Concept explainers

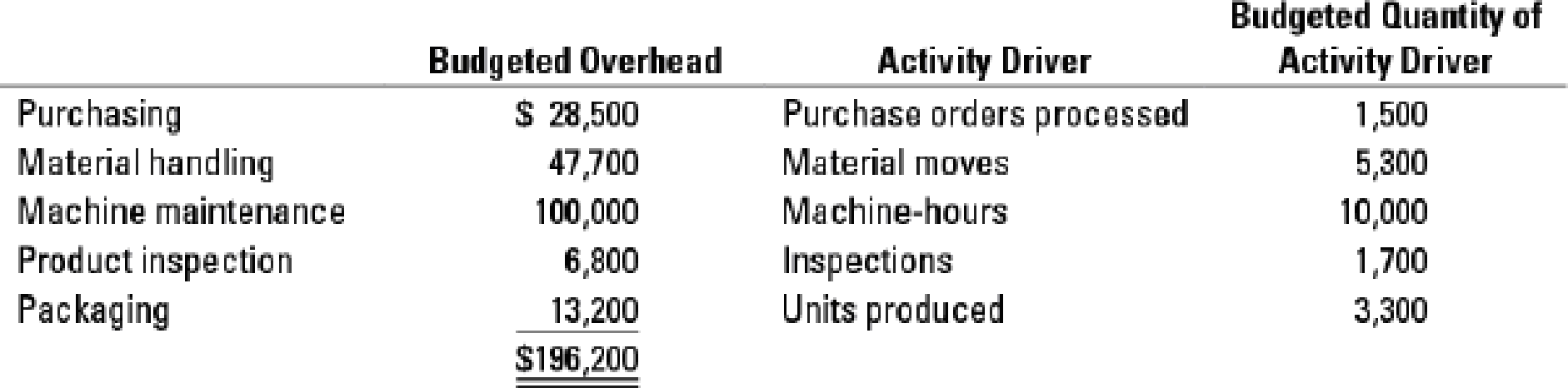

Activity-based costing. The

Information related to Job 220 and Job 330 follows. Job 220 incurs more batch-level costs because it uses more types of materials that need to be purchased, moved, and inspected relative to Job 330.

| Job 220 | Job 330 | |

| Number of purchase orders | 21 | 9 |

| Number of material moves | 18 | 6 |

| Machine-hours | 30 | 70 |

| Number of inspections | 10 | 2 |

| Units produced | 17 | 5 |

- 1. Compute the total overhead allocated to each job under a simple costing system, where overhead is allocated based on machine-hours.

Required

- 2. Compute the total overhead allocated to each job under an activity-based costing system using the appropriate activity drivers.

- 3. Explain why Melody’s Custom Framing might favor the ABC job-costing system over the simple job-costing system, especially in its bidding process.

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Additional Business Textbook Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Foundations Of Finance

Principles of Economics (MindTap Course List)

Macroeconomics

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- FGH Floral Company has a delivery truck that is being sold after 5 years of use. The current book value of the delivery truck is $6,000. If FGH Floral Company sells the delivery truck for $9,000, what is the impact of this transaction? Answerarrow_forwardFinancial Accounting Question please solvearrow_forwardY Company purchased an asset for $73,000 on January 1, Year 1. The asset was expected to have a four-year life and an $8,000 salvage value. What would be the amount of depreciation expense for Year 1 using double-declining balance? Answerarrow_forward

- Y Company purchased an asset for $73,000 on January 1, Year 1. The asset was expected to have a four-year life and an $8,000 salvage value. What would be the amount of depreciation expense for Year 1 using double-declining balance? Ansarrow_forwardFinancial Accountingarrow_forwardSnowbird Company is constructing a building that qualifies for interest capitalization. It is built between January 1 and December 31, Year 1. Snowbird made the following expenditures related to this building: April 1 $396,000July 1 400,000September 1 510,000December 1 120,000The company borrowed $500,000 at 12% to help finance the project. In addition, Snowbird had outstanding borrowings of $2 million at 8% and $1 million at 9%. Required: Compute the amount of interest capitalized related to the construction of the building. Next Level What effect does the interest capitalization have on the company’s financial statements after it completes the building?arrow_forward

- FGH Floral Company has a delivery truck that is being sold after 5 years of use. The current book value of the delivery truck is $6,000. If FGH Floral Company sells the delivery truck for $9,000, what is the impact of this transaction? Provide Answerarrow_forwardOn August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for Common Stock, $22,000. Purchased supplies on account, $1,190. Earned sales commissions, receiving cash, $18,260. Paid rent on office and equipment for the month, $4,020. Paid creditor on account, $440. Paid dividends, $1,080. Paid automobile expenses (including rental charge) for month, $1,110, and miscellaneous expenses, $750. Paid office salaries, $2,340. Determined that the cost of supplies used was $660.arrow_forwardWhat is the corporation's tax liability on these financial accounting question?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning