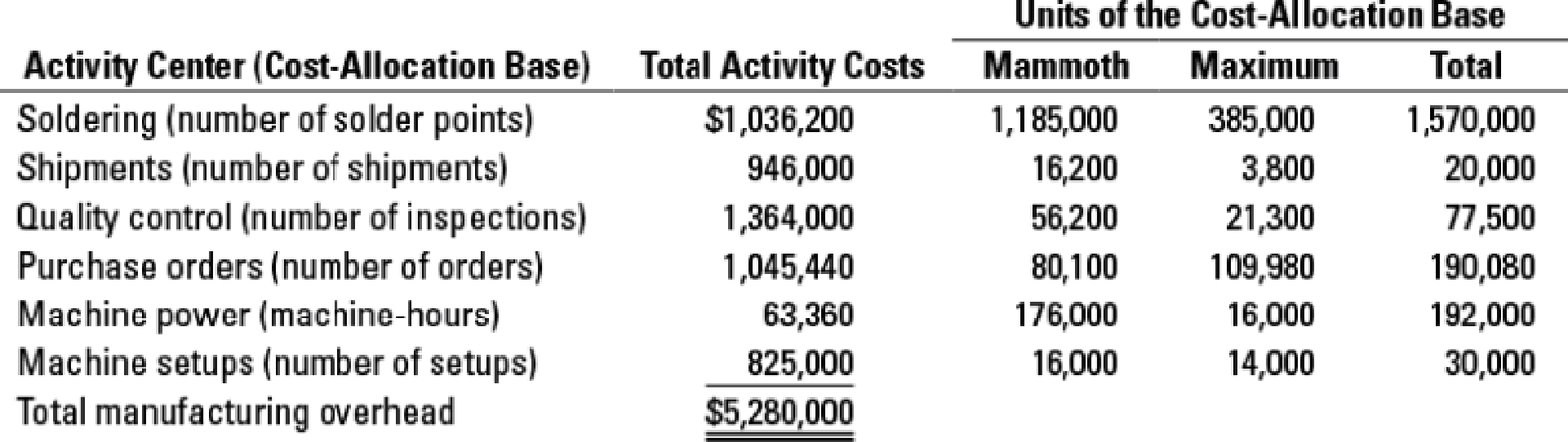

Plum’s controller, Steve Jacobs, is advocating the use of activity-based costing and activity-based management and has gathered the following information about the company’s manufacturing overhead costs for the year ended November 30, 2017.

After completing his analysis, Jacobs shows the results to Charles Clark, the Plum division president. Clark does not like what he sees. “If you show headquarters this analysis, they are going to ask us to phase out the Maximum line, which we have just introduced. This whole costing stuff has been a major problem for us. First Mammoth was not profitable and now Maximum.

“Looking at the ABC analysis, I see two problems. First, we do many more activities than the ones you have listed. If you had included all activities, maybe your conclusions would be different. Second, you used number of setups and number of inspections as allocation bases. The numbers would be different had you used setup-hours and inspection-hours instead. I know that measurement problems precluded you from using these other cost-allocation bases, but I believe you ought to make some adjustments to our current numbers to compensate for these issues. I know you can do better. We can’t afford to phase out either product.” Jacobs knows that his numbers are fairly accurate. As a quick check, he calculates the profitability of Maximum and Mammoth using more and different allocation bases. The set of activities and activity rates he had used results in numbers that closely approximate those based on more detailed analyses. He is confident that headquarters, knowing that Maximum was introduced only recently, will not ask Plum to phase it out. He is also aware that a sizable portion of Clark’s bonus is based on division revenues. Phasing out either product would adversely affect his bonus. Still, he feels some pressure from Clark to do something.

- 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models.

Required

- 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Plum’s existing simple costing system.

- 3. Comment on Clark’s concerns about the accuracy and limitations of ABC.

- 4. How might Plum find the ABC information helpful in managing its business?

- 5. What should Steve Jacobs do in response to Clark’s comments?

Trending nowThis is a popular solution!

Chapter 5 Solutions

COST ACCOUNTING

- The following items and amounts were taken from Sandhill Inc.'s 2025 income statement and balance sheet, the end of its first year of operations. Interest expense $2,100 Equipment, net $55,200 Interest payable 550 Depreciation expense 3,300 Notes payable 11,700 Supplies 4,300 Sales revenue 46,300 Common stock 24,800 Cash 2,400 Supplies expense 750 Salaries and wages expense 15,300 Prepare an income statement for Sandhill Inc. for December 31, 2025. Sandhill Inc. Income Statement S GA $ $arrow_forwardOrganization/Industry Rank Employer Survey Student Survey Career Service Director Survey Average Pay Deloitte & Touche/accounting 1 1 8 1 55 Ernst & Young/accounting 2 6 3 6 50 PricewaterhouseCoopers/accounting 3 22 5 2 50 KPMG/accounting 4 17 11 5 50 U.S. State Department/government 5 12 2 24 60 Goldman Sachs/investment banking 6 3 13 16 60 Teach for America/non-profit; government 7 24 6 7 35 Target/retail 8 19 18 3 45 JPMorgan/investment banking 9 13 12 17 60 IBM/technology 10 11 17 13 60 Accenture/consulting 11 5 38 15 60 General Mills/consumer products 12 3 33 28 60 Abbott Laboratories/health 13 2 44 36 55 Walt Disney/hospitality 14 60 1 8 40 Enterprise Rent-A-Car/transportation 15 28 51 4 35 General Electric/manufacturing 16 19 16 9 55 Phillip Morris/consumer products 17 8 50 19 55 Microsoft/technology 18 28 9 34 75 Prudential/insurance 19 9 55 37 50 Intel/technology 20 14 23 63 60 Aflac/insurance 21 9 55 62 50 Verizon…arrow_forwardIn 2012 XYZ Co. had sales of $74 billion and a net income of $23 billion, and its year-end total assets were $200 billion. The firm's total debt-to-total assets ratio was 45.3%. Based on the DuPont equation, what was XYZ Co.'s ROE in 2012? a) 22.97% b) 8.67% c) 25.62% d) 21.02% e) 14.01%arrow_forward

- Provide correct solution and accountingarrow_forwardCompute the company's degree of opereting leverage?arrow_forwardWhich feature distinguishes nominal accounts from real accounts in closing entries? Options: (i) Temporary nature requiring closure (ii) Balance sheet presentation (iii) Permanent balances carried forward (iv) Contra account status financial Accounting problemarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education