Concept explainers

First-stage allocation, time-driven activity-based costing, service sector. LawnCare USA provides lawn care and landscaping services to commercial clients. LawnCare USA uses activity-based costing to bid on jobs and to evaluate their profitability. LawnCare USA reports the following budgeted annual costs:

| Wages and salaries | $360,000 |

| 72,000 | |

| Supplies | 120,000 |

| Other |

288,000 |

| Total overhead costs | $840,000 |

John Gilroy, controller of LawnCare USA, has established four activity cost pools and the following budgeted activity for each cost pool:

| Activity Cost Pool | Activity Measure | Total Activity for the Year |

| Estimating jobs | Number of job estimates | 250 estimates |

| Lawn care | Number of direct labor-hours | 10,000 direct labor-hours |

| Landscape design | Number of design hours | 500 design hours |

| Other | Facility-sustaining costs that are not allocated to jobs | Not applicable |

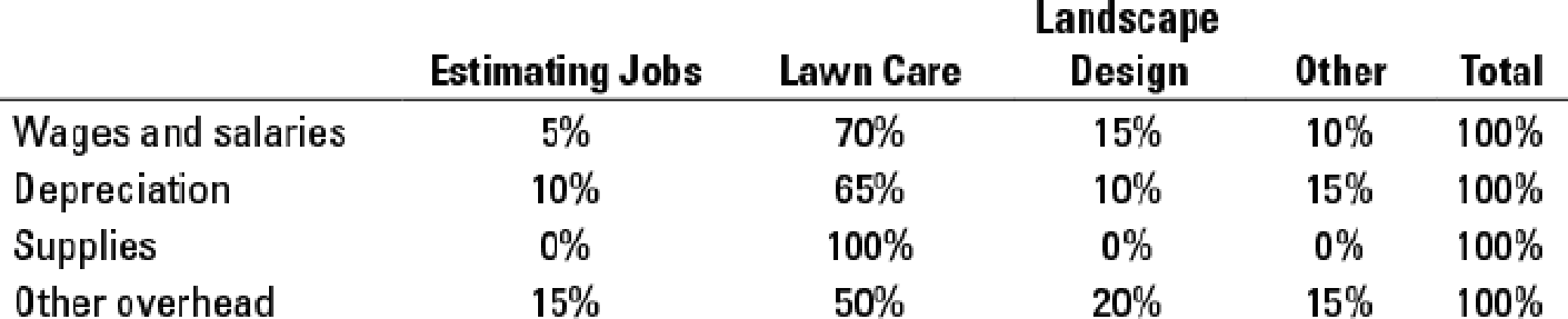

Gilroy estimates that LawnCare USA’s costs are distributed to the activity-cost pools as follows:

Sunset Office Park, a new development in a nearby community, has contacted LawnCare USA to provide an estimate on landscape design and annual lawn maintenance. The job is estimated to require a single landscape design requiring 40 design hours in total and 250 direct labor-hours annually. LawnCare USA has a policy of pricing estimates at 150% of cost.

- 1. Allocate LawnCare USA’s costs to the activity-cost pools and determine the activity rate for each pool.

Required

- 2. Estimate total cost for the Sunset Office Park job. How much would LawnCare USA bid to perform the job?

- 3. LawnCare USA does 30 landscape designs for its customers each year. Estimate the total cost for the Sunset Office park job if LawnCare USA allocated costs of the Landscape Design activity based on the number of landscape designs rather than the number of landscape design-hours. How much would LawnCare USA bid to perform the job? Which cost driver do you prefer for the Landscape Design activity? Why?

- 4. Sunset Office Park asks LawnCare USA to give an estimate for providing its services for a 2-year period. What are the advantages and disadvantages for LawnCare USA to provide a 2-year estimate?

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Construction Accounting And Financial Management (4th Edition)

Principles of Accounting Volume 2

Financial Accounting (11th Edition)

Financial Accounting, Student Value Edition (4th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (11th Edition)

- Varney Corporation, a manufacturer of electronics and communications systems, allocates Computing and Communications Services Department (CCS) costs to profit centers. The following table lists the types of services and cost drivers for each service. The table also includes the budgeted cost and quantity for each service for August. One of the profit centers for Varney Corporation is the Communication Systems (COMM) division. Assume the following information for COMM: COMM has 2,500 employees, of whom 20% are office employees. All of the office employees have been issued a smartphone, and 95% of them have a computer on the network. One hundred percent of the employees with a computer also have an email account. The average number of help desk calls for August was 0.6 call per individual with a computer. There are 400 additional printers, servers, and peripherals on the network beyond the personal computers. a. Compute the service allocation rate for each of CCSs services for August. b. Compute the allocation of CCSs services to COMM for August.arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardCharlies Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on). Production departments include Cutting and Assembly. The Janitorial and Security departments support the Cutting and Assembly departments. The Assembly Department spans about 46,400 square feet and holds assets valued at about 60,000. The Cutting Department spans about 33,600 square feet and holds assets valued at about 140,000. Charlies Wood Works allocates support department costs using the direct method. If costs from the Janitorial Department are allocated based on square feet and costs from the Security Department are allocated based on asset value, determine (a) the percentage of Janitorial costs that should be allocated to the Assembly Department and (b) the percentage of Security costs that should be allocated to the Cutting Department.arrow_forward

- Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forwardActivity-Based Costing Slack Corporation has the following predicted indirect costs and cost drivers for the year for the given activity cost pools: Maintenance Materials handling Machine setups Inspections Machine hours Material moves Machine setups Inspection hours Fabrication Department Finishing Department Cost Driver Machine hours Material moves Direct materials cost Direct labor cost Machine hours (Fabrication) Machine hours (Finishing) Materials moves Machine setups Inspection hours $150,000 The following activity predictions were also made for the year: Fabrication Department Finishing Department Direct materials Direct labor $50,000 30,000 70,000 It is assumed that the cost per unit of activity for a given activity does not vary between departments. Slack's president, Charles Slack, is trying to evaluate the company's product mix strategy regarding two of its five product models, ZX300 and SL500. The company has been using a company- wide overhead rate based on machine hours…arrow_forwardProduct Costing and Decision Analysis for a Service Company Pleasant Stay Medical Inc. wishes to determine its product costs. Pleasant Stay offers a variety of medical procedures (operations) that are considered its “products.” The overhead has been separated into three major activities. The annual estimated activity costs and activity bases follow: Activity Budgeted Activity Cost Activity Base Scheduling and admitting $432,000 Number of patients Housekeeping 4,212,000 Number of patient days Nursing 5,376,000 Weighted care unit Total costs $10,020,000 Total “patient days” are determined by multiplying the number of patients by the average length of stay in the hospital. A weighted care unit (wcu) is a measure of nursing effort used to care for patients. There were 192,000 weighted care units estimated for the year. In addition, Pleasant Stay estimated 6,000 patients and 27,000 patient days for the year. (The…arrow_forward

- Objective: Consider that you are an analyst at Regeneron Pharmaceuticals. You need to decide how to allocate administrative overhead costs to Regeneron's main commercial products (Eylea, Dupixent, Kevzara and Praluent). Determine how to appropriately allocate the costs in the table below to each of the commercial products using an allocation methodology of your choice. Department2019 Annual Operating ExpenseTime spent supporting Commercial productsCommercial$200MM100%IT$100MM25%Facilities$150MM0%Finance$25MM20%Human Resources$75MM10% Use the supporting document Net Product Sales of REGN Products to facilitate your analysis. Provide a written summary of how you allocated the overhead costs to each product in an outline of no more than one page. As a starting point, it's recommended that you revisit the material we covered in Chapter 12. Guidance on calculations:Start off with Net Product Sales of REGN Products. Your objective pertains to 2019 expenses, so you should be reviewing 2019…arrow_forwardSunshine Company sells custom made surf boards in California. The finance manager has supplied the following data from its activity-based costing system: Overhead Costs Staff Salaries $500,000 Selling and administration overheads 200,000 Total Overhead Costs $700,000 Activity Cost Pool Activity Measure Total Activity for the Year Product design Number of new designs 500 new designs Order Processing Number of Customer orders 700 orders Customer Support Number of Customers 400 customers Others Organization sustaining activity Not applicable Distribution of Resource Consumption across Activities Product Design Order Processing Customer Support Other Total Staff Salaries 40% 30% 20% 10% 100% Selling and administration overheads 30% 10% 20% 40% 100% During the year Sunshine Company completed three individual orders for a new customer, Tarpaper…arrow_forwardMiddler Corporation, a manufacturer of electronics and communications systems, allocates Computing and Communications Services (CCS) service department costs to profit centers. The following table lists service categories and cost drivers used by the CCS department. The table also includes cost and cost drivers for each service for October. CCS ServiceCategory Cost Driver Budgeted Cost Budgeted CostDriver Quantity Help desk Number of calls $110,250 2,500 Network center Number of devices monitored 619,500 8,850 Electronic mail Number of user accounts 47,600 5,950 Handheld technology support Number of handheld devices issued 106,240 8,300 One of the profit centers for Middler Corporation is the Communication Systems (COMM) sector. Assume the following information for the COMM sector: The sector has 2,000 employees, of whom 40% are office employees. Almost all office employees (70%) have a computer on the network. 90 percent of the employees with a computer…arrow_forward

- I need help with solving this practice problemarrow_forwardDhapaarrow_forwardMission Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the information provided below. (CMA adapted) Multiple Choice Units produced Material moves per product line Direct labor-hours per product line Budgeted material handling costs: $279,500 Under an activity-based costing (ABC) system, the materials handling costs allocated to one unit of Specialty Windows would be: $6,450.00. $2,170.68. $12,900.00. Wall Mirrors 220 5 1,100 $10,320.00. Specialty Windows 20 60 1,200arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning