Horngren's Financial & Managerial Accounting, The Managerial Chapters Plus MyLab Accounting with Pearson eText - Access Card Package (6th Edition)

6th Edition

ISBN: 9780134674674

Author: MILLER-NOBLES

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 3QC

The

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hi expert please help me

help me to solve this questions

here are the requirements, and the formatting of the closing journal entry. I have done everything i just need to do the closing journal, please ensure its done correctly

Chapter 5 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters Plus MyLab Accounting with Pearson eText - Access Card Package (6th Edition)

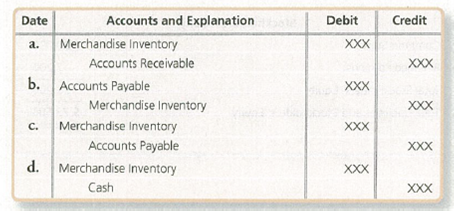

Ch. 5 - Which account does a merchandiser use that a...Ch. 5 - The two main inventory accounting systems are the...Ch. 5 - The journal entry for the purchase of inventory on...Ch. 5 - JC Manufacturing purchase d inventory for 5,300...Ch. 5 - 5. Austin Sound sold inventory for $300,000, terms...Ch. 5 - Suppose Daves Discounts Merchandise Inventory...Ch. 5 - Which of the following accounts would be closed at...Ch. 5 - What is the order of the subtotals that appear on...Ch. 5 - Prob. 9QCCh. 5 - Prob. 10QC

Ch. 5 - The journal entry for the purchase of inventory on...Ch. 5 - What is a merchandiser, and what is the name of...Ch. 5 - Prob. 2RQCh. 5 - Describe the operating cycle of a merchandiser.Ch. 5 - What is Cost of Goods Sold (COGS), and where is it...Ch. 5 - How is gross profit calculated, and what does it...Ch. 5 - What are the two types of inventory accounting...Ch. 5 - What is an invoice?Ch. 5 - What account is debited when recording a purchase...Ch. 5 - Prob. 9RQCh. 5 - What is a purchase return? How does a purchase...Ch. 5 - Prob. 11RQCh. 5 - How is the net cost of inventory calculated?Ch. 5 - What are the two journal entries involved when...Ch. 5 - Prob. 14RQCh. 5 - Prob. 15RQCh. 5 - When granting a sales allowance, is there a return...Ch. 5 - Prob. 17RQCh. 5 - Prob. 18RQCh. 5 - What are the four steps involved in the closing...Ch. 5 - Prob. 20RQCh. 5 - Prob. 21RQCh. 5 - Prob. 22RQCh. 5 - Prob. 23RQCh. 5 - Prob. 24RQCh. 5 - Prob. 25RQCh. 5 - When recording purchase returns and purchase...Ch. 5 - What account is debited when recording the payment...Ch. 5 - Prob. 28RQCh. 5 - Is an adjusting entry needed for inventory...Ch. 5 - Highlight the differences in the closing process...Ch. 5 - Describe the calculation of cost of goods sold...Ch. 5 - Comparing periodic and perpetual inventory systems...Ch. 5 - S5-2 Journalizing purchase transactions

Consider...Ch. 5 - Prob. 5.3SECh. 5 - Prob. 5.4SECh. 5 - Prob. 5.5SECh. 5 - Prob. 5.6SECh. 5 - Prob. 5.7SECh. 5 - Prob. 5.8SECh. 5 - S5-9 Journalizing closing entries

