MANAGERIAL ACCOUNTING (PRINT UPGRADE)

12th Edition

ISBN: 9781264119547

Author: HILTON

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 49P

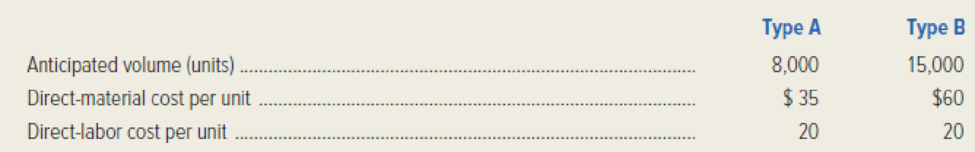

Maxey & Sons manufactures two types of storage cabinets—Type A and Type B—and applies manufacturing

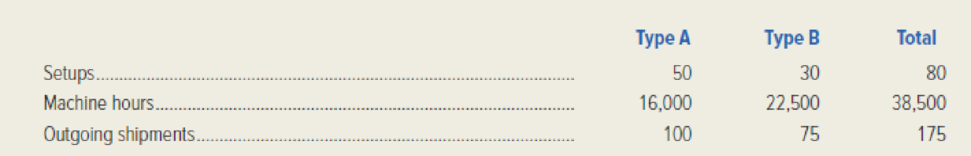

The controller, who is studying the use of activity-based costing, has determined that the firm’s overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities’ three respective cost drivers, follow.

The firm’s total overhead of $3,080,000 is subdivided as follows: manufacturing setups, $672,000; machine processing. $1,848,000: and product shipping, $560,000.

Required:

- 1. Compute the unit

manufacturing cost of Type A and Type B storage cabinets by using the company’s current overhead costing procedures. - 2. Compute the unit manufacturing cost of Type A and Type B storage cabinets by using activity-based costing.

- 3. Is the cost of the Type A storage cabinet overstated or understated (i.e., distorted) by the use of machine hours to allocate total manufacturing overhead to production? By how much?

- 4. Assume that the current selling price of a Type A storage cabinet is $260 and the marketing manager is contemplating a $30 discount to stimulate volume. Is this discount advisable? Briefly discuss.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What are the company's fixed expenses?

Bloom Enterprises has fixed costs of $825,400. The selling price per unit is $210, and the variable cost per unit is $120. How many units must the company sell in order to earn a profit of $190,000?

Can you please answer this financial accounting question?

Chapter 5 Solutions

MANAGERIAL ACCOUNTING (PRINT UPGRADE)

Ch. 5 - Briefly explain how a traditional, volume-based...Ch. 5 - Prob. 2RQCh. 5 - Explain how an activity-based costing system...Ch. 5 - What are cost drivers? What is their role in an...Ch. 5 - List and briefly describe the four broad...Ch. 5 - How can an activity-based costing system alleviate...Ch. 5 - Prob. 7RQCh. 5 - How is the distinction between direct and indirect...Ch. 5 - Explain the concept of a pool rate in...Ch. 5 - Briefly explain two factors that tend to result in...

Ch. 5 - List three factors that are important in selecting...Ch. 5 - Prob. 12RQCh. 5 - Explain why a new product-costing system may be...Ch. 5 - Prob. 14RQCh. 5 - Are activity-based costing systems appropriate for...Ch. 5 - Explain why maintaining their medical-services...Ch. 5 - How could the administration at Immunity Medical...Ch. 5 - Prob. 18RQCh. 5 - Prob. 19RQCh. 5 - What is meant by the term activity analysis? Give...Ch. 5 - Prob. 21RQCh. 5 - What is meant by customer-profitability analysis?...Ch. 5 - Explain the relationship between customer profit...Ch. 5 - What is a customer profitability profile?Ch. 5 - Describe the use of practical capacity in a TDABC...Ch. 5 - Tioga Company manufactures sophisticated lenses...Ch. 5 - Urban Elite Cosmetics has used a traditional cost...Ch. 5 - Kentaro Corporation manufactures Digital Video...Ch. 5 - Kentaro Corporation manufactures Digital Video...Ch. 5 - Prob. 31ECh. 5 - Refer to the description given for Wheelco, Inc....Ch. 5 - Prob. 33ECh. 5 - United Technologies Corporation implemented...Ch. 5 - Redwood Company sells craft kits and supplies to...Ch. 5 - Non-value-added costs occur in nonmanufacturing...Ch. 5 - Since you have always wanted to be an...Ch. 5 - Prob. 39ECh. 5 - Prob. 42ECh. 5 - Prob. 44ECh. 5 - Borealis Manufacturing has just completed a major...Ch. 5 - Ontario, Inc. manufactures two products, Standard...Ch. 5 - Kitchen Kings Toledo plant manufactures three...Ch. 5 - Prob. 48PCh. 5 - Maxey Sons manufactures two types of storage...Ch. 5 - Prob. 50PCh. 5 - John Patrick has recently been hired as controller...Ch. 5 - The controller for Tulsa Medical Supply Company...Ch. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Prob. 55PCh. 5 - World Gourmet Coffee Company (WGCC) is a...Ch. 5 - Knickknack, Inc. manufactures two products: Odds...Ch. 5 - Prob. 58PCh. 5 - Marconi Manufacturing produces two items in its...Ch. 5 - Gigabyte, Inc. manufactures three products for the...Ch. 5 - Refer to the new target prices for Gigabytes three...Ch. 5 - Prob. 62PCh. 5 - Prob. 63PCh. 5 - Midwest Home Furnishings Corporation (MHFC)...Ch. 5 - Fresno Fiber Optics, Inc. manufactures fiber optic...Ch. 5 - Refer to the information given in the preceding...Ch. 5 - Whitestone Company produces two subassemblies,...Ch. 5 - Morelli Electric Motor Corporation manufactures...Ch. 5 - Refer to the product costs developed in...Ch. 5 - Morelli Electric Motor Corporations controller,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this financial accounting questionarrow_forwardCreston Alloy Works manufactures a single product that sells for $90 per unit. Variable costs are $58 per unit, and fixed costs total $135,000 per month. Calculate the operating income if the selling price is raised to $94 per unit, advertising expenditures are increased by $18,000 per month, and monthly unit sales volume becomes 5,500 units.answer thisarrow_forwardWhat would be the amount debited to the work in process inventory on these general accounting question?arrow_forward

- Thompson Corporation has a discontinued operation gain of $45,000 and a 28% tax rate. What is the effect on net income? a. Increase of $32,400 b. Increase of $45,000 c. Increase of $12,600 d. No effectarrow_forwardAccurate Answerarrow_forwardSolve this general accounting question not use aiarrow_forward

- At the beginning of its current fiscal year, Willie Corp.'s balance sheet showed assets of $14,800 and liabilities of $5,100. During the year liabilities decreased by $1,500. Net income for the year was $2,600, and net assets at the end of the year were $10,200. There were no changes in paid-in capital during the Calculate the dividends, if any, declared during the year. year.arrow_forwardPlease provide answer this general accounting questionarrow_forwardGive this question general accounting answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License