Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

16th Edition

ISBN: 9780134642468

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.27E

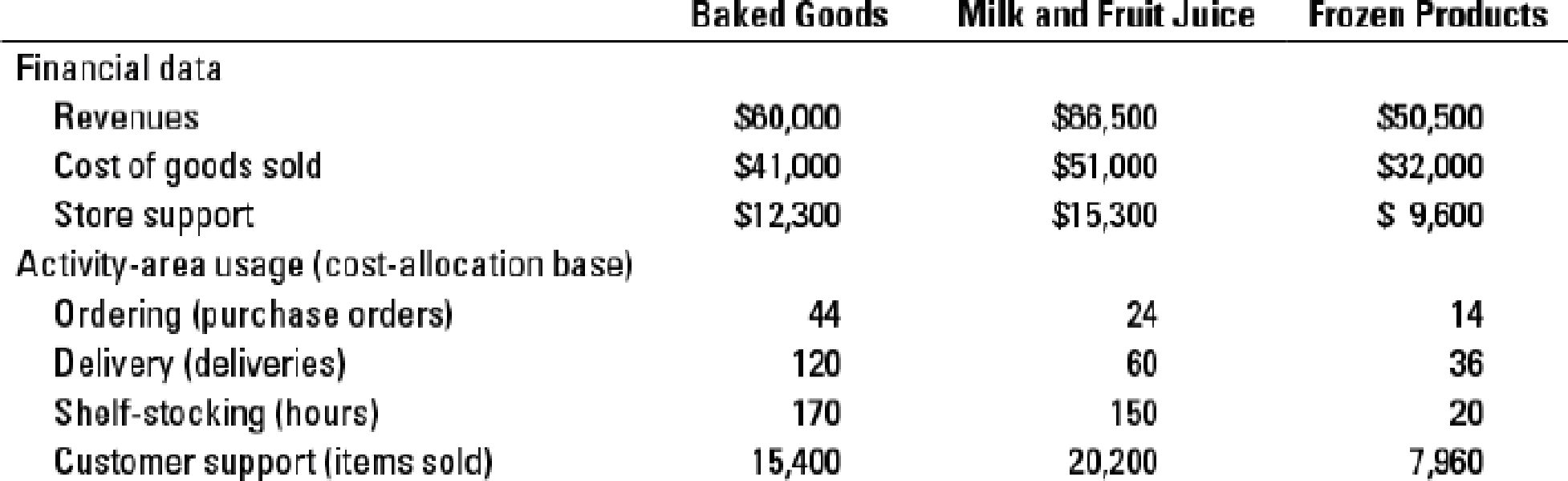

ABC, retail product-line profitability. Fitzgerald Supermarkets (FS) operates at capacity and decides to apply ABC analysis to three product lines: baked goods, milk and fruit juice, and frozen foods. It identifies four activities and their activity cost rates as follows:

| Ordering | $95 per purchase order |

| Delivery and receipt of merchandise | $76 per delivery |

| Shelf-stocking | $19 per hour |

| Customer support and assistance | $ 0.15 per item sold |

The revenues, cost of goods sold, store support costs, activities that account for the store support costs, and activity-area usage of the three product lines are as follows:

Under its simple costing system, FS allocated support costs to products at the rate of 30% of cost of goods sold.

- 1. Use the simple costing system to prepare a product-line profitability report for FS.

Required

- 2. Use the ABC system to prepare a product-line profitability report for FS.

- 3. What new insights does the ABC system in requirement 2 provide to FS managers?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Subject:--- financial accounting

Hi ticher given true answer general accounting

Hello tutor please help me this problem

Chapter 5 Solutions

Horngren's Cost Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText - Access Card Package (16th Edition)

Ch. 5 - What is broad averaging, and what consequences can...Ch. 5 - Why should managers worry about product...Ch. 5 - What is costing system refinement? Describe three...Ch. 5 - What is an activity-based approach to designing a...Ch. 5 - Describe four levels of a cost hierarchy.Ch. 5 - Why is it important to classify costs into a cost...Ch. 5 - What are the key reasons for product cost...Ch. 5 - Prob. 5.8QCh. 5 - Department indirect-cost rates are never...Ch. 5 - Prob. 5.10Q

Ch. 5 - Prob. 5.11QCh. 5 - Prob. 5.12QCh. 5 - Activity-based costing is the wave of the present...Ch. 5 - Increasing the number of indirect-cost pools is...Ch. 5 - The controller of a retail company has just had a...Ch. 5 - Conroe Company is reviewing the data provided by...Ch. 5 - Prob. 5.17MCQCh. 5 - Cost hierarchy. Roberta, Inc., manufactures...Ch. 5 - ABC, cost hierarchy, service. (CMA, adapted)...Ch. 5 - Alternative allocation bases for a professional...Ch. 5 - Plant-wide, department, and ABC Indirect cost...Ch. 5 - Plant-wide, department, and activity-cost rates....Ch. 5 - ABC, process costing. Sander Company produces...Ch. 5 - Department costing, service company. DLN is an...Ch. 5 - Activity-based costing, service company....Ch. 5 - Activity-based costing, manufacturing. Decorative...Ch. 5 - ABC, retail product-line profitability. Fitzgerald...Ch. 5 - Prob. 5.28ECh. 5 - Activity-based costing. The job-costing system at...Ch. 5 - ABC, product costing at banks,...Ch. 5 - Problems 5-31 Job costing with single direct-cost...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - Department and activity-cost rates, service...Ch. 5 - Activity-based costing, merchandising. Pharmahelp,...Ch. 5 - Choosing cost drivers, activity-based costing,...Ch. 5 - ABC, health care. Crosstown Health Center runs two...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - ABC, implementation, ethics. (CMA, adapted) Plum...Ch. 5 - Activity-based costing, activity-based management,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License