Rocky RV...Ch. 5 - Prob. 5.10SECh. 5 - Prob. 5.11SECh. 5 - Prob. 5.12SECh. 5 - Prob. 5.13SECh. 5 - Prob. 5.14SECh. 5 - Prob. 5.15SECh. 5 - Prob. 5.16SECh. 5 - Prob. 5.17SECh. 5 - Prob. 5.18ECh. 5 - Prob. 5.19ECh. 5 - Prob. 5.20ECh. 5 - Prob. 5.21ECh. 5 - Prob. 5.22ECh. 5 - Prob. 5.23ECh. 5 - Prob. 5.24ECh. 5 - Prob. 5.25ECh. 5 - Prob. 5.26ECh. 5 - Prob. 5.27ECh. 5 - Prob. 5.28ECh. 5 - Prob. 5.29ECh. 5 - Prob. 5.30ECh. 5 - Prob. 5.31ECh. 5 - E5B-32 Journalizing closing entries—periodic...Ch. 5 - E5B-33 Computing cost of goods sold in a periodic...Ch. 5 - Prob. 5.34APCh. 5 - P5-35A Journalizing purchase and sale...Ch. 5 - Prob. 5.36APCh. 5 - Prob. 5.37APCh. 5 - Prob. 5.38APCh. 5 - Prob. 5.39APCh. 5 - Prob. 5.40APCh. 5 - Prob. 5.41BPCh. 5 - Prob. 5.42BPCh. 5 - Prob. 5.43BPCh. 5 - Prob. 5.44BPCh. 5 - Prob. 5.45BPCh. 5 - Prob. 5.46BPCh. 5 - Prob. 5.47BPCh. 5 - Prob. 49CPCh. 5 - Prob. 50CPCh. 5 - P5-51 Journalizing purchase and sale transactions,...Ch. 5 - Prob. 5.1TICh. 5 - Prob. 5.1DCCh. 5 - Dobbs Wholesale Antiques makes all sales under...Ch. 5 - Rae Philippe was a warehouse manager for Atkins...Ch. 5 - Prob. 5.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Part A Maharaj Garage & Car Supplies sells a variety of automobile cleaning gadgets including a variety of hand vacuums. The business began the first quarter (January to March) of 2024 with 20 (Mash up Dirt) deep clean, cordless vacuums at a total cost of $126,800. During the quarter, the business completed the following transactions relating to the "Mash up Dirt" brand. January 8 January 31 February 4 February 10 February 28 March 4 March 10 105 vacuums were purchased at a cost of $6,022 each. In addition, the business paid a freight charge of $518 cash on each vacuum to have the inventory shipped from the point of purchase to their warehouse. The sales for January were 85 vacuums which yielded total sales revenue of $768,400. (25 of these units were sold on account to Mandys Cleaning Supplies, a longstanding customer) A new batch of 65 vacuums was purchased at a total cost of $449,800 8 of the vacuums purchased on February 4 were returned to the supplier, as they were either not of…arrow_forwardQuick answer of this accounting questionsarrow_forwardNeed help with this question solution general accountingarrow_forward

- Get correct answer accounting questionsarrow_forwardRepsola is a drilling company that operates an offshore Oilfield in Feeland. Five years ago, Feeland had a major oil discovery and granted licenses to drill oil to reputable, experienced drilling companies. The licensing agreement requires the company to remove the oil rig at the end of production and restore the seabed. Ninety percent of the eventual costs of undertaking the work relate to the removal of the oil rig and restoration of damage caused by building it and ten percent arise through the extraction of the oil. At the Statement of Financial Position (SOFP) date (December 31 2025), the rig has been constructed but no oil has been extracted On January 1st 2023, Repsola obtained the license to construct an oil rig at a cost of $500 million. Two years later the oil rig was completed. The rig is expected to be removed in 20 years from the date of acquisition. The estimated eventual cost is 100 million. The company’s cost of capital is 10% and its year end is December 31st. Repsola…arrow_forwardMaharaj Garage & Car Supplies sells a variety of automobile cleaning gadgets including a variety of hand vacuums. The business began the first quarter (January to March) of 2024 with 20 (Mash up Dirt) deep clean, cordless vacuums at a total cost of $126,800. During the quarter, the business completed the following transactions relating to the “Mash up Dirt” brand. January 8 105 vacuums were purchased at a cost of $6,022 each. In addition, the business paid a freight charge of $518 cash on each vacuum to have the inventory shipped from the point of purchase to their warehouse. January 31 The sales for January were 85 vacuums which yielded total sales revenue of $768,400. (25 of these units were sold on account to Mandys Cleaning Supplies, a longstanding customer) February 4 A new batch of 65 vacuums was purchased at a total cost of $449,800 February 10 8 of the vacuums purchased on February 4 were returned to the supplier, as they were either not of the model ordered or were not…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License